SMI Analysis: Ad Spending for Insurance Was Strongest Among Finance Services Subcategories

Ad spending in the financial category has always been susceptible to economic conditions. When the economy is strong, ad spending is robust; when there's an economic downturn ad spend slows down. The economic slowdown in 2020 was no different, but there were signs of recovery for the finance category.

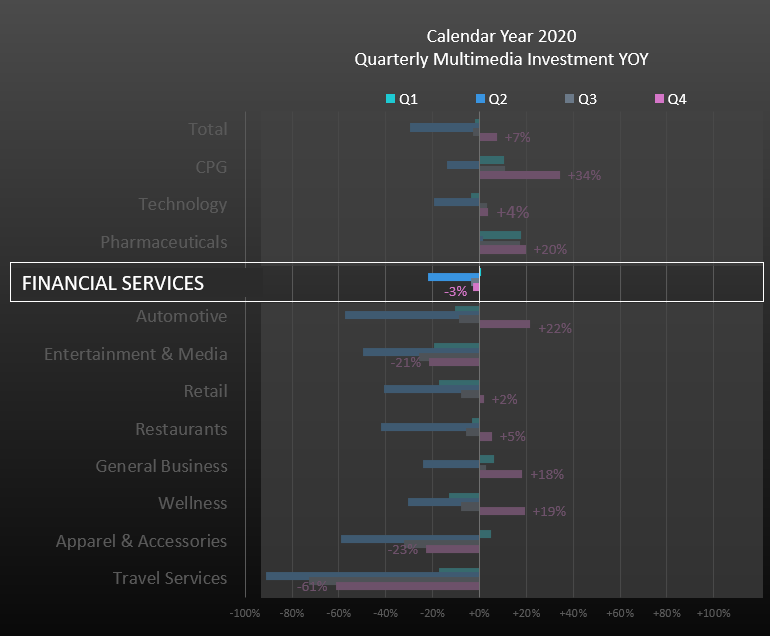

For the final three months of 2020, the ad spend for finance was YOY -3%, compared to the total ad market of +7%. The YOY decline in ad spend was lower than the previous two quarters. For all of 2020 the ad spend for finance was YOY -7%. Despite this drop-off, the category remains important to the advertising industry. In 2020, we found finance ranked fourth in ad spend among the twelve product categories measured, accounting for 10% of all ad dollars invested.

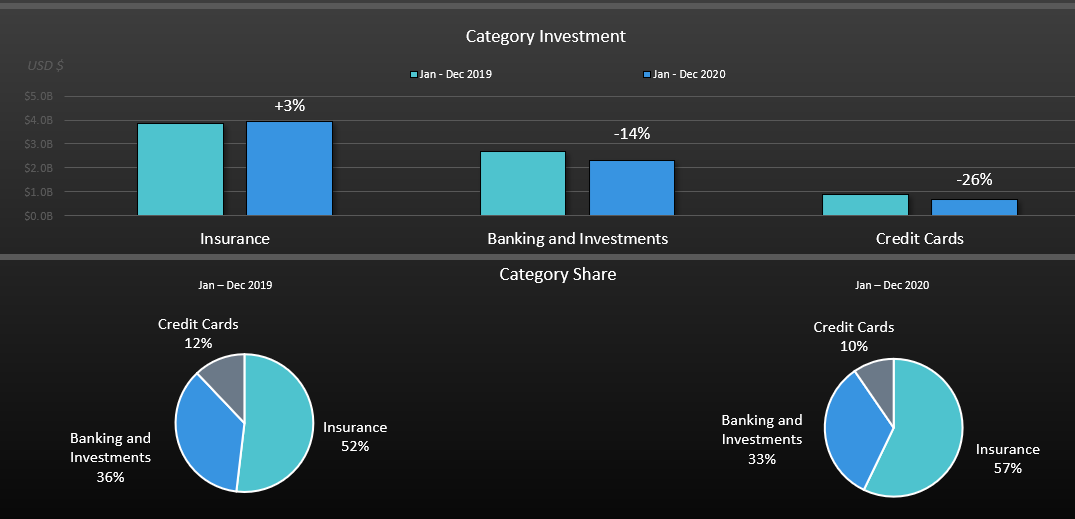

In our analysis, we looked at ad spend for the three finance subcategories; insurance, banking & investment and credit cards. Insurance, a highly competitive subcategory, grew ad spend in 2020. The ad spend for investment & banking began to return to normal in August. Conversely, YOY ad spend for credit cards was down since the second quarter. With the pandemic, credit cards faced discretionary spending concerns with reduced point-earning and redemption opportunities, as consumers curtailed such spending activities as eating out and traveling.

Here is a closer look at the ad spend by subcategory.

Insurance increased YOY multimedia ad spend year by +3% in 2020. The growth was fueled by the return of premiere sporting events in the third quarter and the drawn-out political election news cycle in the fourth quarter. The overall ad spend growth was driven by digital media especially online video (+40%), the ad spend for television overall was flat. With national TV, entertainment accounted for 58% of ad spend, highest among subcategories. Insurance was the only subcategory to increase ad spend in both halves of 2020.

In 2020, the national ad spend for banking & investments reported a YOY decline of -14%. The two bright spots were digital audio which grew by +30% and held strong throughout the year and social was +22%. With the pandemic and political, the ad spend in news was particularly strong, accounting for 26% of total national TV ad spend, the highest percentage among subcategories.

After a strong first quarter, ad spend for credit cards was down -26% for all of 2020. The YOY double digit declines began in April. In the fourth quarter, credit card ad spending did report an uptick in social media and news programming. Only traditional newspapers and social media had slight YOY increases in ad spend. Sports accounted for 42% of national TV ad dollars, the highest among subcategories.

We looked at share of dollars for the year, insurance was the largest subcategory accounting for 57% share of ad spend, up from 52% in 2019. Banking & investments had a 33% share of ad spend, down from 36% in 2019. Credit cards had the lowest ad spend share with a 10% share in 2020, down from 12% in 2019.

For ad spend in the national TV ad marketplace, only insurance increased their YOY ad dollar commitment in both upfront and scatter, although DR was down. Banking & investments reported YOY double digit declines in upfront, scatter and DR. For credit cards, ad dollars for scatter were flat, while upfront had a sharp decline. There was no DR spending either year.

As the economy continues to open up, we are optimistic the ad spend for finance will rebound in 2021.

Standard Media Index is the most trusted source of advertising expenditure and pricing data in the marketplace. SMI accesses actual spend from the world's largest media buying groups, as well as leading independents, and then organizes that data to create a clear, granular, and easy-to-use database for our clients and agency partners.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.com/MyersBizNet.