The Disease CPM-itis Has Been Allowed to Go Too Far

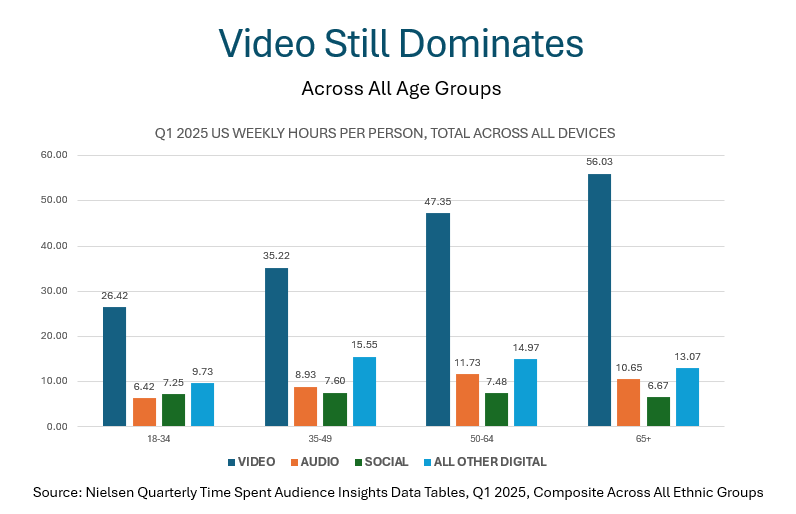

Although most estimates show that digital is 80% of global ad spend and growing that share each year, this does not reflect the way the population uses its time. Looking at Nielsen data in the U.S. in the graph above, we can see that adults of all ages spend much more time with video (~15% of which is digital shortforms) than with non-video forms of digital. (Note: audio includes traditional radio as well as streaming audio.)

Looking at Magna numbers for 2025, total U.S. ad spend in 2025 on all video combined will be $111.1 billion out of a total of $397.7 billion, making video only about 27.9% of total ad spend. This seems somewhat absurd when compared with the data above, which shows that video captures 57.7% of time spent with electronic media.

In fact, the dominance of digital in ad spend is much more a reflection of the profusion of smaller businesses now marketing themselves by advertising, and of agencies responding to being told by clients to grow brands faster with 20% less budget – i.e., go for the lowest CPMs – which is digital display, social, and online video. Unfortunately, this satisfies the numbers game but not the brand growth part.

The Bill Harvey Consulting MMM study sponsored by FOX shows that the percentage of national advertiser brands in CPG, Auto, and QSR that are growing market share dropped from 33% in 2014 to 14% today. This all but proves that pure low CPM tactics work only on paper but not in bank accounts.

The CPM-itis disease can also be seen at work in the dollars spent on video advertising. Citing the Magna data, in the U.S. in 2025 $86.9 billion will be spent on television advertising (national and local combined, linear and CTV combined) while $24.2 billion will be spent on shortform online video. In other words, shortforms account for about 15% of viewing time* but get 21.8% of ad spend within video in the U.S.

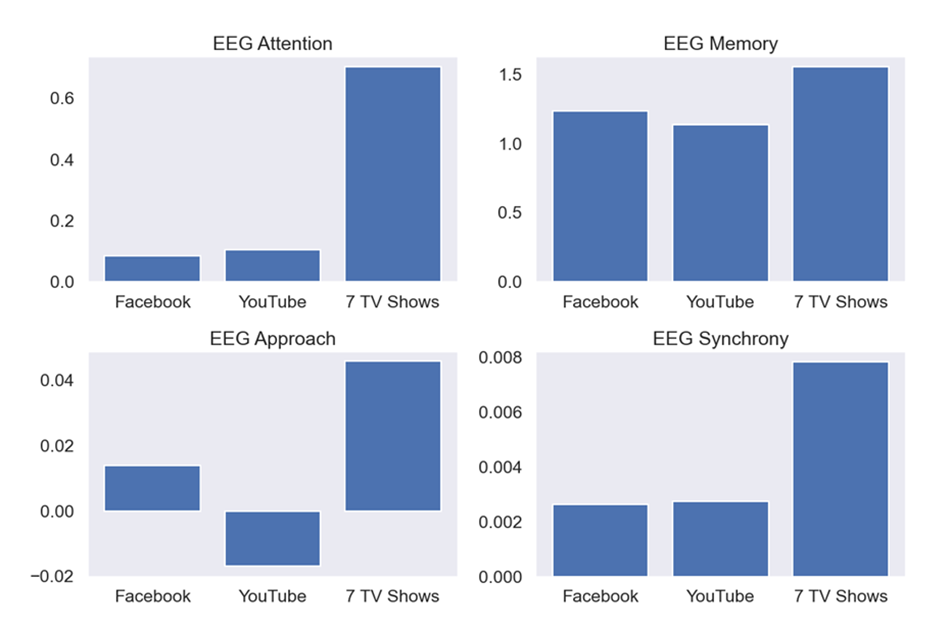

And yet, Wharton Neuroscience, in a study sponsored by FOX with Bill Harvey Consulting found that the effects of shortform digital video on neuro measures known to strongly predict sales effects are nowhere near as strong as television, whether linear or streaming. Whereas television ads on average cause the brain to exhibit approach/attraction signatures, ads in shortforms on average cause the brain to manifest avoidance signatures.

Source: Wharton Neuroscience 2024-2025 study sponsored by FOX with Bill Harvey Consulting

Source: Wharton Neuroscience 2024-2025 study sponsored by FOX with Bill Harvey Consulting

However, this cannot be assumed to apply to all future shortforms. We see evidence that the television industry will soon be producing premium shortforms, likely not using the Skip in 54321 format, and we see no reason why those ads would not perform the way TV ads perform.

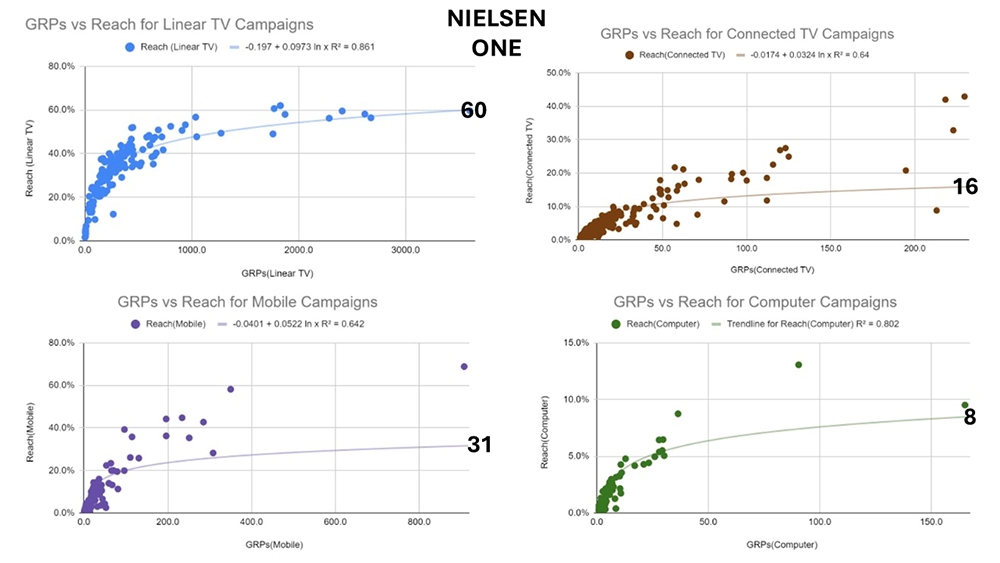

We expect that with the shift to reliance on year-over-year brand growth as the primary KPI of 70% of CEOs (as reported by McKinsey), in time, there will be a rollback of frequency and a return to reach. This will favor television over digital; and as ROAS measurements regain trust across the marketplace, the greater sales effect of television will be documented again and again until CPM-itis goes the way of COVID-19.

* Nielsen Gauge in July 2025 shows 13.4% of viewing goes to YouTube shortforms, and reports 6.6% All Other Streaming - we estimate that 1.5 of these 6.6 points are TikTok and other digital shortforms. With 1800 FAST channels it is unlikely other shortforms will gain share (except TikTok).

* Nielsen Gauge in July 2025 shows 13.4% of viewing goes to YouTube shortforms, and reports 6.6% All Other Streaming - we estimate that 1.5 of these 6.6 points are TikTok and other digital shortforms. With 1800 FAST channels it is unlikely other shortforms will gain share (except TikTok).

Note: Interestingly, if one sought to rationalize why digital should get such a high proportion of ad spend, one could make the argument that in other media, there are long periods in which no ads appear, whereas in digital, there are always ads in sight.

In Memoriam: Bill McKenna

Many of us believed that the man was too tough to ever die. During the Vietnam War, he was a U.S. Navy fighter pilot flying Phantoms off carriers, and volunteered when nobody else would to fly a DC-3 loaded with nitroglycerin over the war space to reach the troops that needed it. He went on to become a consultant at Booz Allen; the CEO of Adtel, which was the first ROAS measurement company in the world; the inventor of ScanAmerica; the founder and principal of Mediafax which was known as the Nielsen of Puerto Rico; the CEO of IMMI, the first viable mobile audience measurement company; the CEO of Kantar Media North America, where he became the key person causing WPP to invest in TRA, where he became the first Board member; the principal architect of BARC, the cross-media audience currency of India; and CEO of RMT where he and I were co-founders.

Bill passed away last Sunday. His wife Evelyn, was with him. “He looked at me, his eyes rolled up, and he was gone,” she said. It was a peaceful departure for a kind and wonderful warrior. I was happy to learn that, as a Navy war hero, he will be buried at Arlington National Cemetery.

I miss him already. I have a feeling, though, that he is happily surprised to still be aware of his own existence, and is in a good mood.

More about Bill McKenna here.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.