The Highest ROI Form of Digital or Television Is … Premium OTT (Part 2)

While we were doing our work on this study, others across the industry were apparently also doing their own homework on the subject, because when COVID fell upon us all, and media ad spend receded -35%, Premium OTT continued to grow +9.7% during COVID. (It had been growing at +30% just before COVID struck.) Source: SMI.

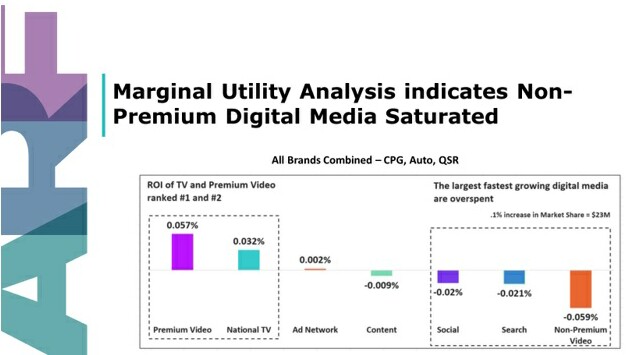

One type of analysis we performed was Marginal Utility. This is the forecasting, based on the cumulative historical results, of the incremental sales yield of the next million dollars spent in this versus that media type.

Here is what that looks like:

This shows that so much money in these three verticals has been poured into Non-Premium Digital Video that it is topped out: Additional allocation there will not pay back. This is not because the ads themselves drive people away from brands; it’s because dollars to the oversaturated media types come from and therefore deplete the media types that are not saturated -- TV and especially Premium OTT.

Note that these remarks may not apply to other types of advertisers -- these are all the biggest, each one invested over a quarter billion dollars over the study period -- in three specific categories. At lower spend levels it’s unlikely that any large media types would be saturated by an advertiser.

Direct response advertisers experience saturation for specific offers/ads within specific pools of people, i.e. direct mail lists, ID audiences, etc. “Burnt out” is the phrase they use for “local” saturation, e.g. a list or a network. Saturation of a whole media type requires hefty spenders.

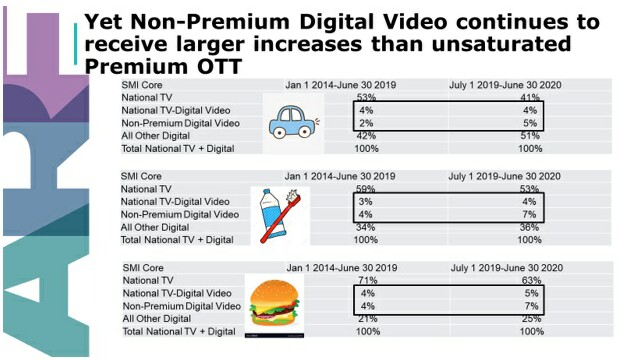

From the data above, released in stages for the past couple of years, one would expect to see that these three verticals would have moved heavily into Premium OTT. The word would have spread, and people would have discovered it on their own -- which seems to be the case in other verticals more than in these three. It’s ironic therefore that brands in these three verticals studied are not upping their investments in Premium OTT to the degree that is happening in other verticals. In Auto, there is no increase in Premium OTT at all on a media type dollar share basis. It's the same in the 12 months ending June 2020 as it had been averaging since 2014.

In the other two verticals, the share allocated to Premium OTT in QSR and CPG has gone up only one point since 2014. In CPG, it’s now 4% of total TV/digital spend, up from 3% averaging since 2014. In QSR it is now 5%.

But in the same time – the 12 months ending June 2020 -- the other digital video, the one that’s topped out for these giants, has grown +150% for Auto (3 percentage points), +75% for CPG and QSR (3 pp).

Everything depends on the unique creative, the target and the media context. Generalizations will only take you so far.

What these broad industry findings suggest is:

- There is reason to suspect that Premium OTT is very high ROI

- Every brand should heavy-up test Premium OTT

- Every brand should learn which advanced methods apply best in Premium OTT, e.g.,

- “All-In” Programmatic

- Addressable

- ID ROl Optimization

- Context Control

- Motivational Targeting

- Synergy

We recommend a full-funnel look at RCT21, the ARF’s own random-control trial initiative (in collaboration with 605, Central Control, and Bill Harvey Consulting). Take advantage of the opportunity to learn all of the tricks of the RCT trade, look at resonance, attention, engagement and other interim outcome stages as well as sales.

For those interested in getting more information on the TV/Digital multiyear ROI study findings, including optimized reallocation analyses, here is the 10-minute video of my presentation at the recent ARF conference.

It is a new time. A time for new ways. They are ripely available all around you.

Photo credit: Erik Mclean / Unsplash

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.