TV Trends: Why Commercial Shares Are More Important Than Ratings -- Pivotal Research Group

BOTTOM LINE: We have analyzed US-based national TV network group-level ratings trends with related ad revenue trends and then compared that data with an analysis connecting commercial share changes to revenue share changes. We have confirmed our prior belief that ratings changes by themselves add very little in forecasting revenue growth trends. At the same time, we have confirmed that commercial audience share changes are strongly correlated with revenue share changes. We believe that investors should generally focus on commercial share changes metrics rather than ratings changes. These metrics combined with assessments of the general state of growth or decline of all advertising and national TV's share of total advertising are best positioned to help assess growth trends for individual TV network groups, as we explain further in this note. Charts with related data involving 14 quarters of growth rates across nine major national TV network owners are included as well.

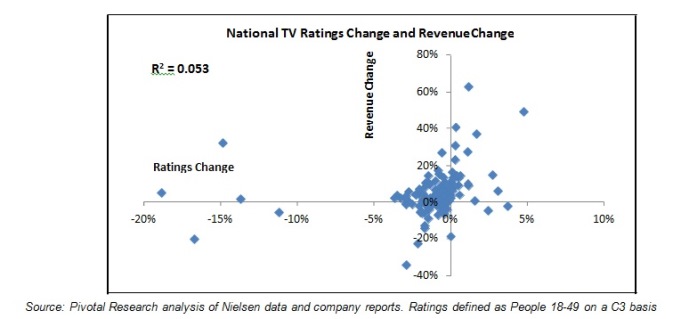

We regularly hear industry participants and investors in media stocks discuss changes in ratings for networks, network groups or the medium-at-large as if they were (along with pricing changes) key drivers of revenue change. However, the relationship of ratings growth or decline alone with revenue is very limited, as illustrated here:

Using our calculations of Nielsen-based national TV ratings at a network group level and our estimates for domestic national TV advertising revenues at each of AMC, CBS, Discovery, Disney, Fox, NBCU, Scripps, Time Warner and Viacom, we compared ratings changes and ad revenue changes during the past 14 quarters for each of these groups. The R2 for our 126 data points was 0.053, which means that only around 5% of the variance in revenue growth trends can be explained by changes in ratings. A ratings-based model could explain more in conjunction with pricing growth data, but such data is difficult to know with much precision, especially beyond broadcast network prime time dayparts.

There are several reasons why ratings growth or decline provides limited value in predicting revenue growth or decline, including the following:

- Advertising market growth and the evolving dynamics of advertisers who choose to use national TV vs. other media.The most important factor driving growth in television has been growth in total advertising at a national level, which is driven by factors that are independent of ratings trends. For example, many categories have shifted orientation from local media to national media over the course of decades; other categories emerge essentially from out of nowhere as mass media advertisers.

- Cost bases vary widely between advertisers.New advertisers tend to have higher cost bases for a given type of inventory than do older ones. Consequently, as older advertisers shift their spending towards other media and marketing vehicles which are not so focused on driving awareness, their "bad money" is commonly replaced with "good money."

- Budgets flow to historically less desirable inventory over time.Large advertisers historically concentrated all of their spending in network TV, and gradually shifted spending over to cable. Cable networks generally have capacity to absorb budgets even now, as smaller networks and non-prime dayparts have generally been less desirable than larger networks and prime dayparts. This means that lower ratings can be made up for through spending shifts to under-monetized inventory within the medium.

- Other variables connecting ratings to revenues are difficult to track.Reported ratings are different than guaranteed ratings, and the gap between those numbers is never known at an industry level (and at best can be guessed at an individual network level). As well, commercial pod lengths can be fluid, and are not picked up in single-figure commercial ratings or program ratings measures, but are captured in commercial inventory metrics (such as commercial ratings multiplied by commercial loads a given media owner possesses).

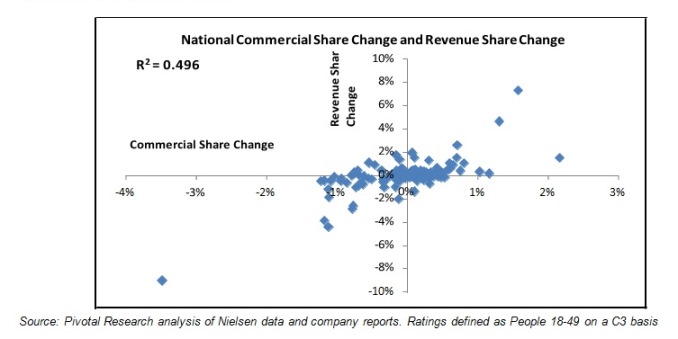

We next looked at the connection between commercial share changes and revenue share changes. We found a much tighter fit in this analysis: 49.6% of the variation in revenue share changes are driven by changes in commercial shares.

We note that using this data to forecast revenue growth for a given media owner requires an assessment of total advertising industry level growth and the share gains or losses that national TV experiences inside of that spending. However, we believe these are relatively forecastable based upon relatively knowable historical data points and qualitative drivers. Estimating the revenue growth for a given media owner also requires an assessment of any extraordinary circumstances (i.e. hosting of a Super Bowl game or other company-specific factors). As well, we note that different audience profiles will be more appropriate for some media owners vs. others, as many have audiences who are intentionally skewed young or old.

Perhaps most importantly, investors need to recall that nationally-oriented advertisers generally spend money with national TV because it commonly satisfies reach and frequency goals better than the next- best alternatives. We see pricing as an output rather than an input in forecasting total industry-level budgeting. Further, advertisers buy packages of GRPs (gross ratings points) rather than individual ad units, and so long as networks have capacity to help advertisers meet their GRPs and reach delivery goals, the ups and downs of ratings have only a limited impact on ad budgets.

The nature of the business described here suggests only a tangential connecting between ratings trends and budgeting. By contrast, we have observed that media planners tend to allocate sharesof budgets to specific media owners with some mindfulness towards the share of inventory that a given media owner possesses. In that sense, a focus on commercial share comes much closer to reflecting an actual industry behavior, and explains why we consider commercial share models to be superior tools of analysis.

FULL REPORT INCLUDING RISKS AND DISCLOSURES CAN BE FOUND HERE: TV Update 5-23-16.pdf

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaVillage.com / MyersBizNet, Inc. management or associated bloggers.