UM: Do Influencers Really Matter? - Graeme Hutton - MediaBizBloggers

If you have ever read Malcolm Gladwell's, The Tipping Point, you will know what a perceptive and persuasive treatise on the viral power of social trends this book really is. Through an eclectic set of superbly chosen anecdotes, Gladwell engagingly unveils this phenomenon, from the retro rise of Hush Puppies footwear to the disturbing epidemic nature of teen suicides.

If you have ever read Malcolm Gladwell's, The Tipping Point, you will know what a perceptive and persuasive treatise on the viral power of social trends this book really is. Through an eclectic set of superbly chosen anecdotes, Gladwell engagingly unveils this phenomenon, from the retro rise of Hush Puppies footwear to the disturbing epidemic nature of teen suicides.

But do such findings really apply to a brand's advertising and marketing? Can we see an outwardly perceptible relationship between the few, influencers who have the capacity to influence, and the many, general consumers of a brand or product. If so, can we readily quantify that relationship?

To help answer this, we recently interrogated the word of mouth study, Talk Track, by the Keller Fay Group. We found clear evidence that the relationship between influencers and general consumers talking about a brand varies by market category in quite a predictable relationship.

Each year, Talk Track asks 36,000 consumers about their daily word of mouth goings-on and how often and in what ways they talk about brands. Talk Track also classifies people by the size of their social network and the amount of advice they provide to others in a specific market category. Consumers placed in the highest social network and category advice levels are called Conversation Catalysts, as an effective proxy for a category's influencers.

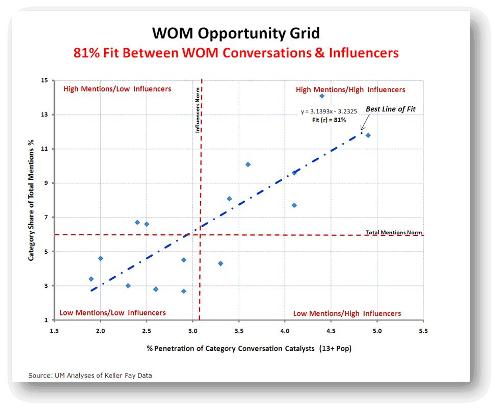

Taking the fifteen market categories that Talk Track monitors, we can place them on a map to determine if there is a visual relationship between general brand mentions by consumers and Conversation Catalysts or influencers. We call this type of map, the WOM Opportunity Grid (see Figure 1), and it shows a clear relationship between the two criteria:

Figure 1

As we can see, the map implies a connection between, on the vertical axis, a category's share of total mentions (for all brands in all categories) and, on the horizontal axis, the penetration of a category's Conversation Catalystsamong the general US population.

The individual blue dots on the map represent each of Keller Fay's 15 market category's spanning the full range from Media & Entertainment to Household Products. We can see the best line of fit, the regression line, as the dotted blue line that dissects the map, running diagonally from bottom left to top right. And we can also quantify the relationship or fit between these two factors where correlation is 81%. In other words, as conversation levels increases there is, on average, an 81% proportional increase in influencers and vice versa.

This map and its findings have two major implications for marketers:

1. If a brand is to maximize its conversation potential, it is not enough to focus simply on creating that conversation with consumers, a parallel communications strategy should often be embraced for influencers.

2. Where a brand and its category fall on the map is critically important for that brand's conversation, face-to-face marketing and social media strategies. Plainly, it is not a case where one overarching conversational strategy will fit all brands in all categories. Brands in categories in the top-right hand quadrant, high mentions/high influencers, have a very different – and much easier – task to develop consumer conversation levels than products in categories in the lower left quadrant, low mentions/low influencers.

How do we identify and reach influencers. For an influencers' strategy, it not just a case of reaching them but actively nurturing them as well. For example, the major media survey, MRI, has specific proprietary questions to identify what it terms category influentials. Taking the travel category as an illustration, MRI indicates three magazines, Travel + Leisure, Condé Nast Traveler and Arthur Frommer's Budget Travel, are particularly relevant at reaching travel influencers. Online has similar opportunities such as Trip Advisor. By proactively harnessing these media, one would not only aim to reach out to travel influencers, but also via competitions or promotions or other invitations to be involved, start to build a direct dialogue with them and establish a highly customized, relationship marketing strategy.

In such a short column, we can only quantify and explain the core issues. Macro approaches and solutions that are individually tailored to a brand's conversational aims and needs also follow some clear guidelines. If you are keen to know more, I would urge you to attend to the Word of Mouth Marketing Association Summit on November 17-19. Among others, Brad Fay of Keller Fay and I will talk about tangible and practical solutions to the issue of amplifying a brand's conversation levels using the approach outlined here.

Graeme is SVP, Director of Consumer Insights & Research, Graeme is responsible for ensuring that all appropriate proprietary and syndicated research tools and resources are applied in the development of consumer insight strategies, for a total communications research platform--from TV to chat rooms--which informs the efforts of Universal McCann and its agency partners. Graeme can be reached at Graeme.hutton@umww.com

Read all Graeme's MediaBizBloggers commentaries at Curious Thoughts from Curious Minds - MediaBizBloggers.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates @MediaBizBlogger