Unlocking Linear TV’s Untapped Potential with Data Driven Buying

Linear TV continues to be a highly resilient marketing channel, one that in spite of the many environmental changes that have happened over the recent years continues to provide advertisers with national reach at scale in brand safe programming, and allows advertisers to transact in a highly transparent, fraud free fashion.

Nielsen recently released their Ad Supported Gauge, and Gauge reports that broadcast and cable make up nearly 60% of time spent in ad supported content, and by my estimate, nearly 70% of all ad avails.

Transacting linear using advanced audiences, also known as data driven linear (DDL) has been around for over 15 years, driven by advancements by agencies, publishers, measurement and marketing technology companies.

A major step forward for transacting using DDL took place in 2022, when VideoAmp data started being used by agencies and publishers. The scale of the VideoAmp data, 40 million identities large, helped democratize DDL by making that capability available for advertisers with more narrow targets than what a 40,000-household panel could support. That sample size allows publishers to forecast and steward DDL buys with far greater precision, and leverage lower rated programming to drive greater yield (increased target GRPs) for advertisers. This point is especially important with the continued fragmentation of audiences in linear.

For this upcoming broadcast year, when Nielsen enables advanced audiences with their Panel & Big Data service, the market will have two options for DDL using big data providers.

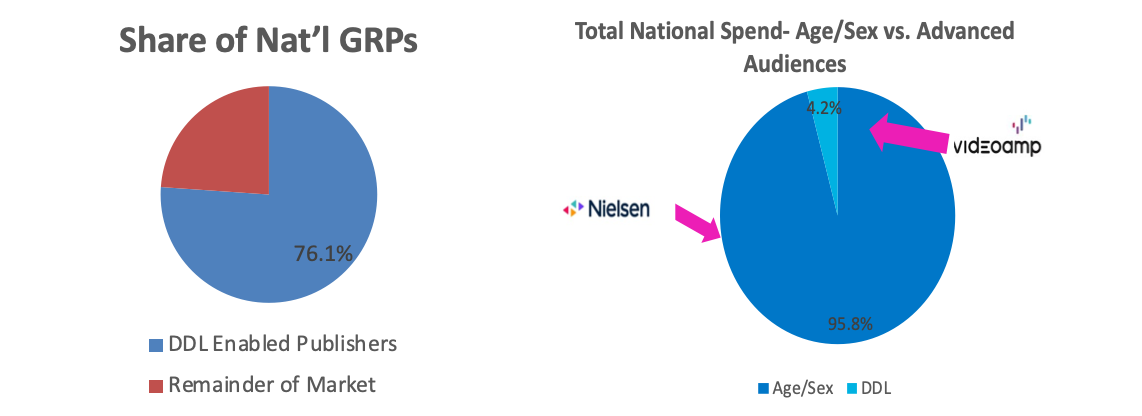

But today, heading into the 2025/2026 upfront, while over 75% of national GRPs are controlled by publishers enabled for DDL, only about 4% of national TV ad spend uses publisher optimization capabilities for DDL. The other 96% are bought based on traditional age/sex, even if they are planned based on advanced audiences.

One thing that is clear from the confluence of events- the TV upfront market happening at the same time there is massive uncertainty in the economy due to tariffs and the Big Beautiful Bill being considered in Congress- is that advertisers are moving dollars to market channels that provide direct measure of outcomes. Data driven linear allows advertisers to leverage linear TV’s benefits while taking a giant step forward in connecting with the audiences that drives sales.

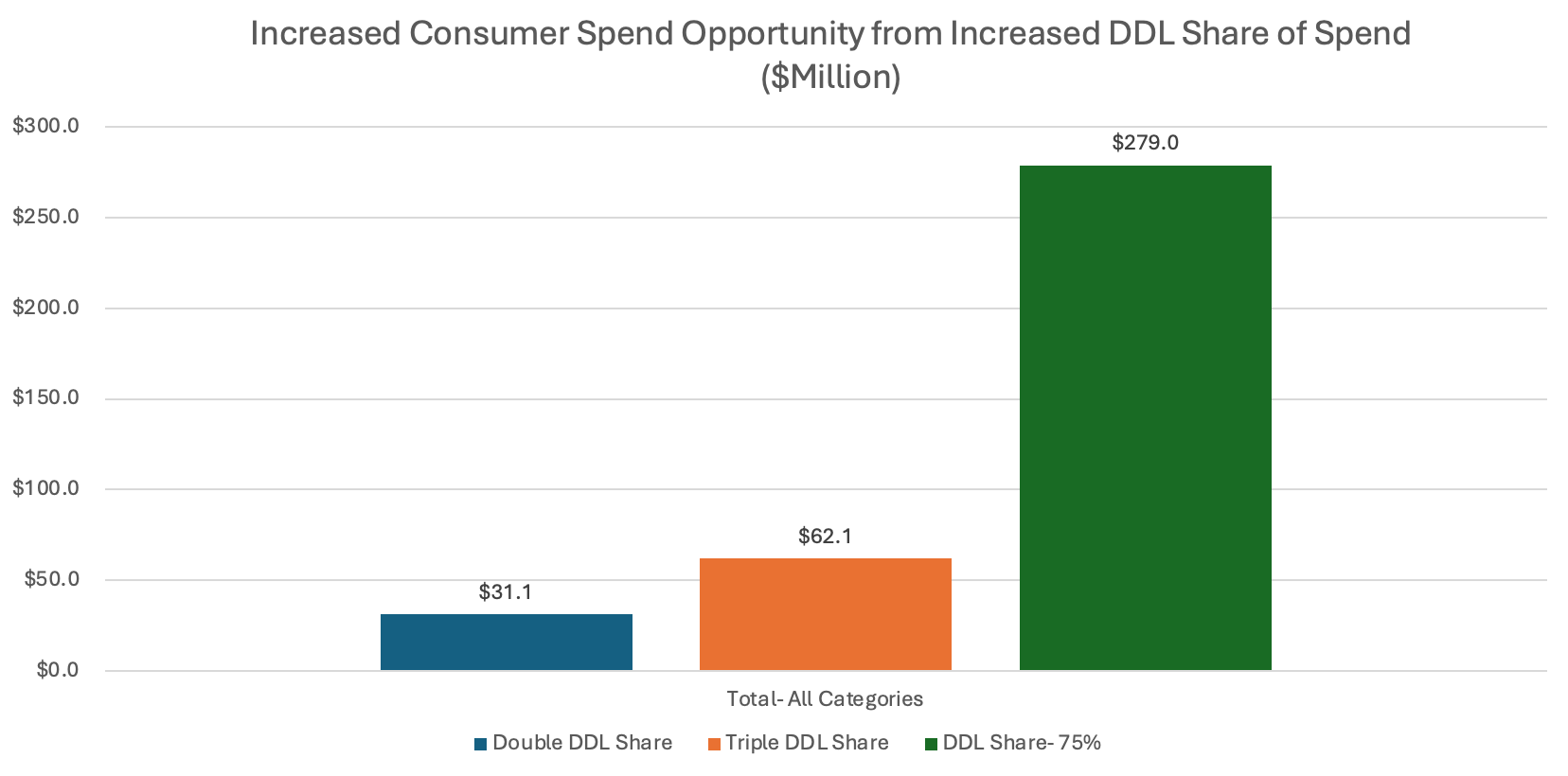

We decided to analyze the amount of consumer spending for top verticals that advertisers may be missing by not leveraging DDL at greater scale. At datafuelX, based on our experience optimizing nearly 200 campaigns, we see that publishers are able to generate increased target DDL impressions through optimization. This increase ranges from 5%-10% for publishers with more narrow portfolios (fewer networks), and around 30% for publishers with broader portfolios (more networks).

We used ROAS norms from Arima for linear TV, and modeled the increased target audience impressions that each category would generate from optimization, and how that translates to increased consumer sales.

Focusing on seven advertiser verticals (Pharma, QSR, Technology & Telcom, Retail/Apparel, CPG, Automotive and Financial Services), we found that these verticals could generate an additional $31million per year in sales by doubling DDL’s share, and additional $62 million by tripling DDL’s share, and an additional $280 million by leveraging DDL for all spend with DDL enabled publishers.

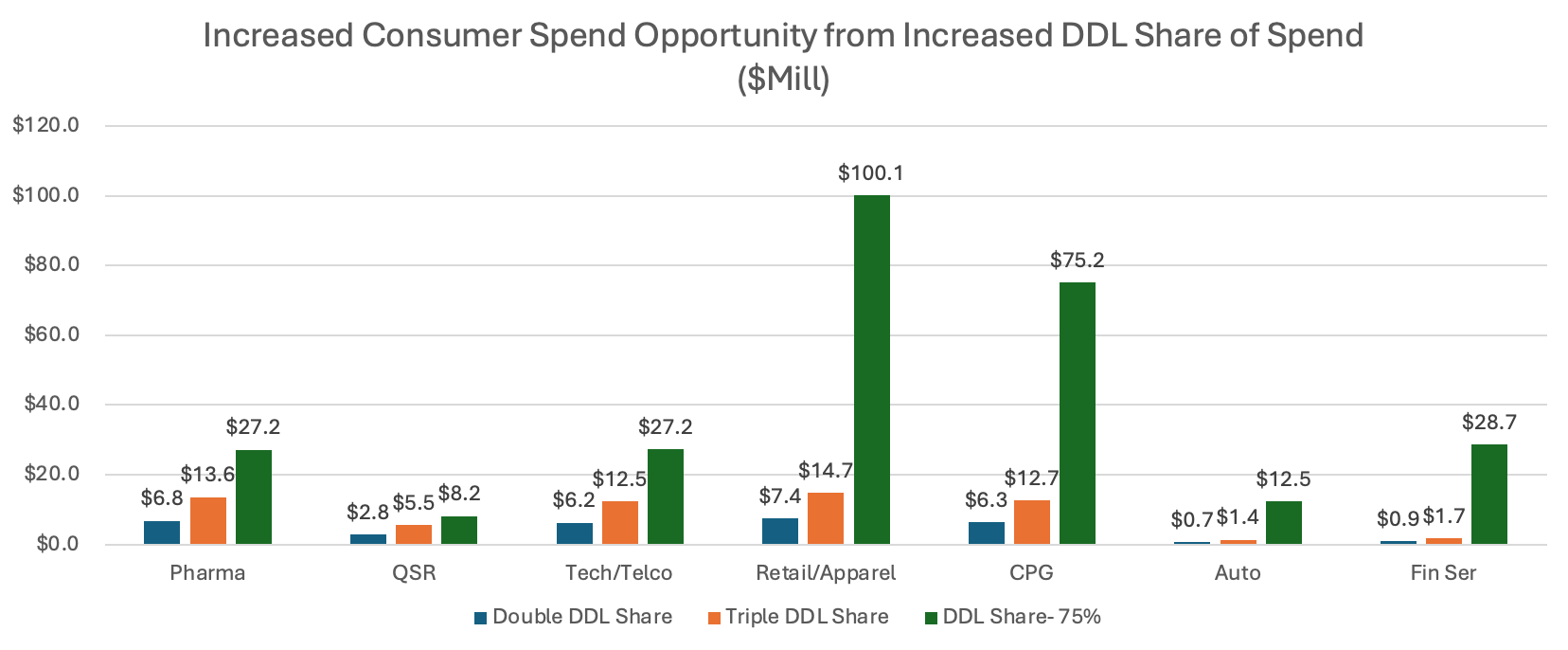

When we look at the opportunity vertical by vertical, we see that the increased sales opportunity is as large as $7.4 million for doubling DDL’s share of spend, as large as $14.7 million for tripling DDL’s share, and as large as $100 million if DDL’s share was equal to the share of GRPs that DDL enabled publishers represent.

We often hear that procurement, and historical age/sex CPM benchmarks, are a major reason for not moving away from age/sex buying. But in the new world, where we have data at scale which allows us to accurately forecast, optimize, steward and deliver deals, where DDL campaigns can be executed as efficiently as age/sex deals, are advertisers willing to sacrifice the increased consumer sales that more DDL will provide?

At a time when there is so much uncertainty in the US economy, leading advertisers to move dollars to media that they can directly tie to sales response, leveraging DDL allows advertisers to both take advantage of the known benefits of linear while driving higher ROI from that linear spend.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.