Wharton Neuro Rates TV High Over Digital in “Brain Sales”

At the Advertising Research Foundation’s (ARF’s) ATTENTION 2024 conference on May 14, FOX Chief Research and Analytics Officer Mainak Mazumdar, Wharton Neuroscience Initiative Director Michael Platt and myself presented the latest flash report from the FOX Wharton Bill Harvey Consulting (BHC) ongoing study of the Media Drivers of Advertising Sales Effect.

Mainak started off by positioning the study as an effort to shed light on how attention and other brain phenomena interact to cause advertising sales effects. Attention had been found by FOX from numerous studies cited in the presentation to be good at predicting recall but not sales.

He stated that a key goal was to find out if a scalable proxy for EEG could be found that, when combined with attention, could be affordably and quickly used on a day-to-day basis to maximize advertising sales results. And he stated up front that the goal had been achieved, a scalable proxy had been found which excelled in predicting “out of sample” (real world) sales results.

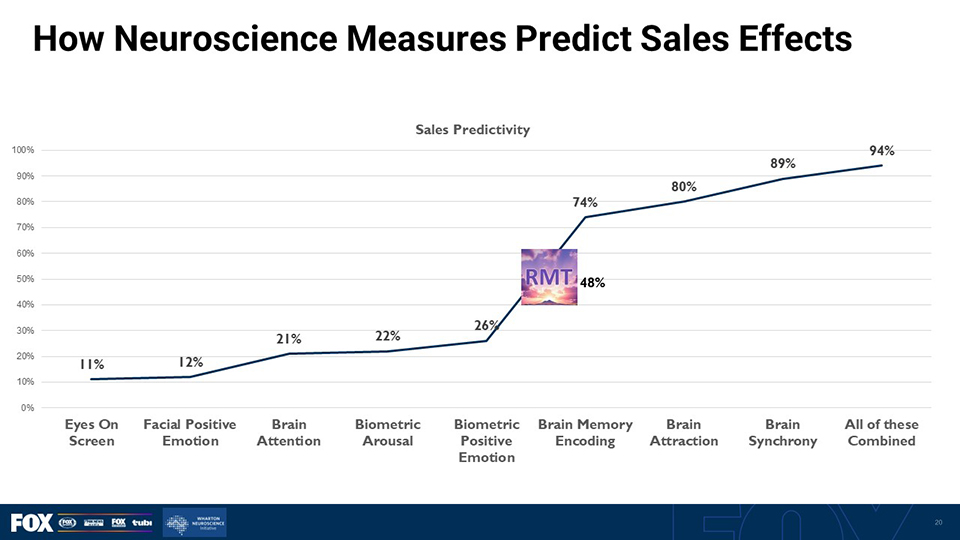

Michael Platt introduced the notion of a scale on which one could weigh various measures' ability to predict advertising's sales effects. He showed a graph of that scale with attention measures at the low end and EEG measures at the high end. Specifically, three EEG measures which are the best predictors of incremental sales effects caused by advertising:

- Synchrony – a measure of the degree to which all the brains in the sample resonated with one another in their reaction to a stimulus – the best predictor of sales

- Approach/Avoidance – second best predictor of sales effect

- Memory Encoding – third best predictor of sales effect

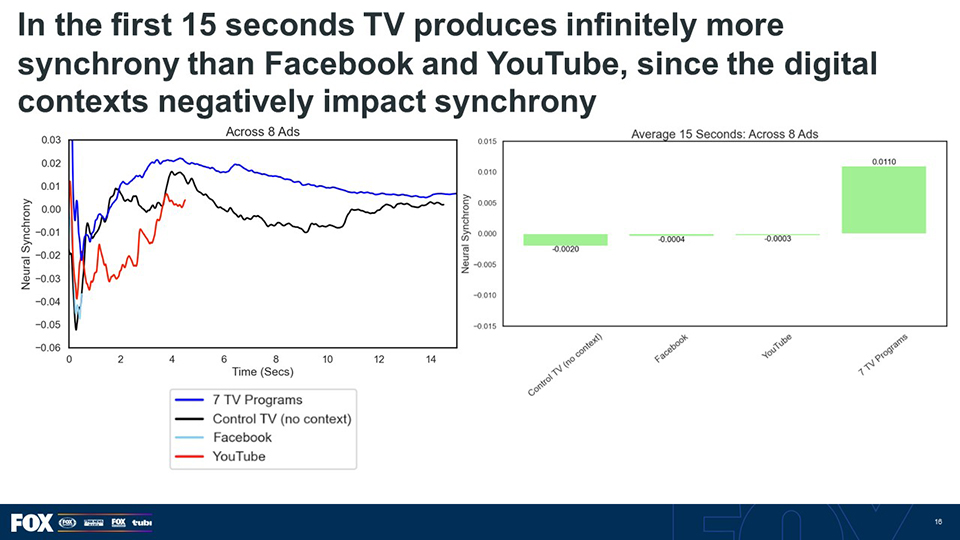

Michael showed how these three measures all needed a certain amount of time to fully develop – on the order of around 15-20 seconds. This of course is far more attention duration than is common in digital, where the industry footrule is 1-2 seconds, although YouTube and other shortform video ads have about 3-5 average seconds of attention, some of that is to the skip button.

As Karen Nelson-Field has pointed out, certain media platforms come with ingrained habit patterns of use, which form a very strong ceiling on the duration of attention even with breakthrough creative. Feeds like Facebook and short forms like YouTube are where most advertising dollars have been going, and they are the media with the least attention elasticity. This does not allow the “brain sales” measures enough time to form.

Enter television and its premium streaming daughter. These contexts excel far above digital in attention duration, enabling storytelling, positive emotion, immersion, and the three varieties of “brain sales”.

In terms of the strongest sales determinant, synchrony, TV/premium streaming have positive synchrony, while YouTube and Facebook actually drove synchrony slightly down.

Although these results may not be surprising to some – they mirror NCS ROAS norms which show TV +86% over digital (TRA results had been similar) – they pose a potentially revolutionary notion to the ad investment professionals at brands and agencies who have been contracting TV spend while shoveling tens of billions more each year into digital. Globally today digital is receiving over $600 billion, more than four times TV spend.

Will this spending pattern react to Wharton science revelations quickly, slowly, or never?

Will industry leaders continue to focus on whatever issues have been engrossing them, or might this catch their attention?

The Scalable Proxy

The media planning and buying process is strongly institutionalized into computer systems and business practices that resist change and any new costs, while they demand speed and ease. Anything that causes agencies more work provokes fights between brands and agencies.

Attention has managed to edge its way into this world because it is inexpensive and easy enough.

EEG, which is head and shoulders above attention in predicting sales effect, takes too long and costs too much to edge its way into the media buying process at scale. Hence some other proxy measure which agrees closely with EEG, if it could be found, would be combinable into the systems that today can already use attention data.

For several years FOX has been experimenting with the RMT content coding system and so that system came up for testing as a possible proxy for EEG. RMT had already been piloted by Playgroundxyz Neuro, and showed promising ability to predict EEG, as presented at ARF AUDIENCExSCIENCE 2024.

Howard Shimmel’s groundbreaking work at Turner on making RMT’s system easy for media selling and buying in 2017-2018 led to many studies in which sales increases were linked to the RMT Resonance between the ad and the context. These studies were conducted for different sets of ads and clients by NCS, Simmons, 605, Neustar, ARF Cognition Council.

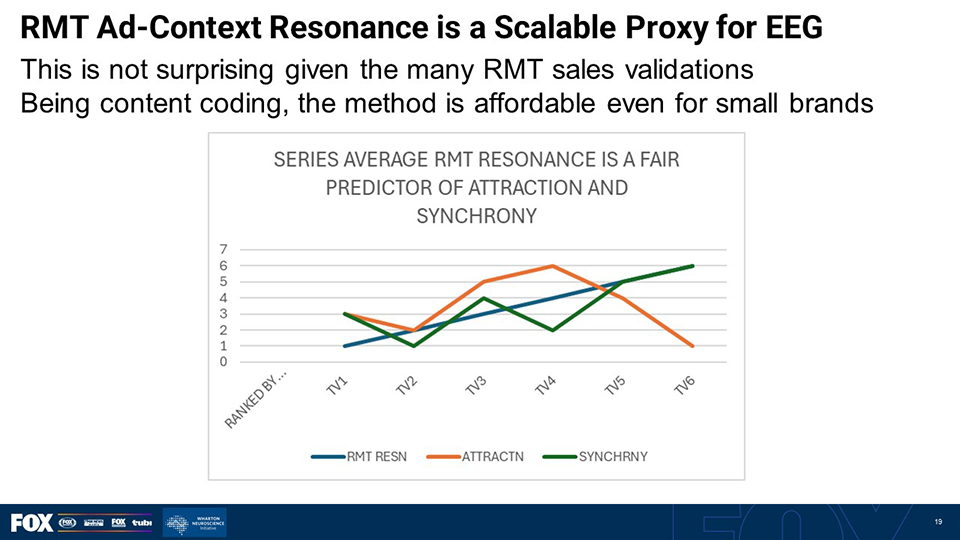

Thus it was not entirely a surprise when it was found that RMT Ad-Context Resonance predicted the Wharton “brain sales” data.

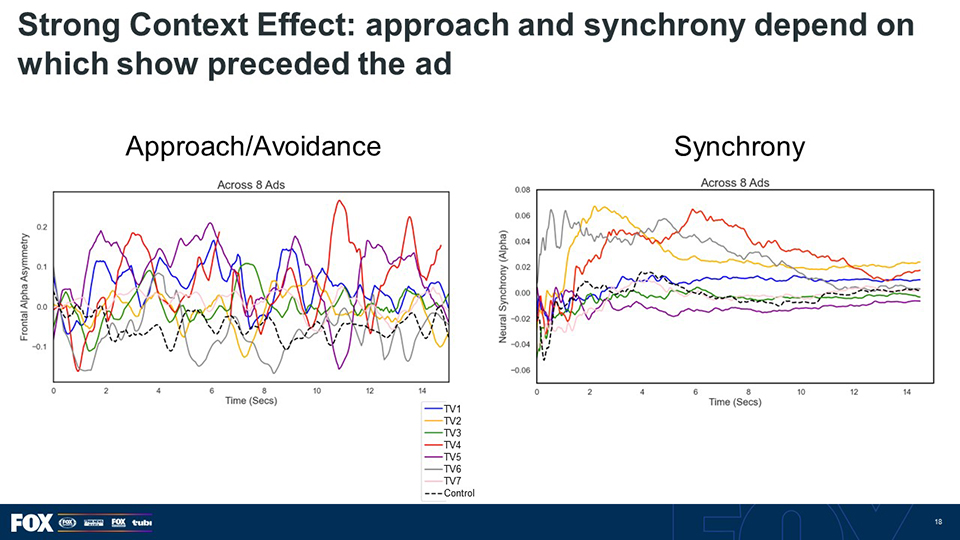

In presenting these data we first established that the performance of the ads was strongly affected by the program in which the ad appeared. If there was zero context effect, the average ad tested would have the same score in every environment. If there was a slight context effect, there would have been 8 lines overlapping one another very closely (because 8 ads were tested, one from each of the top 8 verticals in terms of media spend). Instead, these were the actual findings:

Because the context effect is so strong, it is very important to be able to understand, predict, and leverage that effect, which is RMT’s raison d’etre. The 265 content codes which were distilled by set-top box data machine learning out of all of the psychologically-oriented words in the English language by Emmy®Award-winning Next Century Media are the basis for judging the alignment/congruence/overlap (Resonance) between a specific ad and a specific program context.

The ability of RMT Resonance to predict the brain sales metrics is shown in this chart:

The program TV6 was the one case in this first analysis where RMT Resonance failed to predict the Approach metric (here called by its other commonly used name “Attraction”). For the most powerful brain sales measure, Synchrony, there were no failures to predict. More in-depth correlations are now being conducted at the ad-by-ad level, providing 8 times as many data points, and using full correlation rather than rank correlation. Stay tuned.

When Michael Platt, one of the founders of Neuroeconomics and an inventor of home-use EEG systems, saw the RMT results he wrote:

“Given the alignment so far it looks like these may prove to be, dare I say, universal predictors (which resonates with the ability to predict out-of-sample sales at high levels).”

When added to the plot of other sales predictive metrics RMT falls right below the EEG measures (the 0.48 Adjusted R2 ability to predict sales comes from the ARF Cognition Council study which used six years of IRI data):

Watch this space, more results to come in future postings here.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.