Which Program Type Dominates OTT? – Bill Harvey and Alex Petrilli

Third of a Three-Part Series on Over The Top Viewing with Alex Petrilli of TiVo

In the first and second parts of this report on OTT we looked at the current increases in TV viewing being caused by OTT and the emphasis on well-scripted drama with interesting characters and an edginess that one gets most often in premium channel original productions. Now the question we turn to in the third and final part is the long run. Where is OTT taking us and where will it go, and what will its impact be when its gets there?

OTT Homes and Cord Cutting

Outside of House of Cards’ nine Emmy nominations, a television network’s biggest fear is cord cutting. And there are no candidates with the scissors dangling as perilously close to the wire as OTT homes. Once they have comfortably settled into their Netflix streaming queue and Amazon Prime options, what is to keep them paying those monthly cable/satellite/telco bills?

Apparently there is plenty. According to research firm GfK, the main driver in U.S. households cutting the cord last year was financial pressure. The need to save money outweighed any provider dissatisfaction or lack of necessity. It is quite possible that the plethora of OTT options has made it easier on households to cut the cord, but as David Tice, senior vice president of media and entertainment of GfK, said in a blog post, “I continue to wait for the economy to really gain traction and pick up, which will be the real test if people maintain their broadcast-only status even as economic concerns lessen. That’s when I’ll decide if I’ll pull my toe out and jump in the deep end of the cord-cutting pool.”

OTT Penetration

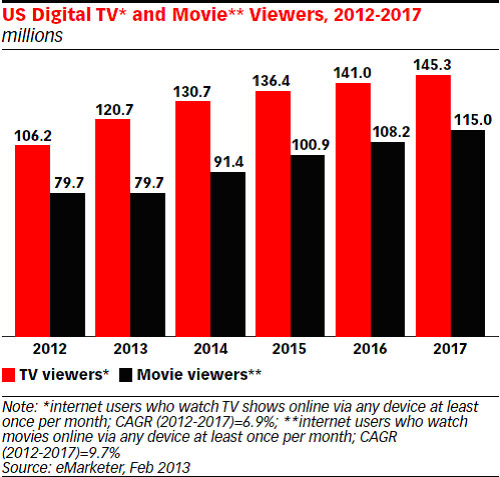

As technology and bandwidth increase at the same rate as MLB drug suspensions, the adoption of OTT technology should continue to rise. A recent report from eMarketer shows a steady progression should continue through at least 2017.

The top factor driving the increase in OTT subscriptions according to a report by Bruce Friend, president of media and entertainment at Vision Critical, is convenience. Of OTT subscribers, 74% list “watching programs when they want to” as the main motivation for signing up for an OTT service. Also high on their list of reasons is catching up on recent episodes, avoiding commercials and binge viewing.

Made conspicuous by its omission is original programming. While it did not appear to be a driving force in OTT subscriptions, Friend speculates this is probably because first- run programs originating from OTT providers is a relatively new trend. As occurred with HBO and Showtime, expect first-run programming to rank high on the list of OTT motivating factors in the near future.

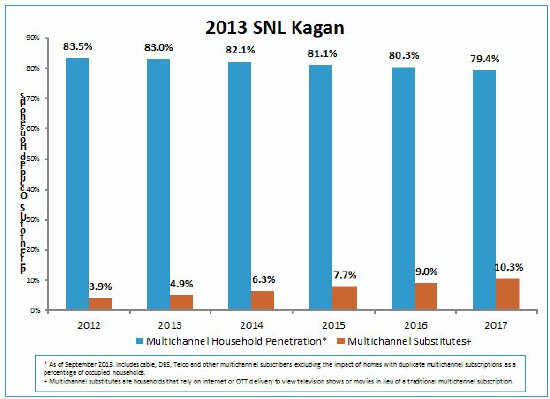

In a similar vein, SNL Kagan recently released a report isolating what they call Multichannel Substitutes, defined as households that rely on Internet or OTT delivery to view television shows or movies in lieu of a traditional multichannel subscription. According to SNL Kagan this segment could account for 10% of the population by 2017 while Multichannel Household Penetration is expected to steadily decline.

Over-the-Air Homes

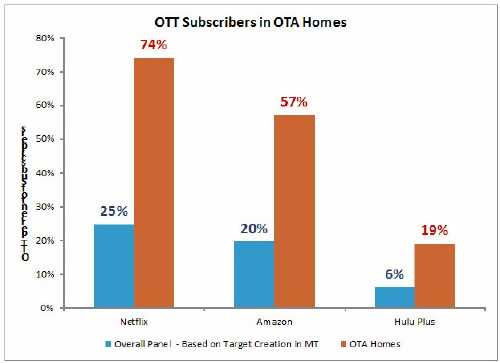

An interesting phenomen we uncovered while analyzing our panel data was the extent to which Over-the-Air (OTA) homes subscribe to OTT services. Among TiVo homes in the panel, 8% do not pay for television service (from MVPDs). Netflix subscription is three times higher among this cord-cutter group. Not surprisingly viewership of broadcast networks indexes very high for OTA households as well, when compared to the overall panel. Indices range from 150 to 250.

Of even greater concern perhaps is the additional 6% among TiVo homes who say they expect to cord cut from MVPDs over the next six months. The Netflix, DVR and online television viewing pattern of this group is closely aligned with the pattern among the recent cohort of cord cutters. This looks as if they are serious and the leakage is not about to stop. MVPDs clearly need to address this issue with compelling countermeasures. At least one MVPD is rumored to be preparing its own digital virtual MVPD service, kind of an in-house self-competitor line extension model other MVPDs might follow. Whether wired or unwired, the packaging of television experience is going to continue to evolve into new forms. The consumer desire for premium television is not going away.

Latest Forecasts

We have already cited the eMarketer forecast for OTT above. In addition, a new report from The Diffusion Group (TDG), “The Maturation of Netflix — US Streaming Subscriptions & Viewing thru 2022”, Netflix streaming use in the US will double from 2013 to 2018 . “Online TV and movie service Netflix will continue its strong track record of success with domestic streaming forecast to reach 13 billion hours during 2013 and top 26 billion hours in 2018.”

Despite this growth, TDG expects market forces will cause domestic Netflix subscriptions and total viewing to level out around 2020, while international growth will continue. According to Bill Niemeyer, TDG senior analyst and author of the new report, “Netflix is well out front in Over The Top (OTT) TV with excellent strategy and execution, but will face increasing competition in the US from online enterprises including Amazon, Google and Hulu, as well as the TV Everywhere efforts of television networks and multichannel operators.”

“Even with domestic growth expected to plateau in 2020, Netflix will remain a formidable US market force,” adds Niemeyer. “Would-be competitors will need to do as Netflix has done: Spend the considerable money it takes to acquire quality content, move forward with good strategy and offer a high-quality consumer search/discovery and viewing experience.”

Sports OTT?

One final sign of things to come concerns the NFL Sunday Ticket package that expires with DirecTV in 2014. According to engadget.com, one of the rumored potential buyers is none other than Google. With all the billions of dollars the broadcast networks currently pay the NFL for rights to their weekly contests, we don’t see this happening anytime soon. But who’s to say?

If OTT players and Internet behemoths begin to become active players in the bidding process for live sports, all bets are off. All it takes is one well-timed investment to quickly bring someone up through the ranks and make them a major player. Remember when Fox invested in the NFL? That propelled them from second-tier network into one of the “big four.”

In Conclusion -- by Alex Petrilli

TiVo will continue to track these developments and issue reports based on our own research and that of others on a regular basis. We continue to focus on the television experience as the pivotal factor in attracting and keeping both audiences and subscribers. The same technological explosion that has made OTT possible also brings the phenomenon of using multiple screens at once, offering opportunities both for distraction and for deeper engagement with the primary content in which the viewer wishes to absorb his or her mind. The complexity of the television business has never been greater and perhaps has not yet reached its zenith.

As mentioned when this series began, we are collecting new data and will bring you up to date here from time to time. Looking forward to that!

Bill Harvey is a well-known media researcher and inventor who co-founded TRA, Inc. and is its Strategic Advisor. His nonprofit Human Effectiveness Institute runs his weekly blog on consciousness optimization. Bill can be contacted at bill@billharveyconsulting.com

Read all Bill’s MediaBizBloggers commentaries at In Terms of ROI.

Alex Petrilli serves as senior manager of media insights at TiVo. In this role, Alex is responsible for utilizing the vast data resources available at TiVo to convey valuable information about the television industry and viewing trends. Alex has presented TiVo Stop||Watch data at past conferences including TMRE, ARF Research 5.0 and BBM Canada.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates at @MediaBizBlogger

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaBizBloggers.com management or associated bloggers. MediaBizBloggers is an open thought leadership platform and readers may share their comments and opinions in response to all commentaries.