In 1998, The Myers Report published E-Commerce: The Electronic Marketing Future, co-written by Jack Myers and then–senior editor Joe Mandese. At the time, the internet was just beginning to transform commerce, and e-commerce sales in the United States were measured in millions, not trillions. Amazon was still primarily a bookseller, Dell was pioneering direct-to-consumer PC sales, and terms like “mass customization” and “disintermediation” were just entering the marketing vocabulary.

Today, e-commerce is a $6.3 trillion global market (2024, eMarketer), representing more than 20% of all retail sales worldwide. The strategic imperatives Myers and Mandese identified more than 25 years ago have not only been validated, they’ve been amplified. Now, with generative AI accelerating faster than any prior technology in human history, the next upheaval in consumer marketing could dwarf even the internet’s disruption.

This Back-to-the-Future analysis revisits the 1998 report’s insights, compares them with the realities of today’s marketplace, and projects how AI will reshape e-commerce in the decade ahead.

Then and Now: Core Predictions That Came True

The 1998 report foresaw two competing visions for e-commerce:

- Utopian: A world of mass customization, where marketers deliver products literally to order, boosting consumer satisfaction, brand loyalty, and corporate profitability through zero-inventory and no-return models.

- Chaotic: A commoditized marketplace where brand value erodes, price becomes the primary differentiator, and small and large marketers alike compete for attention in an open bidding war.

Both scenarios have played out, often within the same platform. Amazon, Shopify, Temu, and Shein deliver mass customization and hyper-efficient logistics, yet also contribute to intense price-driven competition. The report’s observation that “size definitely does not matter” has proven prescient: niche direct-to-consumer brands can scale globally almost overnight through targeted advertising, social media, and marketplace integrations.

What came true:

- Disintermediation: The report predicted traditional intermediaries would be cut out as digital platforms connected producers directly to consumers. Today’s DTC brands, creator-driven commerce, and influencer storefronts are direct descendants of this trend.

- Customer control: Consumers now expect price transparency, comparison tools, and near-instant delivery - the “immediacy” Myers highlighted as redefining brand loyalty.

- Cross-category disruption: In 1998, sectors like auto retailing and travel were already feeling early e-commerce effects. Today, virtually every retail category is touched, from groceries to luxury fashion.

Key Examples from 1998: Historical Markers of a Shift

The report cited examples that, in hindsight, were early signals of a seismic transformation:

- Auto-by-Tel: $1.8 billion in new car sales through web leads in 1996-97, proof that big-ticket items could be sold online or heavily influenced by digital research.

- Dell Computers: $6 million in daily sales by the end of 1997, an early master of build-to-order e-commerce.

- Amazon.com: Less than $16 million in 1996 revenue, but already a threat to Barnes & Noble, which launched its own online store in 1997.

These companies’ strategies - direct engagement, inventory efficiency, and a relentless focus on user experience - are now table stakes.

The Speed of Adoption: Then vs. Now

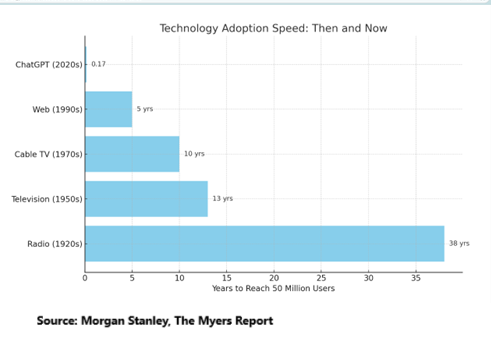

One of the report’s most striking data points was the time to 50 million users:

- Radio: 38 years

- Television: 13 years

- Cable TV: 10 years

- Web: 5 years

Today, ChatGPT reached 100 million users in just two months,a rate of adoption that outpaces every prior media or technology platform. This acceleration matters because the next major disruption in e-commerce will be AI-native commerce, where search, selection, personalization, and even negotiation are handled by AI agents.

Just as early e-commerce eliminated physical friction (location, hours, inventory limits), AI is poised to remove cognitive friction: the effort consumers expend in finding, comparing, and deciding.

Then and Now: The Economics of E-Commerce

1998 Economics:

- Online spending forecast: $11 billion by 2005

- Impact on media: Web users reported watching 24% less TV, reading 7% fewer magazines

- Anticipated shift: Ad budgets migrating toward digital media channels

2024 Reality:

- Global e-commerce sales: $6.3 trillion (eMarketer)

- U.S. share: $1.3 trillion, 21% of total retail sales (U.S. Census Bureau)

- Advertising shift: Digital advertising surpassed all traditional media combined in 2019 and now accounts for over 70% of ad spend with retail media networks (Amazon, Walmart Connect, Instacart) among the fastest-growing segments.

The prediction that e-commerce would not only drive retail transformation but also reshape advertising economics has played out more dramatically than even the 1998 report envisioned.

Lessons from 1998 That Still Matter

The Myers Report outlined several enduring truths:

- The power shift to consumers is permanent. Once buyers control access to product information, price transparency, and alternatives, the balance of power never returns to sellers.

- Experience matters as much as price. While commoditization is real, the winning brands are those that design seamless, trust-building journeys.

- Integration beats isolation. E-commerce cannot be an afterthought; it must be woven into the brand’s total marketing and operational fabric.

- Adaptation speed is survival. The companies that embraced change fastest - Amazon, Dell, Expedia - are the ones that became category leaders.

The Next Disruption: AI-Powered Commerce

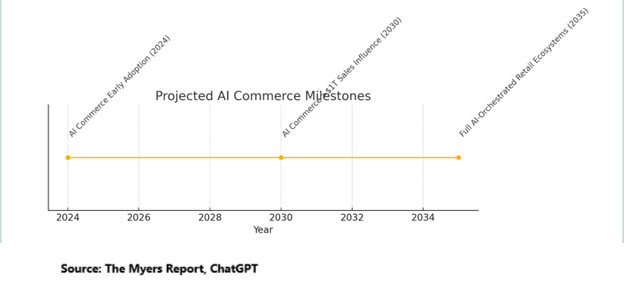

If 199-2010 was the internet wave, and 2010-2023 was the mobile and social commerce wave, 2024 onward will be the AI commerce wave. Generative AI will transform:

- Product discovery: Conversational commerce agents that can understand intent and curate highly personalized product selections in real time.

- Dynamic pricing & negotiation: AI agents acting on behalf of consumers to secure the best deals, much like automated stock trading bots.

- Mass personalization at scale: Every shopper’s online experience unique to their needs, behavior, and context, fulfilling the mass customization vision from 1998.

- Predictive fulfillment: Retailers shipping products before an order is placed, based on AI prediction of purchase likelihood.

- Immersive shopping: AI-powered AR/VR environments blurring the line between digital browsing and physical product interaction.

Economic implications:

If adoption follows AI’s early trajectory, AI-driven commerce could surpass $1 trillion in annual sales influence within a decade. Retail media, already a $63 billion market in the U.S., (See The Myers Report on Retail Media) will evolve into AI media, where product recommendations are no longer based solely on search keywords or demographics, but on multi-dimensional behavioral, contextual, and emotional data.

Strategic Recommendations for Today’s Marketers

The 1998 Myers Report urged marketers to “recognize the shift and capitalize on it.” That advice is timeless. For 2024 and beyond, the imperatives are:

- Invest in AI integration now: waiting risks being as obsolete as pre-web retailers were by 2005.

- Control the consumer relationship: don’t outsource entirely to marketplaces or intermediaries; own the data and the interface.

- Prioritize trust: in an AI-driven world, authenticity and data ethics will differentiate winners from manipulators.

- Experiment relentlessly: the pace of change will reward those willing to test new formats, platforms, and customer engagement models.

- Think ecosystem, not channel: commerce, media, and customer service will merge into unified, AI-orchestrated environments.

The Relevance of the 1998 Report Today

Looking back, E-Commerce: The Electronic Marketing Future reads as both a snapshot of a pivotal moment and a playbook for navigating technology-driven disruption. The framing of utopian vs. chaotic outcomes remains useful for AI-era strategists. The emphasis on consumer empowerment, experience, and integration is as relevant now as it was then.

The most important lesson? Disruption is not an event; it is a continuum. In 1998, the internet’s impact on commerce was just beginning. In 2024, AI’s impact is just beginning. The businesses that will dominate in 2030 are those making the right moves now -- just as Amazon, Dell, and others did in the early internet era.