Insights from 3,500 Advertising Professionals Reveal Key Shifts Toward Digital Innovation, Data-Driven Decisions, and Emerging Media Categories

As the advertising landscape evolves, the results of a July 2024 survey of 3,500 media planners, buyers, and influencers highlight the dramatic shifts redefining budget priorities for 2025. The rise of connected TV (CTV), data-centric strategies, and innovative channels like gaming and retail media signals a pivotal moment for agencies and advertisers. While non-legacy media categories surge in importance, traditional formats such as linear TV and print continue to decline, presenting both challenges and opportunities for marketers. This report provides a comprehensive analysis of these trends, offering actionable insights to help industry professionals navigate a future shaped by technological innovation, audience fragmentation, and the quest for measurable impact.

The report provides a comprehensive look at the shifting priorities and budget allocations for media and advertising categories heading into 2025. The insights highlight a clear distinction between "non-legacy" media categories experiencing growth and "legacy" media categories facing continued declines. This data is critical for shaping planning strategies, optimizing resource allocation, and leveraging trends for competitive advantage.

Key Insights and Context

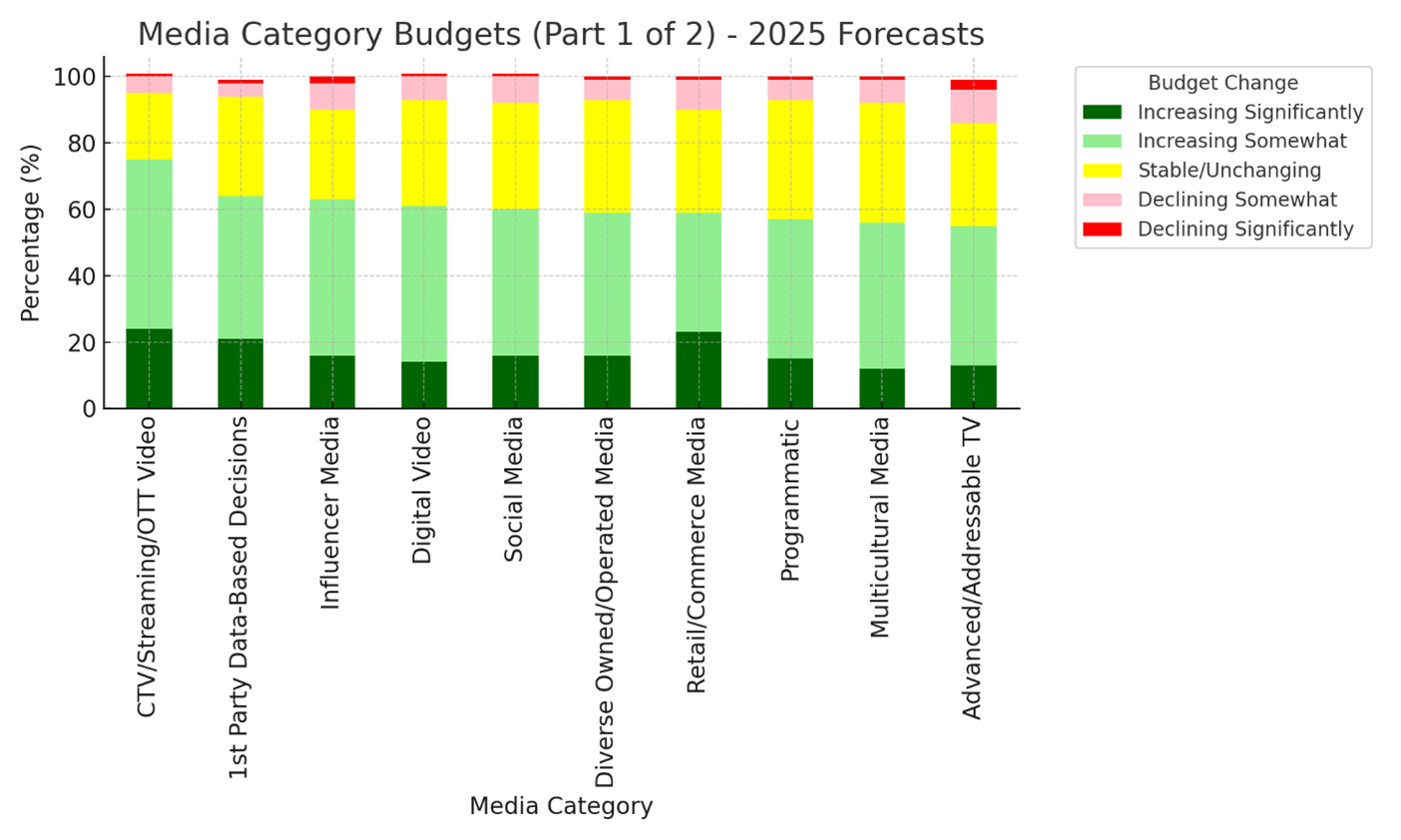

Non-Legacy Media Categories Driving Growth The survey results underline the dominance of non-legacy media categories in budget increases, particularly those connected to streaming, data-driven decision-making, and digital-first strategies. Categories such as CTV/Streaming/OTT Video, 1st Party Data-Based Decisions, and Influencer Media are projected to see significant growth in 2025.

- CTV/Streaming/OTT Video: The standout category, with 24% of respondents indicating a significant budget increase and an additional 51% reporting moderate growth. This reflects the ongoing migration of audiences from traditional linear channels to streaming platforms. For planners, this means prioritizing partnerships with premium OTT providers and leveraging advanced targeting capabilities to maximize ROI.

- 1st Party Data-Based Decisions: With 21% significant and 43% moderate growth, this category showcases the shift toward privacy-centric, data-driven marketing. Agencies must enhance their data infrastructure to capture and utilize actionable insights.

- Influencer Media: A combined 63% increase reflects the continued reliance on social media influencers as key drivers of brand awareness and engagement. Advertisers should consider diversifying influencer partnerships to encompass micro and niche influencers.

Legacy Media Categories Declining Traditional media categories such as Linear Broadcast, Linear Cable TV, and Print are projected to experience steep declines, with double-digit percentages reporting decreases in budget allocation.

- Linear Cable TV: 43% of respondents noted some budget decline, while 15% reported a significant decrease. This mirrors audience fragmentation and the rise of on-demand viewing. Agencies should explore programmatic buying to retain value in these categories.

- Editorial/Print Originated Content: With only 1% reporting significant growth and 26% anticipating significant declines, print media continues its downward trajectory. For planners, this implies reallocating print budgets to digital channels while leveraging print selectively for high-impact campaigns.

- Linear Broadcast TV Linear Broadcast TV, a traditional mainstay of advertising, continues to face declines in budget allocation as audiences migrate to streaming and digital platforms. 32% of respondents indicated stable budgets for this category, reflecting its continued relevance in reaching older demographics and regional markets. 44% of respondents report budget decreases, with another 13% seeing significant declines. These trends highlight the need for advertisers to justify broadcast investments through highly targeted campaigns that leverage its mass reach and live programming appeal (e.g., sports, award shows).

- Audio/Radio Audio and radio remain a stable media category, benefiting from their accessibility and adaptability in digital formats (e.g., podcasts, streaming audio services). 41% of respondents indicated budgets will remain stable, reflecting consistent listener engagement. 24% expect some budget growth, driven by the rising popularity of audio streaming and programmatic audio. 29% report reductions in spending, particularly for terrestrial radio, which continues to lose market share to digital audio platforms.

- Digital Display Digital Display, a mature category, shows a mix of stability and decline as advertisers increasingly favor video and programmatic options. 50% of respondents indicate budgets will remain steady. 21% of respondents anticipate decreases, signaling the need to re-evaluate static display’s ROI compared to more engaging formats like video.

Stable and Emerging Media Categories and Opportunities The data also reveals opportunities in innovation and emerging areas:

- Gaming, Metaverse, and eSports: Despite being niche, these categories are seeing strong growth potential, with 10% reporting significant and 41% reporting moderate increases. These areas cater to younger demographics and offer immersive engagement opportunities.

- Retail and Commerce Media: With 23% indicating significant growth, this category reflects the blend of e-commerce and advertising, particularly in shoppable media formats.

- Advanced/Addressable TV: Although categorized as non-legacy, this segment shows slower growth compared to other digital-first media. Planners should focus on its precision targeting capabilities to justify continued investment.

- Sponsorships/Branded Content This category remains stable, supported by its ability to create deep, authentic connections with audiences. 33% of respondents indicate some growth, driven by increased demand for custom content solutions. 47% of budgets remain stable, showing its steady relevance.

- Gaming, Metaverse, and eSports This emerging category offers unique opportunities to engage younger, tech-savvy audiences in highly immersive environments. 10% reported significant budget increases, with another 41% indicating moderate growth. These increases highlight the growing importance of gaming and virtual environments as new frontiers for brand storytelling.

- Out-of-Home (OOH) and Place-Based Media While OOH media faces challenges from the shift to digital, it remains a relevant category for localized and impactful advertising. 47% of respondents report steady budgets. 28% of respondents anticipate decreases, as advertisers prioritize digital formats.

- Innovation and Advanced/Addressable TV These forward-looking categories reflect the industry's focus on precise targeting and technology-driven engagement. 13% significant and 41% moderate increases, underscoring the importance of cutting-edge approaches. 13% significant and 42% moderate increases, driven by its ability to combine TV’s reach with digital’s precision.

- Retail and Commerce Media This category sees robust growth as the lines between e-commerce and advertising blur. 23% report significant increases, with 36% indicating moderate growth. Focus on shoppable media and retail partnerships that integrate directly into the consumer purchase journey.

Overall Conclusions and Recommendations

The 2025 forecasts highlight a dynamic shift toward digital-first and data-driven advertising strategies, with growth concentrated in categories that enable personalized and measurable campaigns. Legacy media categories, while declining, still offer strategic value when used selectively.

SOURCE: The Myers Report Survey of 3,500 agency and advertiser professionals engaged in media planning and buying. July 2024. Content © Copyright 2024 The Myers Report

- Investment Priorities:

- Prioritize digital video, CTV, and influencer media for broad-based growth.

- Experiment with gaming, metaverse, and innovation categories to future-proof strategies.

- Adaptation Strategies:

- Develop hybrid campaigns that integrate linear and digital formats to maximize audience reach.

- Leverage programmatic tools to enhance efficiency and ROI across media channels.

- Future Planning Needs: