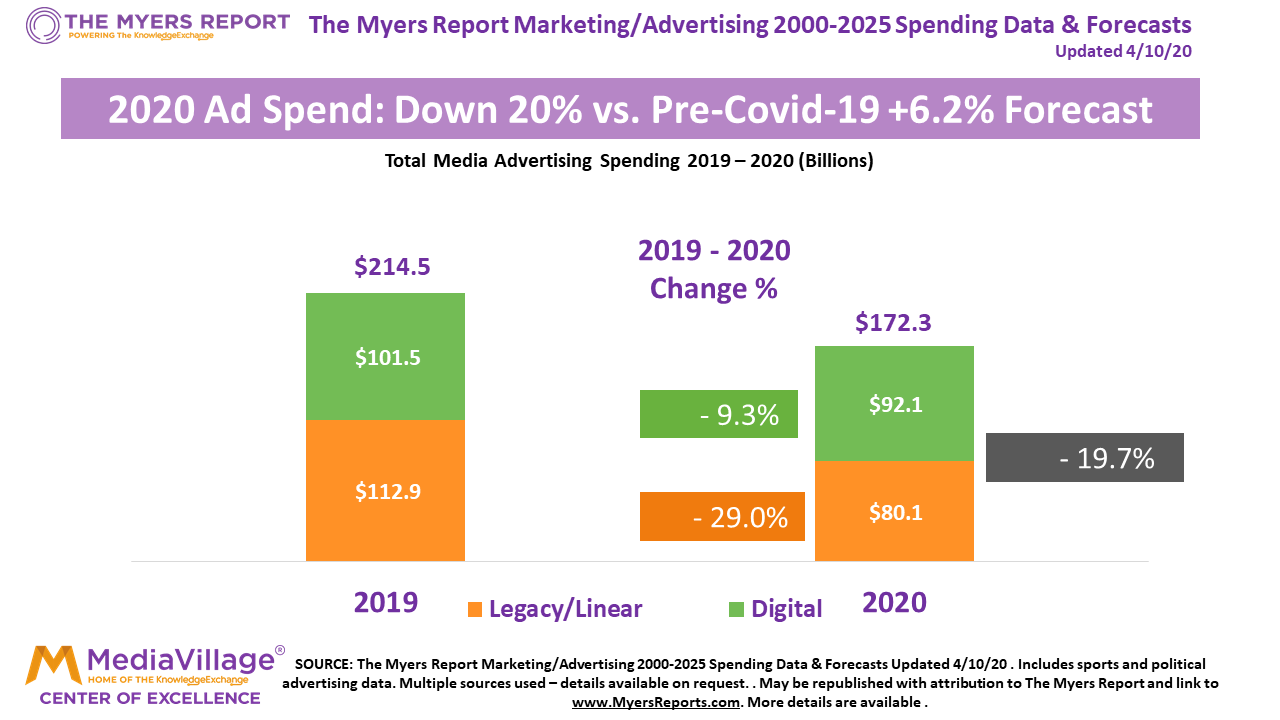

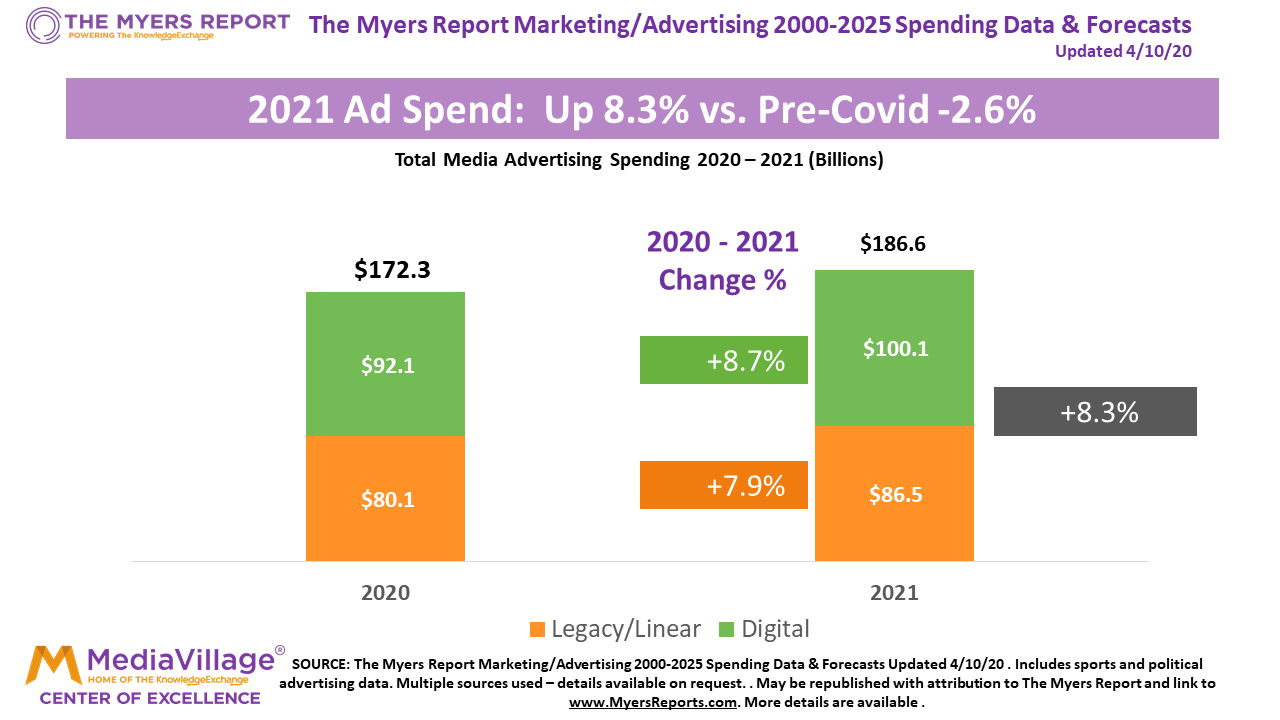

The Myers Report released new data last week on the state of the media and advertising economy, reflecting the anticipated impact of COVID-19 and the resulting economic downturn. Our forecasts are more bearish on 2020 ad spending and, unlike other forecasters we're projecting a long economic recovery pattern that will continue to be reflected by a local, regional, and national advertising recession. The Myers Report does not expect total advertising investments to return until 2024/2025 to 2019's $215 billion. We forecast declines of 20% in 2020 followed by increases in 2021 and 2022 of only 8% annually, bringing 2022 ad spending only to $202 billion. For insights and more details on our forecasts scroll down and you can view my economic conversation with analyst Michael Nathanson of MoffettNathanson here.

Several factors differentiate our forecast from others. We have based our forecasts on the belief that:

- Restrictions on mobility, retail, restaurant, and other public access will continue through 2020 and into 2021;

- All MLB, NCAA sports and most indoor sports will not be played until 2021;

- NFL, golf, tennis competition may resume in 2020 but with highly restricted audience access;

- The Olympics will be postponed until 2022;

- Economic impact of unemployment, small business closures and secular economic issues will accelerate a global recession.

Additional economic insights from The Myers Report are available at and will be published regularly over the next weeks. Subscribe to The Myers Report for our regular updates.