Another Win for Sports; Can Entertainment Stage a Comeback?

While 2016 was an anomaly as an Olympic and Election year, there is an undercurrent in the marketplace that ad spend in 2017 may be uncertain in a different way with the new, somewhat unpredictable administration in town. For example, it is possible that ad spend by organizations and associations will continue to grow as "campaigning" may continue even further past the election and pharmaceutical spend may also rise as President Trump has an open relationship with DTC. The political climate aside, with the digital advertising industry fighting concerns ROI is reaching an inflection point it is possible that advertisers will return to television en force, shaking up ad spend even further.

Regardless of what's happening in any given year, we all know that sports television has been the reliable programming driver of viewership, distribution and ad revenue. However, some programmers and media pundits expressed concern that with cord cutting, skinny bundles, increased OTT content and oversaturation of some sports programming in the marketplace, sports might not remain the force that it once was.

I have good news for those involved with sports television: While viewership and ratings were soft at times, when it comes to driving revenue sports remained king in 2016, handily topping entertainment programming. However, two questions remain: How long will the sports dynasty thrive, and can entertainment make a comeback?

Our 2016 SMI AccuTV report shows that sports continued to dominate the television playing field with a +13.8% YoY increase in ad spend. Despite the proliferation of entertainment content, broadcast entertainment primetime spend was down -5.4% and cable entertainment spend was flat across all dayparts YoY.

As I've highlighted previously, NBC was the big beneficiary of sports dominance as it saw total ad revenue grow +20% for the year which included the Olympics and the addition of Thursday Night Football to its schedule.

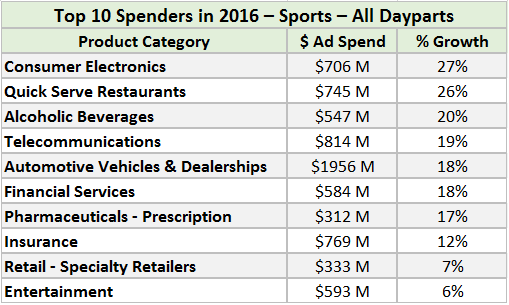

Now let's take a look at advertiser categories that doubled down on sports. As you'll see below, the top 10 spending categories by volume all increased their sports buys.

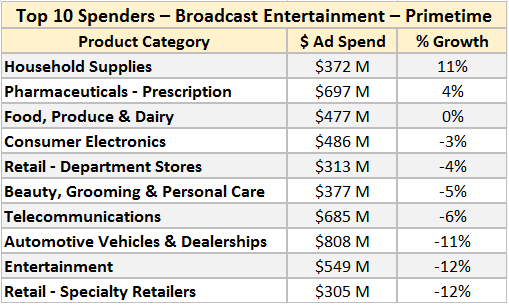

In contrast, only two of the top 10 categories by volume increased their commitment to primetime broadcast television and the others were down in terms of ad volume and % change, highlighting the fact that this important revenue flow from big advertisers is steadily shrinking.

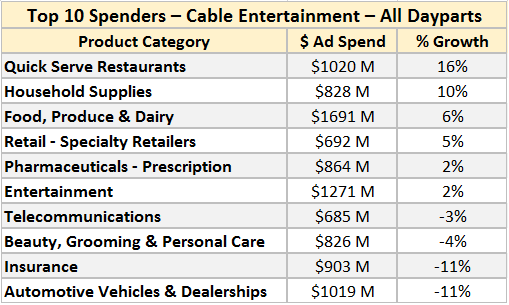

Cable entertainment fared slightly better across all dayparts, though it was also handily outperformed by sports.

This is a lot to digest, and especially troubling for those networks heavily reliant on advertising in entertainment programming. Not to mention, 2017 is projected to be the year digital overtakes broadcast TV in ad spend volume.

We saw the tide begin to turn in Q4 with more dollars going to broadcast television. With the return of big franchises to broadcast such as Scandal, 24: Legacy, NCISand Empire, and the return to cable of The Americans, Fargo andSuits, it is possible that destination, entertainment programming on TV will stage a comeback. I know I'll be watching.

Click the social buttons above or below to share this story with your friends and colleagues.

The opinions and points of view expressed in this article are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated bloggers.