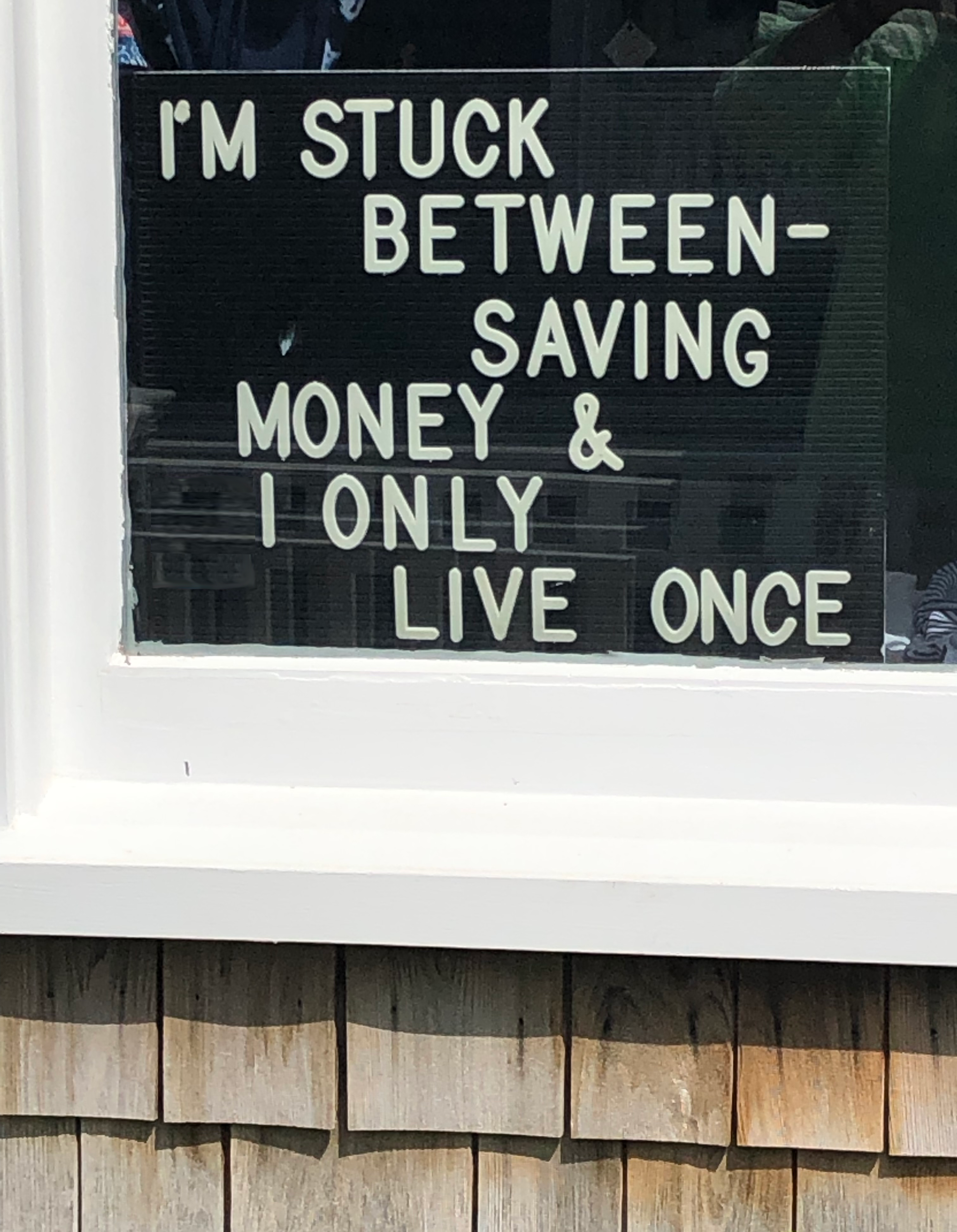

Boomers: Stuck Between "Saving for the Future" and "You Only Live Once"

We can all relate to one of life's recurring dilemmas: Should I save my hard-earned money for the future or spend it on the immediate gratification that I deserve?

If you're young, you have a whole lifetime ahead to balance these debits and credits; but if you're an aging boomer, you're starting to run out of time. Even though boomers know they may outlive their savings, many are still stuck between the instinct to save and the hedonistic call to live in the moment — after all, you only live once. What's a boomer to do?

As aging people look to their future, most share the same aspirational goal: to age successfully. Previously, the general aim of successful aging was to live as long as possible with a limited decline in health and well-being. By contrast, many of today's boomers expect to live longer than prior generations and aspire to a sustained — if not improved — quality of life as they age. What's more, the generation that's been accustomed to getting what it wants actually expects to get better with age.

When you talk to a boomer about their future, most assess it in the context of their anticipated physical and mental well-being. The news here is good, as continued advances in medical science and personal attentiveness to wellness (Pilates, anyone?) mean improved quality of life and personal productivity in one's later years. What you hear less of in that conversation is how boomers are planning to fund a costly future that includes, not only extended longevity, but also an uncompromised lifestyle.

Spoiler alert: Life has living expenses and the longer you live, the more expensive it gets.

So, once again, the boomers have irrational expectations for what the future holds. Nothing surprising in that, per se, but what makes this scenario much more alarming is their double standard: They're spending as if there's no tomorrow while simultaneously talking about life as though they expect it to be endless.

How should marketers think about this baffling behavior and, what if anything, can boomers do to better prepare for the future? Here are a few considerations to help answer those questions:

They're Bullish on the Future: Many boomers are ignoring the future because they're pre-occupied with "the good life" of what still feels like mid-life. Adam Smith, the great Scottish economist and philosopher once described a similar psychology, writing about the dilemma of investors in a late-stage bull market:

We are all at a wonderful ball where the champagne sparkles in every glass and soft laughter falls upon the summer air. We know, by the rules, that at some moment, the Black Horseman will come shattering through the great terrace doors, wreaking vengeance and scattering the survivors. Those who leave early are saved, but the ball is so splendid no one wants to leave while there is still time, so that everyone keeps asking 'What time is it? What time is it?' But none of the clocks have any hands."

The boomers are every bit as bullish about life and the future of life. Like Smith's party metaphor, this optimism is intoxicating. The more they spend on enjoying the day, on living in the moment they've waited a lifetime for, the harder it's going to be to leave the "party." For the typical boomers, a decision to spend less on enjoying life now, so as to save for the future, feels like the beginning of the end. If you believe you're ageless, the clock has no hands — and that's OK.

They're Also Living for the Moment: As much as people of age are changing, when it comes to balancing the needs of the future and the desires of the present, expect the same old, same old. Most will continue to opt to live in the moment versus sacrificing for the future. This is largely driven by their personal values.

The values that guide their behavior today were fashioned during their formative years and have persisted throughout a lifetime. If their trademark values, such as optimism and resourcefulness, have remained that steadfast for that long, they're not about to change now.

Although many boomers don't have a practical plan for funding their future, they do have a history of figuring things out when they need to be figured out. They're smart enough to know they need a plan, but they're opting to cross that bridge when they come to it. Their optimistic spirit has them confident they will prevail because they always have.

They're Controlling What They Can:It's hard to anticipate how you will respond to advancing age until you get there yourself. A lot of the public commentary about saving for the future — and what happens when you don't — is coming from constituencies with a vested interest, such as the retirement savings industry. It's OK for them to preach smart financial practice, but the reality is that many of them can't relate to the choice because they've yet to confront the realities of being of age.

None of us — boomers included — have the ability to predict the future. Absent are the concrete facts (How long will I live?) needed to make rational decisions (How much do I save?). So, we resort to making irrational decisions instead. What boomers do know, and that which they can control, is that life is pretty good right now. Sustained quality of life is a worthy investment that's paying solid returns in the short-term.

Avoiding FOMO with YOLO

In a boomer's world of uncertainty, one thing remains certain: You only live once. While everyone is free to react to that reality in their own way, the generation's modus operandi seems to be "get the most out of life while you can." Related to that, many also understand that "you can't take it with you." True — and also the perfect justification for spending your life's wages on your life.

Yet, for generations prior to the boomers, the values around saving for the future were markedly different. For Americans who had experienced life-altering events, such as the Great Depression and World War II, saving for the future was not about their later years, it was about the future of their children. Their reaction to "you can't take it with you" meant "leave it behind for someone else to use."

While it's tempting to judge the boomers, the lesson here is that every generation has a different set of values than the ones that preceded it. There is no contest, no winners, no right or wrong. As marketers, we have to take them as they are, and the better we can understand them, the more we can do to enrich their lives.

So, in the end, maybe they aren't really stuck between "saving for the future" and "you only live once." They're actually freer than they've ever been to do what they want, and if freedom is the secret to happiness, then maybe everyone will live happily ever after.

Photo courtesy of BoomAgers

Click the social buttons to share this story with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.