Nielsen Session Lifts Veil on Impact of Streaming Video

On Day One at CES 2021, Brian Fuhrer, Nielsen’s Senior Vice President of Product Strategy & Thought Leadership, presented a data-driven view of the impact the past nine months have had on television viewing and OTT usage. Summing up the media year, Fuhrer stated the obvious. "If we take pillars of things that happened with COVID, elections, social unrest, sports and the launch of streaming services, each one, individually, could have been the biggest news of the year or even the decade," he declared.

Fuhrer believes the collective impact of these events occurring in a single year sent viewers to streaming OTT to escape. What is interesting in the numbers is that the younger demos, which had already adopted OTT behaviors prior to the pandemic, seem to have settled back close to pre-COVID viewing levels. However, Fuhrer noted, older demos, which were forced by the pandemic to join the streaming video/OTT world to access new content, have maintained their recent levels.

Fuhrer offered up an interesting hypothesis around the decline of sports ratings, which surprised many given how profoundly impacted fans when sports went dark in the early phase of COVID. Fuhrer believes that the lack of a live audience had an adverse impact on the enjoyment of the experience at home due the lack of aural input of live fans. It seems fans were glad to have their sports back, but they turned to streaming and social to connect with other fans, rather than watch the games on TV. A similar sentiment was presented in the sports panel on fandom earlier today at CES.

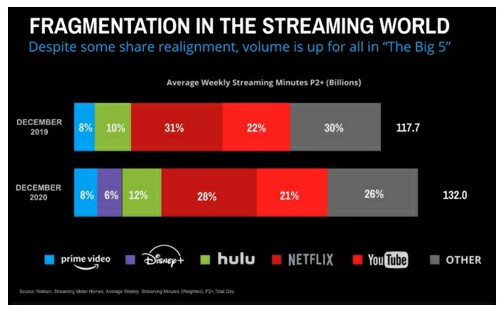

Fuhrer took viewers of the virtual session through several charts reflecting the impact of OTT services.

He believes that the streaming world is beginning to show the same fragmentation cycle that cable did. While he did not bring this up, it is interesting to note that at least 42% of all viewing minutes in December occurred in non-ad supported environments.

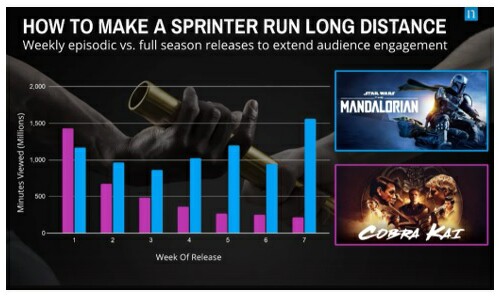

Fuhrer provided a perspective in the ongoing question on whether it is more advantageous to simultaneously release all episodes of original content or to release individual episodes on a weekly basis. Sharing data from Cobra Kai(Netflix), which was released all at once, versus The Mandalorian(Disney+), you can see the overall consistency in minutes viewed seems to favor the weekly roll-out. This info is more directional as some of this could be explained away by the longer average show time of The Mandalorian versus Cobra Kai (The Mandalorian episodes are about 10 minutes longer than Cobra Kai episodes), or a different make-up of the fanbase of each show (for example, given all the Star Wars references and Easter Eggs in The Mandalorian, it's likely that there is a higher multiple viewing rate than Cobra Kai).

Getting any kind of data around reach or impact of Netflix shows has been an ongoing struggle for years, with only the occasional insight released by the company. That's why it was especially rewarding when Fuhrer closed his session with some insight into the top viewed Originals, Movies and Acquired content of 2020. Unsurprisingly, when it came to Originals, Netflix was dominant, with The Mandalorian on Disney+ being the only non-Netflix show to make the top 10 by Minutes Viewed. The Netflix drama Ozark tops the list with 30.5B minutes viewed. Fuhrer pointed out that both Ozark and Tiger King, also on Netflix, benefited from the initial stay-at-home lockdown last spring. "Typically, a show that has 1B minutes per week is considered a hit," he explained. "Ozark and Tiger King each had 5B minute weeks, which is simply astounding."

In the Movies category, Disney+ dominated taking seven out of the top ten spots with Frozen II tops at 14.9B minutes viewed. Interestingly, two of the three Netflix films on the list were family kid-friendly movies, Secret Life of Pets 2 (9.1B minutes) and Dr. Seuss’s "The Grinch" (6.2B minutes). Fuhrer attributes this to tendency of kids more than any other age group to watch content multiple times.

Finally, in acquired content, The Office was top of the list with over 57.1B minutes viewed. (Note: These hours were on Netflix. The show has since been taken off Netflix and is now on Peacock, an ad-supported platform.) This is a show that's final first-run episode was broadcast over seven years ago. Perhaps, given the abruptness, for many of us, of being cut-off from a real-life office environment, we were looking for psychological comfort or a nostalgic reminder (with a few laughs) of what life was pre-pandemic.

Nielsen's panel provided much insight into the impact of 2020 events and the transition to OTT, and finally provided some benchmarks as to what can be considered successful, at least by one metric, within a media universe where Netflix dominates. It also solidified a harsh fact for advertisers: Consumers are transitioning into a world where a significant and growing percentage of their viewing is occurring in a non-ad supported or very limited ad supported world, making them more difficult and likely more expensive to reach.

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.