Early Indicators of Rebound and Other Recent Signals

Jack Myers tells me that "Premium linear content and overall high demand are pushing CPMs for top networks to +15%. Overall spending is about the same as 2019. Buyers are preparing clients to accept more OTT and addressable inventory, and I understand NBCU, ViacomCBS, Disney, Discovery and WarnerMedia will all be pushing to activate within their own inventory across digital and linear channels. Money moving is from scatter to Upfront.

"Buyers are actively pushing back and looking at options outside of the mainstream -- more national unwired local inventory, more Cadent- and Simulmedia-like deals," Jack continues. "It’s going to be difficult for the standalones to get CPM increases at the same level of majors, but they will have CPM increases."

This tracks with my own observations and it's clear that premium OTT/CTV -- the species of digital that the major television networks and others sell, which is really television content -- is driving growth of all of television, as I've reported here before.

Innovidsaw a +60% increase in 2020 global CTV impressions delivered, while programmatic CTV went up by more than +200% YOY.

Standard Media Index (SMI) had shown a tepid start to TV's year in January-February.

- Cable TV revenue has started the year (Jan + Feb) down only -3% versus last year, while Broadcast TV is down -14% for the same period.

- Some of this can be attributed to less new content, because production limitations due to the pandemic have caused delays on primetime programs. Award shows have also been impacted with lower ratings and re-scheduling until later in the year.

- The Discovery channels have had strong results in recent months and started the year (Jan + Feb) at +14% versus last year.

This now appears to be changing in a positive direction as we move into the Upfront. The scarcity of premium content both in linear and especially in premium OTT/CTV makes for a most meaningful Upfront moment, as scarcity of premium content was always the main point of the Upfront.

Because markets are coming back at differential rates, there should be strong local activity. A Bill Harvey Consulting analysis of Geopath data (available on request) shows that the rebound of mobility is very different by markets. For example, commuter miles are still at only 55% of their 2019 level in San Francisco as of ISO Week 11 of each year, whereas they are up to 2% over their 2019 level in Charleston West Virginia.

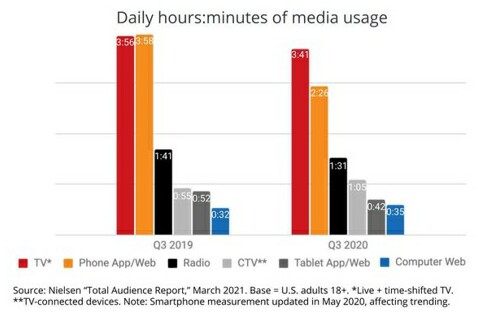

Another set of signals we are seeing among our Nielsen clients is a spate of recalled and reissued reports, unusually numerous. Also, Nielsen restated the way it models together its disparate data sets (passive measures and survey measures) resulting in a Q3 2020 picture quite different from the one Nielsen (and 605, Samba and others) had reported before, in which TV viewing was up as a result of the pandemic, while the new numbers go the other way, and are somewhat counter intuitive.

The restated numbers still show CTV up ten minutes per day per adult YOY.

No one can appreciate how challenging a task Nielsen faces moving from a relatively simple medium to a world of complexity in a relatively short time. Their ambitious and wise goals for Nielsen One are praiseworthy but we should fasten our seatbelts for the adjustments in measurements that we will see for the next few years.

Marketers need to establish their own worldview based on data they can confirm with their own data, rather than the ease of depending on third party measures which have become slightly unmoored. This means doing some hard work analyzing and comparing all their own and licensed signals. The reward for this hard work will be a far better understanding of how they ought to use specific metrics in making multimillion-dollar decisions.

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.