Leveraging Relationships Among Attention, Motivation and Incremental Brand Sales

I see the industry’s current focus on attention as a good thing, mainly because it has finally broken the logjam in studying the psychology of how advertising really works.

Attention has been described as a form of "net impressions" (Andy Brown, head of the Attention Council) and that strikes me as apt, based on the higher correlations one sees between attention and ad recall, and the adjacency between Advertising Exposures and Attention in the ARF Model. It makes sense that Opportunity To See (exposure) would be heightened by the eye gaze being toward the screen.

The lower correlations I’ve observed between attention and the mid-to-low-funnel metrics (higher in the ARF Model) also make sense, in that attention in itself does not contain any inherent payload that would naturally increase purchase. The creative's role is to deliver such a payload.

Yet, as Max Kalehoff (Realeyes) says, "No attention, no sales." ARF CEO Scott McDonald expresses it similarly when he dubs attention a threshold measure, a gate that must be passed through, a necessary but not sufficient condition for advertising effectiveness -- much like impressions themselves.

Wayne Wu in his brilliant book on attention summarizes the entire field’s scientific work as showing one relationship between goals and attention: We tend to pay attention to things that are relevant to our goals (motivations). If the payload of the creative maintains and builds upon those same motivations which drew our attention to that ad, the ad works and increases incremental sales effects and predispositions toward future purchase (brand equity).

As you may know, my own psychological work in advertising through RMT has beenfocused on motivations. Nielsen NCS validated that RMT Motivations, when the ad and context align in terms of those motivations, increases incremental sales, while 605 validated that same ad-context motivational resonance increases the whole funnel of brand equity measures. Neustar validated that when there is alignment between the motivations of the person reached (RMT and partner Semasio have determined the Motivations of 320 million IDs in the U.S. and 16 million in Canada) and the motivations in the ad, incremental sales increases. Simmons and the ARF Cognition Council separately showed that RMT motivational measures explain more of the variability in brand adoption and sales. These unusual degrees of proof for new marketing metrics are probably the result of RMT having empirically derived its taxonomy for motivational analytics from massive samples of set-top-box data.

Also, the RMT approach to measuring Motivations is not based on survey questions, but on passive measurement of content consumption by set-top-box and digital big data. The content coding of ads and media contexts is the basis of judging the Motivations present in ads and media contexts -- and by the people who consume these media contexts. The conscious answers a person would give in a survey are not the answers which RMT collects by means of this indirect approach, which may be said to tap the subconscious motivations which can be read from actual behavior.

Vividata ("the MRI/Simmons of Canada") has just released its Spring 2023 study in which RMT motivational scores have been appended to each of the 40,000 respondents. This makes Canada the global marketing industry’s testbed for deep learning about how CMOs can think up new communication strategies when armed with insights about the motivations of their current brand users vs. users of competitive brands vs. other segments of prospects.

Let’s look at two product categories, Quick Service Restaurants (QSR) and banks, through the lens of Vividata/RMT’s new Motivation Analytics platform, available through two self-serve user interfaces, Dapresy and Telmar, as well as through custom studies. The syndicated platforms focus on the 15 RMT Motivations, which can be analyzed by any of the other data in the Vividata survey: products, brands, media vehicles (television programs, websites, apps, other digital/social/mobile ad platforms, magazines, newspapers, radio stations), demographics, attitudinal questions. Custom studies widen the lens to include fine-grain subtypes within the 15 Motivations, including 86 Need States which are breakdowns of Motivational segments.

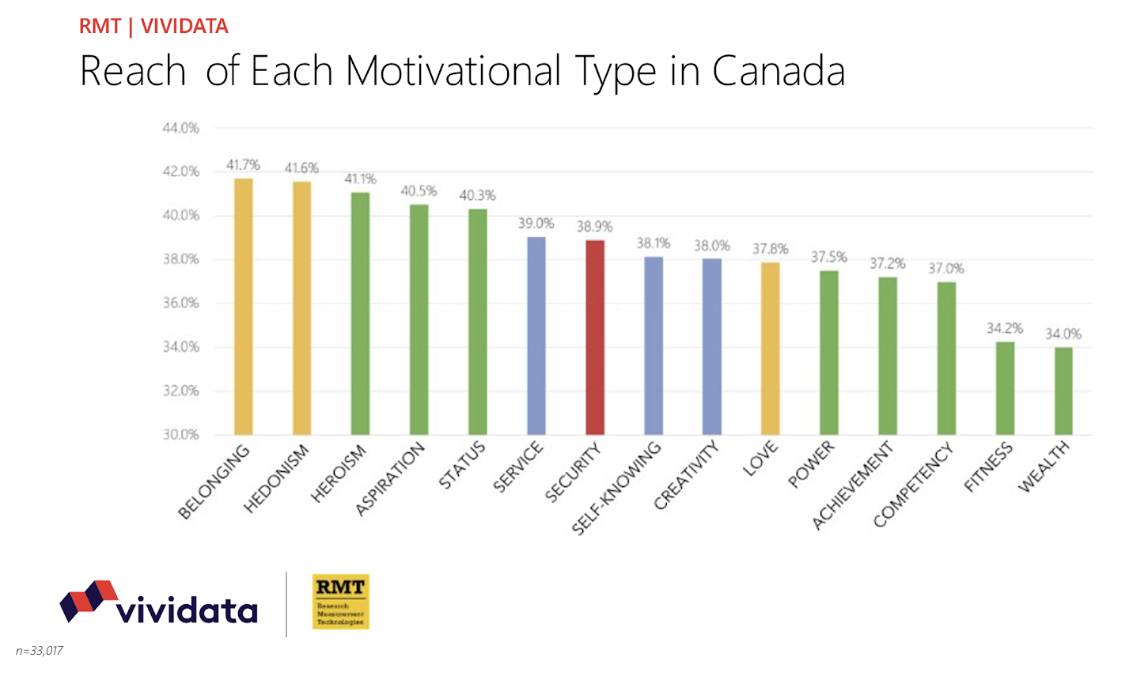

None of the 15 Motivations reaches/covers 100% of Canadians. The one Motivation that influences the most Canadians is Belonging, with Hedonism a close second. Wealth/Success is last in line in terms of reach of the Canadian public.

This might appear to be counter-intuitive, given how important money is across most of the nations of the world, and in fact, in surveys and even in a person’s own conscious awareness of himself and herself, money seems to take a major role in all of our lives. So how could a measure that has been so widely validated say that in Canada, money is apparently of less importance than many other things? It’s because our findings are not based on conscious motivations, but on whatever drives us to consume the content which we do personally consume. Remember that 95% of what drives us is at the subconscious level, according to Neuroscientist and Harvard professor Gerald Zaltman.

We chose five leading brands within QSR and five leading brands within banks in Canada. We will refer to them as QSR A through QSR E, and Bank A through Bank E. Interestingly, although Wealth is not the main Motivator in Canada, for these first ten brands looked at, Wealth/Success, Love and Status/Prestige appear to be the RMT Motivations which could have the most positive effect in new creative executions against these user targets in Canada.

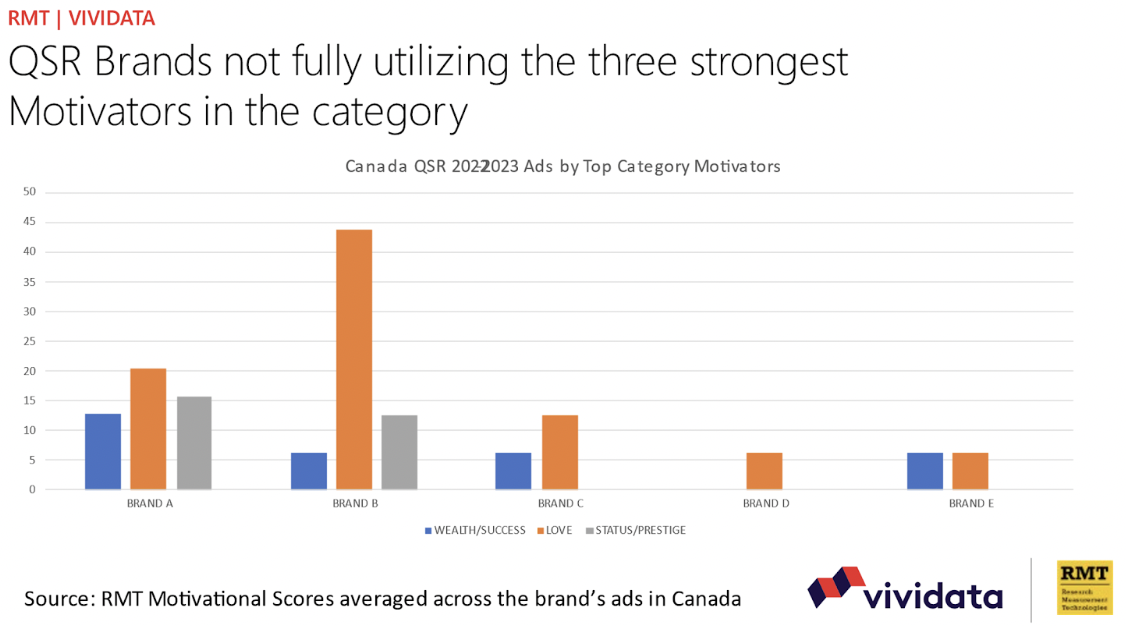

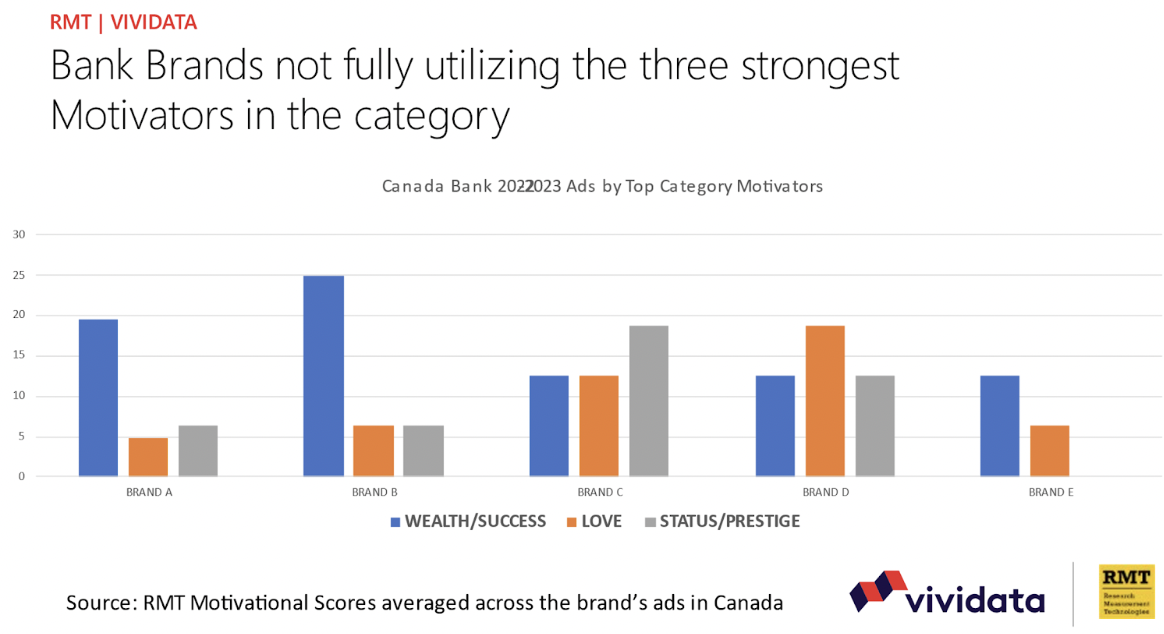

RMT was curious to see if perhaps some of these ten brands had already come to the same conclusion, and so conducted analyses of nearly 30 of the most recent ads these brands used in Canada. Interestingly, these brands in general are not making much use of these motivations in their video/television ads.

QSR Brands -– Observations:

- Brand A is communicating Wealth/Success

- Brands A and B are sometimes communicating Love

- None of the five QSR brands are doing enough with Status/Prestige (understandable given the image of QSR, but this can be changed)

- QSR ads analyzed achieved Motivation scores of 20+ in at least one Motivation about 70% of the time, of at least 30+ about 30% of the time -– although mostly among Motivations of lesser importance to that QSR’s customers

Bank Brands -– Observations:

- Brand A and Brand B are communicating Wealth/Success

- None of the five bank brands are doing enough with Love or Status/Prestige

- All five brands are communicating Power and Creativity more than the latter three top Motivations of bank customers

- Brand A ads were better aligned with the top three Motivations in late 2022 than in early 2023

- Bank ads analyzed achieved Motivation scores of 20+ in at least one Motivation about 70% of the time, of at least 30+ about 40% of the time – although mostly among Motivations of lesser importance to that bank’s customers

In this brief introduction to this new learning laboratory for the marketing world, we’ve only been able to impart a thin sliver of the tons of intriguing insights Vividata and RMT have already seen by dipping into the new data. We’ll continue to monitor developments in this mammoth new telescope into the minds and behaviors of our good neighbors to the North, and will report to you findings and approaches which deserve consideration by marketers everywhere.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.com/MyersBizNet.