Historically, the tried and true method for determining media mixes has generally consisted of connecting advertising prices and supply-side metrics (reach, GRPs, impressions, etc.). However, as the industry migrates to a more digital-focused world, this method is beginning to break down. Even just the act of gathering data is no longer that simple.

The failure of transparency of digital media companies has left the marketplace in a deep hole. It's 2019 and no significant supply-side competitive intelligence for the digital marketplace exists. While companies have made some progress, once the details were fully investigated these attempts were discovered to be incomplete.

The limited data supply has left the industry vulnerable to false assumptions, such as the popular refrain that digital is more than 50% of ad spend. While that is technically true, it is significantly misleading. The result holds only when considering the millions of small and medium businesses (SMBs) using the Google and Facebook duopoly's self-serve platforms.

SMB marketers don't have the budgets, time or expertise to care about branding: position, safety, health and so forth. It's no wonder Silicon Valley cares mostly about performance-based marketing; the sheer volume of their customers can only care about that. Even still, SMI sees a growing number of direct brands are changing that narrative and moving to TV and other traditional mass media. Their sales are strong enough now that they have the budgets to better manage their brands.

Meanwhile, the preferences of national marketers tell a very different story. To address the data nuances and generate transparency, SMI has developed a historical-looking dataset as well as forward-looking projections for the marketplace to benchmark both types of marketers: national and SMB/local. This is unusual since typical media analyses only break down the media side of the marketplace and not the marketer side.

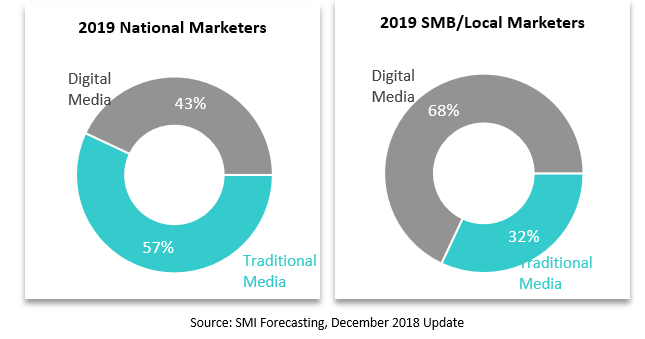

Here's where the discrepancy between the types of marketers truly comes into play. Consider again the idea that digital is greater than 50% of all ad spend. Among national marketers -- those who support major media companies as well as work with leading agencies -- digital is forecasted to comprise 43% of their advertising spend in 2019, not the reported 50%+ share that digital holds with all marketers combined. Comparatively, among SMB and local marketers an eye-popping 68% of ad spend is allocated to digital.

To further illustrate this point, below are five media types. Based on the split between national and SMB/local marketers, it is clear which kind of advertiser is driving revenue growth in each media type. National marketers are nearly the entire advertiser base for national television. On the other hand, Google and Facebook, with their self-serve platforms, allow SMBs to enter the ad marketplace. National marketers are more of an afterthought for those two media companies. The key difference here is the size of the market. Search and social have millions of advertisers paying thousands of dollars, while national television has thousands of advertisers paying millions of dollars.