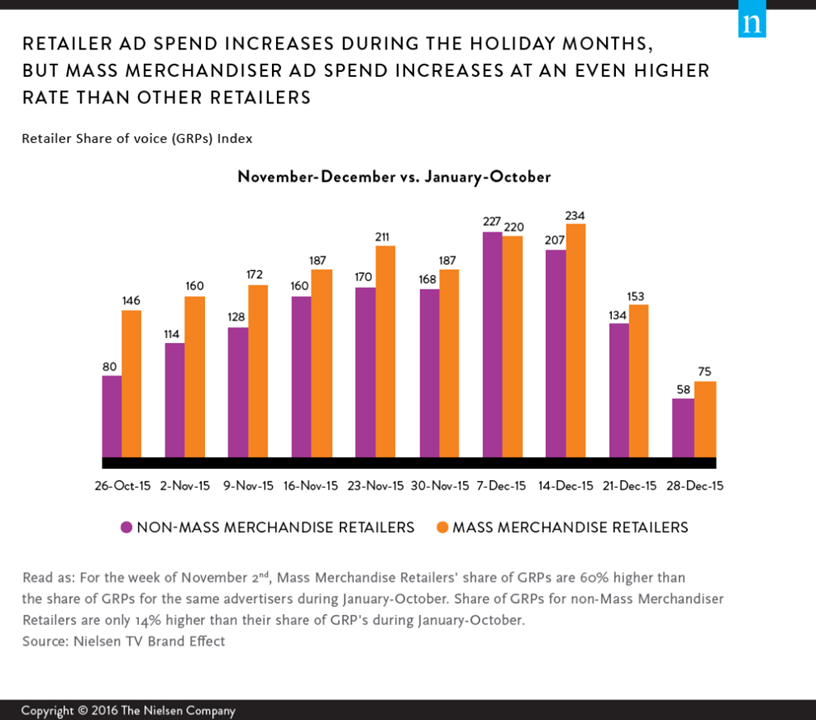

When it comes to holiday ads, mass merchandisers comprise over half of the total retail category’s Gross Ratings Points (GRPs), measuring ad impressions, during the holiday months. And not surprisingly, there is a significant increase in mass merchandiser ad spend (and overall retail ad spend) during the holidays compared to the rest of the year. However, that is not the case across all advertiser categories.

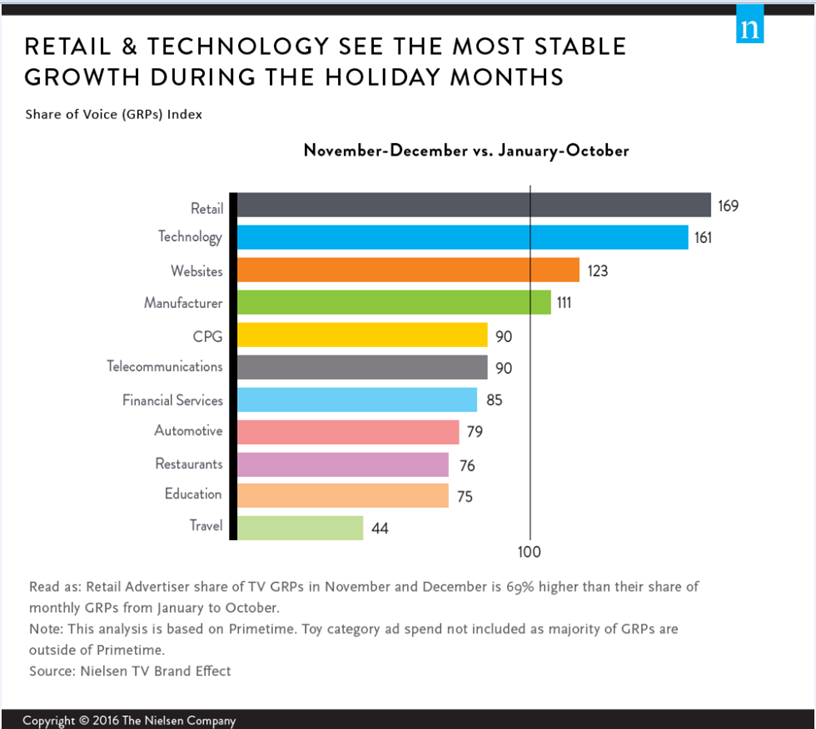

When comparing GRPs during the months of November and December to the GRPs over the rest of the year, the retail and technology categories see a significant increase in media weight while other categories see relatively equal spend or in some cases, less media weight than in other parts of the year.

While the retail category as a whole increases its media weight during the holiday season, this increase in GRPs is more significant within the mass merchandiser subcategory than all of the other retailer brands combined. Mass merchandiser brands doubled down on a weekly basis leading up to the holidays in 2015, particularly in early November and the week leading up to Black Friday.

So, does all of this extra media weight pay off? Despite the cluttered environment resulting from significantly higher ad spend across the category, ad performance for mass merchandiser retailers who increase their media weight do not suffer during the cluttered holiday months. In fact, Ad and Brand Memorability performance for these advertisers during November and December in 2015 was on par compared to their performance the rest of the year.