Not Your Father’s Tune-In -- Part 4

This continues our multi-part series about the new tune-in advertising, whose rating effects are now generally being measured to varying degrees by all players, using Nielsen itself in some cases, and especially using set top box data where the statistical significance of the findings leads to greater confidence in acting on the results.

In Part 1,we reported a crossmedia study done by NBCU and TiVo Research that showcased the synergistic effects of using multiple media. In Part 2, a leading expert in the new tune-in, Charlie Fiordalis, CDO of Media Storm, shared best practices and key action takeaways. In Part 3,we reported on spending trends by TV networks in paid tune-in advertising, based on the authoritative new SMI actual spending data. Here in Part 4 we will continue to delve deeper into SMI data.

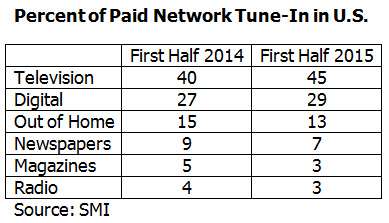

Of the paid tune-in invested by television networks in the first half of 2015, 45% was in television — up from 40% in the first half of 2014. Television networks believe in their product — they buy it themselves.

You might think, “Only 45%?” This seems inconsistent with Charlie Fiordalis’ remarks suggesting that more like 80% of tune-in today is on TV. But it isn’t. The nonpaid tune-in category dwarfs the paid tune-in category, and virtually all of the nonpaid tune-in is on TV — i.e. a network using its own airtime to promote its own products, which accounts for about 20% of all TV commercial time available. So 45% of the paid tune-in is on TV, while 80% of the total tune-in is on TV.

The diversity of the other 55%, shown in the table below, reflects the learning that synergy is a powerful factor: The more one reaches you through different media, the more your brain pays attention to the advertised show. It’s the same for other product categories, too. Use all media, the data says; the real question is finding the optimal allocation among them.

TV’s biggest advantage over other media is its reach. It is very hard using digital or any other media, alone or in combination, to rapidly build reach the way TV does, especially high-rated TV (which generally means broadcast prime time). This is why TV continues to get the largest share of adspend even within categories and brands that have the greatest commitment to digital.

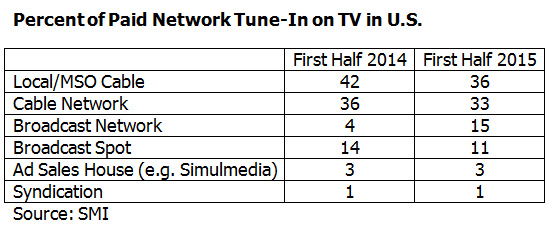

TV networks have virtually quadrupled their allocation to broadcast TV in the past year, from 4% to 15% of paid tune-in on TV. This probably represents learning from experience that broadcast, especially prime time, is a reach accelerator and therefore helps a lot in driving rating lift for an advertised show. This is the beginning of a spring-back from years of attrition in the allocation given to broadcast by advertisers in general, a trend caused by the seeming validation of “pure lowest-CPM thinking” by marketing mix modeling (MMM). (See also the value of fast reach in this other post of mine.)

No other category of TV increased its share of paid network tune-in in the last year, and shrinkage in Local/MSO Cable, Network Cable, and Spot Broadcast went into the expansion of Broadcast Network.

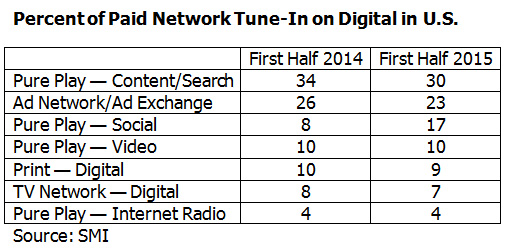

Paid network tune-in buyers more than doubled their allocation to social media in the last year. This expansion came from share losses in search, ad networks/exchanges, print-owned digital, and TV network-owned digital. Digital video did not grow share.

As tune-in advertising becomes more optimized through analysis of rating lifts in relation to tune-in exposure, we see shifts to TV especially broadcast, and to social media (up to third largest digital subtype, from fifth last year). The synergy theme continues to be dominant, causing allocation across a host of media types and subtypes.

In the next article in this series: What are the most significant recent trends in theatrical motion picture tune-in advertising?

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaVillage/MyersBizNet management or associated bloggers.