Not Your Father’s Tune-In — Part 5

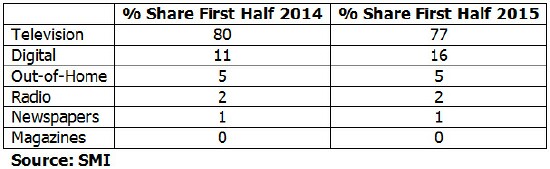

What is the shifting media mix for theatrical motion pictures? Although there were some striking shifts from first half 2104 to first half 2015, 77% of the money is still in television, down from 80% in 2014. Under this seemingly steady surface, the small magazine spend increased +70% while newspapers declined -67%, digital grew +22%, out-of-home declined -19% and radio shrank -13%. In fact the total motion picture category cut back spending -13% across all media types combined.

One wonders what led to a smaller adspend in this category. In general there is every indication that advertising is working for the motion picture business and the ability of viewers to get content at home is at an all-time high; why then cut back? Uncertainties (there sure are plenty of those) and/or clouded thinking? It would seem an obvious case that advertising is needed to get people to make the extra effort to leave their homes to see a movie. Perhaps my readers can give me a clue as to the forces shaping this decline; I’ll be happy to share your thoughts here.

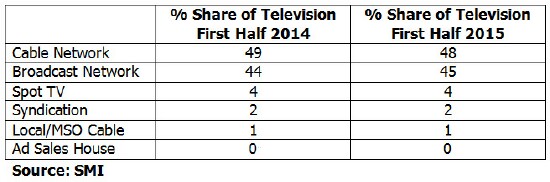

Television’s dominance in the motion picture category is shown more clearly by the following chart. Note that digital grew while the total spend declined, resulting in the share growth shown below.

Within television, theatricals widely favor cable network and broadcast network over all other types. Cable spend has edged out broadcast probably due to CPM, while the studios could be behind other product categories in testing and measuring the ROI of alternative mixes. In CPG for example the ARF found that 24% of GRPs and therefore about half of dollars in high-rated programming is optimal for driving ROI. If movies work the same way, then the studios should be putting about half their TV dollars into high-rated programs on broadcast network, broadcast syndication and cable network, building fast reach on Thursdays and Fridays. In fact broadcast network edged up its share in the past year, signifying possible awareness of the fast-reach advantage of high ratings.

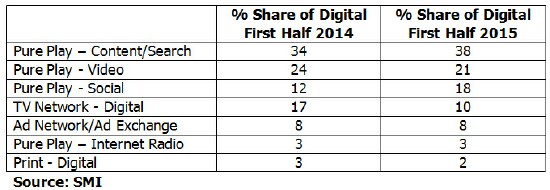

Within digital, Social and Search were the big gainers, with Search increasing +37% from 34% to 38% in the first half of 2015, and Social increasing +87% from 12% to 18% share of digital over the same period. Studios backed quite a bit out of TV Network Digital (-30%) and out of Print Digital (-12%) in the same period. Perhaps the theory behind this is that those categories are just more exposure whereas Search and Social have other psychological interactions with the prospective ticket buyers. One wonders if actual in-market data was used to make these decisions. Anyone who wishes to come forward can get a hearing here.

This view suggests that the motion picture industry believes it does need as much advertising as it used to use so long as enough of it is in the right places, such as TV networks, Search and Social in the right proportions. Analysis over time will help reveal whether they are right. Given the intensifying entertainment options at home, one would think the time propitious for heavy-up testing.

Read the earlier posts in this series:

Part 1: We reported on a cross-media study done by NBCU and TiVo Research that showcased the synergistic effects of using multiple media.

Part 2:A leading expert in the new tune-in, Charlie Fiordalis, CDO of Media Storm, shared best practices and key action takeaways.

Part 3: We reported on spending trends by TV networks in paid tune-in advertising, based on the authoritative new SMI actual spending data.

Part 4: We continued to delve deeper into SMI data.

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaVillage/MyersBizNet management or associated bloggers.