Surprise! Fastest and Slowest Growing Media are Not What You Think

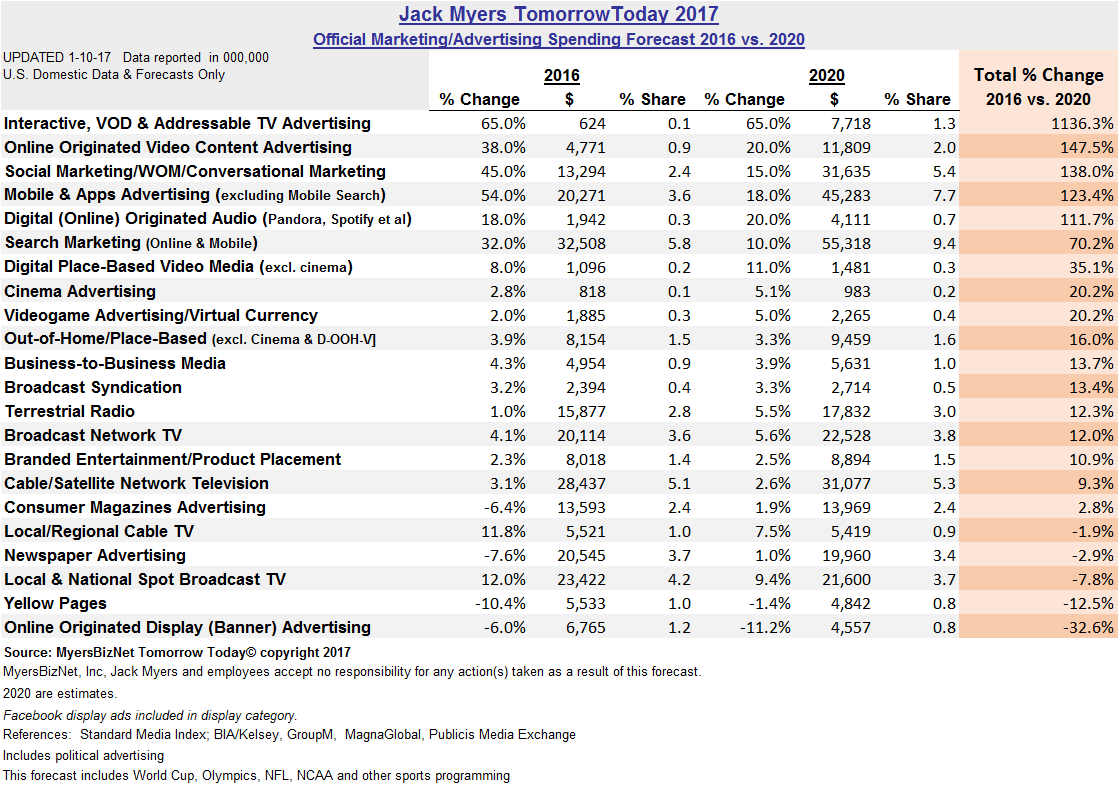

Guess which medium is forecast to grow the fastest and which to decline the most in the next four years. I'll bet you can't guess either. According to MyersBizNet's 29th Annual Marketing & Advertising Data and Spending Forecast, the fastest growing media category is television! While broadcast network television ad spending is forecast to increase 12% and cable network TV by 9.3% between 2016 and 2020, both driven by digital growth and well below several other media categories, the TV business overall will be the beneficiary of growth from $624 million in 2016 to a projected 2020 total of $7.7 billion in interactive/addressable/VOD television advertising investments.

Scroll down for full details.

As for the greatest percentage decline, you might guess continued erosion of newspaper, magazine or yellow pages advertising. While yellow pages are forecast by MyersBizNet to decline another 12.5% to $4.8 billion and newspapers to decline only 2.9% to just under $20 billion in 2020 ad spend, consumer magazines will actually increase their share of advertiser budgets, with projected growth of 2.8% comparing 2016 to 2020. Here's the surprise: the greatest decline in annual advertiser investments will be in a digital media category.

Online originated desktop display (banner) advertising is forecast to decline 32.6% from $6.8 billion in 2016 to $4.6 billion in 2020. Of course, digital spending overall is continuing to grow as marketers shift below-the-line budgets to social, search, video and mobile advertising. (Scroll down to view MyersBizNet data on Media Spending Shifts 2016 to 2020. MediaVillage members can link to our full 2000-2020 advertising and marketing economic reports here.) Among digital media, online originated video content advertising is forecast to experience the greatest growth, from $4.8 billion in 2016 to $11.8 billion in 2020 (147.5%). Social marketing is projected by MyersBizNet to increase 138%; Mobile/apps advertising by 123% and search marketing (desktop and mobile) by 70%. (See details below)

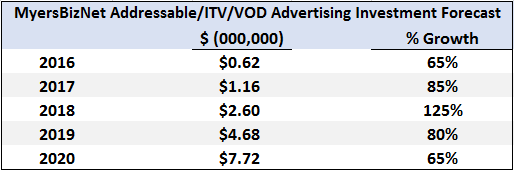

Interactive and addressable TV proponents have been frustrated by slow advertiser embrace since the late 1990s, when more than 100 software and hardware companies were actively competing for what was expected to grow to a multi-billion-dollar industry by 2005. However, in 2003 cable operators opted to retain so-called "dumb" set-top boxes rather than adopting the advanced technology they were expected to deploy. That slowed the advance of ITV and addressable media for a decade as the industry waited to fully amortize its investment in dumb boxes before moving to advanced technologies, and they are just now catching up with early adapters like DISH and Cablevision. By 2010, advertisers were investing only a paltry $50 million in addressable and ITV media, and it wasn't until last year that the industry experienced a meaningful 65% surge to $624 million.

Today, all new cable and satellite installations are ITV and addressable-ready. As my colleague Simon Applebaum points out at MediaVillage.com, "at least half of all U.S. television households now operate a smart or connected set, or devices like Roku, Chromecast, Apple TV, Shield and Amazon Fire TV, or both. Recent studies indicate viewership of Web-transmitted services through these devices is rising." Whatever the source of the content and distribution, it's television that's the beneficiary, and advertisers are paying attention to the emerging opportunity to deliver addressable/targeted messages at mass. Yes, "targeted mass" sounds like an oxymoron, but it's a growing reality.

As marketers and agencies shift their media buying priorities from awareness-focused cost efficiencies to results-oriented performance measures based on sophisticated data and analytics, there will be an inevitable and rapid shift to highly targetable addressable opportunities. Based on this combination of factors, MyersBizNet is forecasting exponential growth for the category.