What We Have Learned About TV and Digital Advertising -- Part 2

This is the second half of a two-part series covering reach, frequency and sales impact written by Bill Harvey and MediaVillage guest contributors Gian Fulgoni and Andrew Lipsman.

In Part One we reported the general patterns of delivering reach on TV. In this post we will delve into delivering reach on digital, and on crossmedia.

Delivering Reach on Digital

Digital has long been considered to be more measurable and targetable than TV and, while that is indeed the case, over time new learning has emerged showing that all is not as it seems. Because digital metrics are often contaminated by factors such as cookie deletion, non-viewable impressions and fraud (i.e. non-human traffic), some long held assumptions about reach have been incorrect. The good news is that as these issues have been identified and addressed through measurement systems, we are getting a much clearer picture.

To begin with, digital for a long time used “served impressions” as the currency for buying and selling display ads, and these cookie-based metrics systematically overstated reach and understated frequency due to the high incidence of cookie deletion. The effect was typically a 2-3x overstatement of reach and corresponding understatement of frequency. And that was even before qualifying whether or not these served impressions even had the opportunity to be seen by human eyes.

In examining thousands of digital ad campaigns measured in comScore vCE, the heaviest plans we’ve seen (defined as those with at least 100 million gross impressions in a 3-month period) deliver an average of 227 million impressions, translating to an average Internet reach of 19% and 24% against the target population. But this is before adjusting these metrics to filter for non-viewable and fraudulent impressions, which routinely account for more than half of gross impressions.

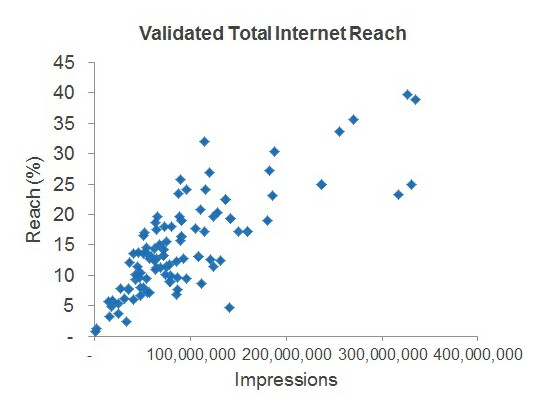

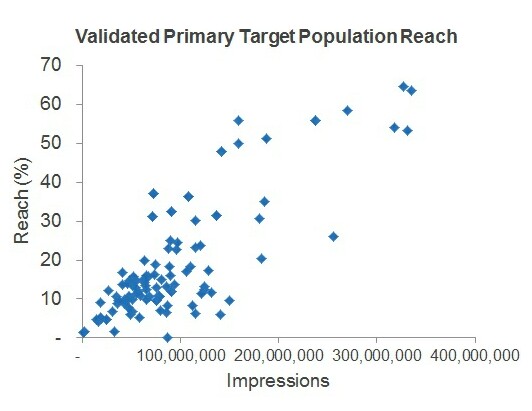

In fact, comScore research has shown that filtering out these impressions reduces a campaign’s reach by about 23% while also reducing frequency by slightly more than 33%. But once an ad has been validated as both viewable and absent of fraud, we get a more realistic understanding of online reach. The illustrations below highlight how reach in a three-month period varies by the number of impressions in a campaign for both the total internet population and the primary target audience. Only a small number of campaigns are big enough to deliver 30 percent overall reach or about 40 percent in-target reach, which suggests that digital does not yet compare to TV on this dimension.

And yet there’s more to the story. A closer examination of the data suggests not that digital isn’t capable of delivering audience scale but rather that advertisers likely need to spend more to get the sort of reach that is commonly delivered on TV. The reach curves for digital show little to no evidence of declining marginal reach at significantly higher levels of impressions, suggesting that advertisers could safely spend more in digital to maximize reach. And since digital CPMs are typically a lot less expensive than TV (except for digital video), advertisers willing to heavy up on digital can get the sort of mass reach they’re looking for.

Maximizing Reach through Integrated Cross-Platform Media Planning

Looking to the future, it’s clear that the much-anticipated availability of cross-platform data which encompasses both TV and digital will provide vital and much-needed data for planners. Having an unduplicated view of reach across TV, desktop, smartphones and tablets means that advertisers can buy media more efficiently to reach their target audiences, while ensuring they spend fewer dollars on the flat part of the reach curves. And, content owners can better establish the value of their entire audience.

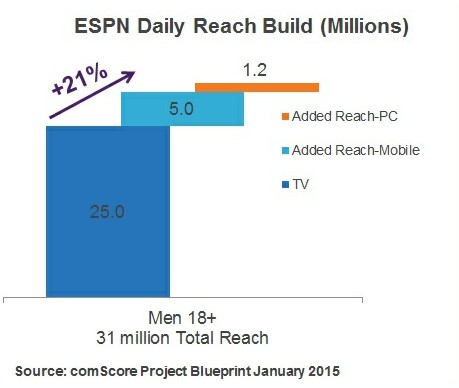

ESPN, for example, was able to demonstrate through comScore’s Project Blueprint cross-platform measurement initiative that their daily audience reach for Men 18+ grew by 21% -- representing more than 6 million individuals – when accounting for the incremental non-duplicated audiences on desktop and mobile.

Ultimately, understanding the manner in which both unduplicated audience and frequency increase as ads are delivered across platforms will allow planners, buyers and sellers to combine and leverage the best aspects of TV and digital media.

Gian Fulgoni is the Co-Founder and Executive Chairman Emeritus of comScore.

Andrew Lipsman is the Vice President, Marketing and Insights at comScore.

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaVillage management or associated bloggers.