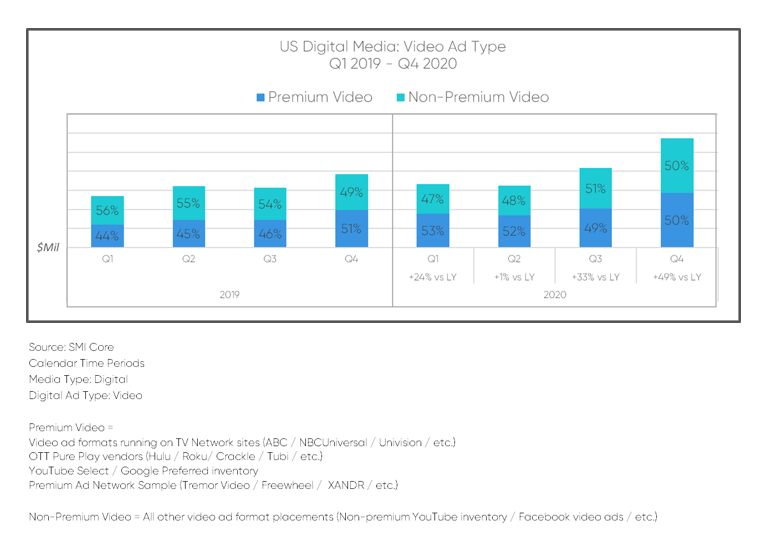

Premium OTT ad dollars in the U.S. have been trailing YouTube/Facebook video for years, but finally caught up in Q4 according to Standard Media Index (SMI), and will soon pass non-premium digital video due to the ROAS (return on advertising spend) advantage of Premium and increased common sense about context effects. Premium consists of the video content produced by the major television networks and studios or indistinguishable from such product.

A Bill Harvey Consulting (BHC) and Fox study of $2.2 trillion in sales in relation to $48 billion in ad spend by media types found that ROAS of Premium digital video is higher than television, and the synergy between them adds a kicker effect. That study, and Nielsen NCS, both find that Premium digital video and TV have about twice the ROAS of Nonpremium digital video and digital display.

The average person can tell you that it makes sense to expect more positive effect with your ad in Premium digital video versus a Skip-in-5 environment, however advertising practitioners, closer to the trees, have not been quick to definitively confirm and act upon that notion, and have instead raced to the bottom in terms of that great oversimplification called CPM. Global ad dollars in digital are double TV; digital being 90% small space static ads with documented lowest ROAS among major media types. Up until the end of 2020, the growth (after Search) has always been in Nonpremium or Display. Now more marketers have woken up and the idea of Television plus Premium OTT is starting to spread exponentially.

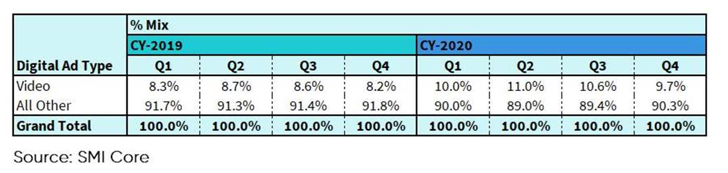

Putting this in perspective, SMI has provided this table which shows that both forms of digital video combined are still only about 10% of total digital ad spend in the U.S. by national advertisers:

Which means that although it’s increasing, Premium OTT is still only about 5% of national advertiser digital, whereas based on its ROAS it ought to be the largest part of national advertiser ROAS.

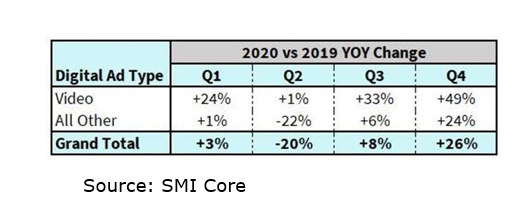

SMI also provided this fascinating table showing what happened to digital video vs. the rest of digital when COVID hit:

Digital Video came into 2020 growing 24 times faster than the rest of digital. In Q2 COVID hit and Digital Video showed its resiliency by growing +1% in that quarter while the rest of digital dropped -22%. As the rest of digital rebounded too, digital video growth stayed more than 25 percentage points higher in growth than the rest of digital.

In an earlier post I reminded us that sight-sound-motion was long ago theorized to be a more powerful communication style than just the sight of a static piece of text and picture, or just hearing an audio track. That's why 58% of 1990 ad dollars in the U.S. were in TV. Twenty-seven percent were in sight-only media and 15% were in audio-only media. But look at how that has changed!

In 2020 we put as much money in static sight-only ads (44%) as we put into sight sound and motion ads (45%). In 30 years, we went from spending twice as much in sight-sound-motion as static sight only, to spending the same in both.

Was this due to some advertising research discovery that I never heard about? Have neuroscientists and ROI/branding measurements scientists proven that sight only sells better per dollar invested and builds brand equity better than sight sound and motion? No. As stated above, Nielsen NCS finds the ROAS of TV to be double that of digital display. Yet marketers have been putting 18 times the number of dollars into low-ROAS digital display as they put in high-ROAS Premium OTT. Every dollar that walked from TV to digital therefore lost half its selling effect. For all the talk of scientific media selection, and all the great AdTech, the actual bets are placed simplistically on bargain basement CPMs as if the whole thing is just a game, and the psychological finesse of advertising is just more empty rhetoric.

The good news is that we appear to be emerging from a cloud of ignorance into a better place -- maybe at all levels, let's hope, and work towards that. The SMI numbers show that Premium caught up. In Q3, the buys that were made for Q4 2020 shows Premium catching up by growing +49% year over year -- a very fine number for any new industry in any one quarter. Perhaps our $2.2 trillion study made a difference; it came out in mid-2020.

Is Premium OTT a new industry? It is a proven industry (TV) yet wine in new bottles (streaming). The bottles are very attractive to a growing majority of us who have become technophiles and just love our smart content screens. What's not to love? It's got sight sound motion, it's convenient, and there is so much content.

For an advertiser, the ad context matters. Context Effect in 20th Century hit +15% on ad recall, now RMT is getting +36% on ROI and +62% on first brand mention. The content around your ad should mirror the feeling of your ad. That and the quality of the program content are both important if you want to set your creative up to have its maximum impact.

If you just want to buy cheap impressions, good luck with that; hyper-loads of frequency do more to irritate the citizen than to convert her or him.

You can do this matching of ad to context much more sales effectively at the program level than at the network level. The lifts to sales and brand metrics are roughly double when context and ad resonate at the program level than when they merely resonate at the network level.

This is why Crackle was first to announce making program-specific buys available in