Since 1948, when commercial television was born, media pups were taught in their first week in the business about different media coming through different sensory channels: TV (Sight, Sound and Motion), Print (Sight), Outdoor (Sight) and Radio (Sound).

At Grey, like every other agency, we believed in the power of television because of the Sight, Sound and Motion notion. It seemed obvious that attention and emotions are much more easily captivated when both eyes and ears are engaged rather than just one or the other.

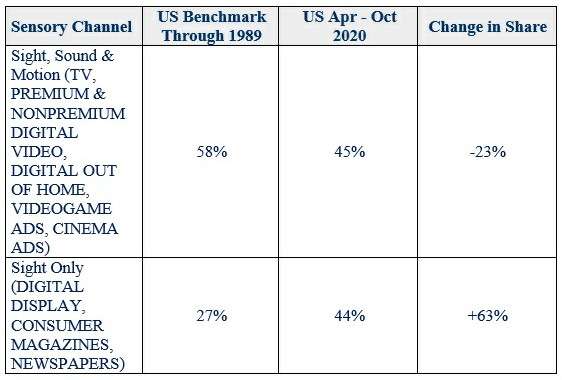

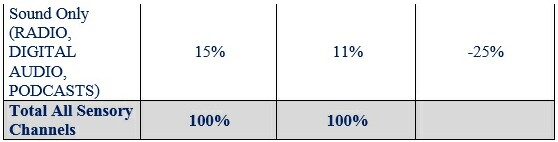

I estimate that until around 1989 (the year Timothy Berners-Lee launched the World Wide Web) we big agencies spent around 58% of our clients’ money in TV, about 27% in Sight-only media Print and Outdoor, and the remaining 15% or so in the Sound-only medium of Radio. (I’m hoping Ed Papazian will sharpen that estimate in an appended comment.)

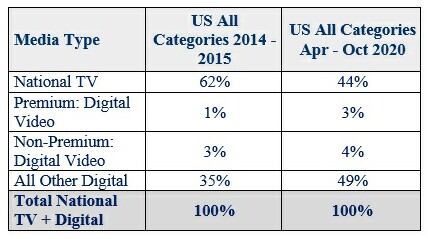

As I was writing my December 10 post my mind connected some dots it had never connected before, and I observed how most of the money in Digital today is Sight-only, i.e. display ads. This kind of surprised me, given that Digital Video has now been available for well over a decade, and appears, compared to its own prior baseline, to be booming today. Yet U.S. ad spend in Digital Video is dwarfed by Digital Display 7 to 1 across all SMI product/service categories combined in the period April-October 2020 in which Digital Video is at its record highs in history.

This reflects the biggest advertisers, the ones that use the major holding company and largest independent media agencies. (My estimates for 1989 above cover the same major advertiser/agency universe.) Here are the data for all product/service categories combined:

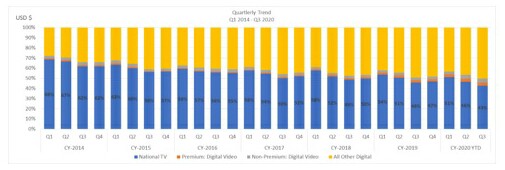

Another view is presented by the following bar chart. Note how the two Digital Video slices in the middle (which you have to really peer at to even see) do not grow even slightly for a very long time and then very recently start to grow but very slowly, and more at the expense of TV than at the expense of Digital Display, which strangely still continues to grow far more than the Digital Video types.

Here's what James Fennessy, CEO of Standard Media Index (SMI), has to say about it: “Our data shows video advertising to be underutilized, specifically premium video where streaming options can provide strong ROI to marketers. While ad spend on OTT has shown some growth of late, it is still a very small share of total investment.”

I agree. CPM is the probable reason for it, CPM without regard to ROI.

Here are my own estimates based on PwC, SMI and other sources, when we lay side by side today’s Sensory Media Allocation here is what we see:

My question to all of us is, do we now all believe that what we were taught about Sight, Sound and Motion was a mistake, and we now all believe that static, small-space print-type ads on screens are the equal of Sight, Sound and Motion, or did this pattern sneak up on us, and maybe should be questioned as to maximum cost effectiveness?

Again, the pattern has all the earmarks of being the result of fixation on low CPMs with blinders on as regards all other considerations.

What are those other considerations, then? ROI is one healthy consideration, especially because it automatically integrates CPM. If a media type has high enough CPM, its ROI will not look good even if it has more upward sales impact. So, ROI already covers all your concerns about CPM, plus, it values sales more than impressions, which is good thinking.

From an ROI point of view, the BHC FOX SMI study shows that premium Digital Video has the highest ROAS, TV is second, non-premium Digital Video is third, and Digital Display is fourth-ranked in ROAS.

However, unless you use random control trials such as the ARF is offering with Central Control, BHC and 605, we know that measurers and modelers of ROI often appear to be getting different answers. So, not content to rely on one study alone, I asked my friend Leslie Wood, Chief Research Officer of NCSolutions, for the latest ROI meta-analysis norms by media type, based on over a thousand studies mostly focused on CPG. I find the results extremely interesting and I think you will, too.