Regardless of what's happening in any given year, we all know that sports television has been the reliable programming driver of viewership, distribution and ad revenue. However, some programmers and media pundits expressed concern that with cord cutting, skinny bundles, increased OTT content and oversaturation of some sports programming in the marketplace, sports might not remain the force that it once was.

I have good news for those involved with sports television: While viewership and ratings were soft at times, when it comes to driving revenue sports remained king in 2016, handily topping entertainment programming. However, two questions remain: How long will the sports dynasty thrive, and can entertainment make a comeback?

Our 2016 SMI AccuTV report shows that sports continued to dominate the television playing field with a +13.8% YoY increase in ad spend. Despite the proliferation of entertainment content, broadcast entertainment primetime spend was down -5.4% and cable entertainment spend was flat across all dayparts YoY.

As I've highlighted previously, NBC was the big beneficiary of sports dominance as it saw total ad revenue grow +20% for the year which included the Olympics and the addition of Thursday Night Football to its schedule.

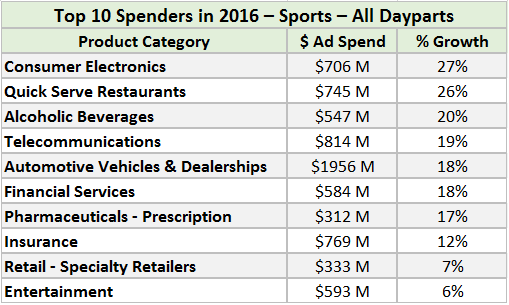

Now let's take a look at advertiser categories that doubled down on sports. As you'll see below, the top 10 spending categories by volume all increased their sports buys.

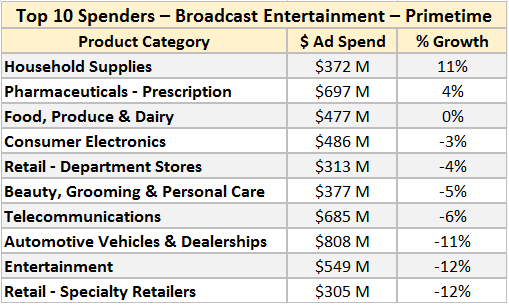

In contrast, only two of the top 10 categories by volume increased their commitment to primetime broadcast television and the others were down in terms of ad volume and % change, highlighting the fact that this important revenue flow from big advertisers is steadily shrinking.

Cable entertainment fared slightly better across all dayparts, though it was also handily outperformed by sports.