Quarterly Quotes Q3 2019 Featuring Companies Like WarnerMedia, Twitter, Viacom, CBS, Snap, Dentsu, Omnicom and Many More

MediaVillage’s Wall St. Report is happy to provide you with “Quarterly Quotes” for Q3 2019. Quarterly Quotes is a curation of the top insights and forward-looking strategic views taken directly from the earnings calls from major publicly traded media and advertising agency companies. Our intent is for this report to save you significant time from having to comb through every single company’s report, while enabling you to better understand the current advertising and media ecosystem directly from the mouths of the most influential and powerful executives in the media and advertising agency world. The insights provided during the Quarterly Earnings calls, in particular during the Q&A periods, in response to Wall Street analyst questions, present a unique opportunity to get a solid perspective of what these companies primary focus will be in the near term and, perhaps more importantly, a glimpse into the rationale and the way of thinking that is driving each company’s priority.

Insights from Q3 2019 reflect the views immediately prior to the start of what will likely be a tectonic shift in the media industry with the roll-out of several high-profile direct to consumer over-the-top plays. AppleTV+ and Disney+ have rolled out with several other high-profile players, including NBCU’s Peacock and AT&T’s HBO Max, in the coming months. Disney+ has surpassed expectations with over 24MM subscribers reportedly signed up as of this week. The impact of this unprecedented time is a recurring theme throughout the calls. General economic conditions also play a recurring theme with varying degrees of opinions as to whether or not 2020 will be a slowdown. In the agency world, the topics of in-housing and progress in both data platforms and client development continue to be the focus.

We wish you and your loved ones a wonderful holiday season and much success and prosperity in 2020.

Media Companies

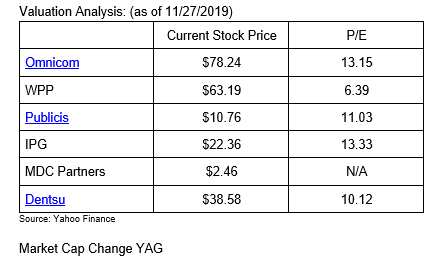

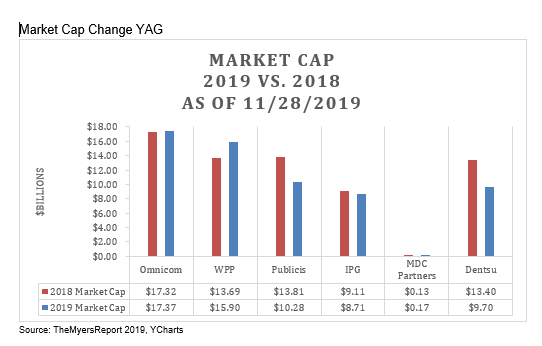

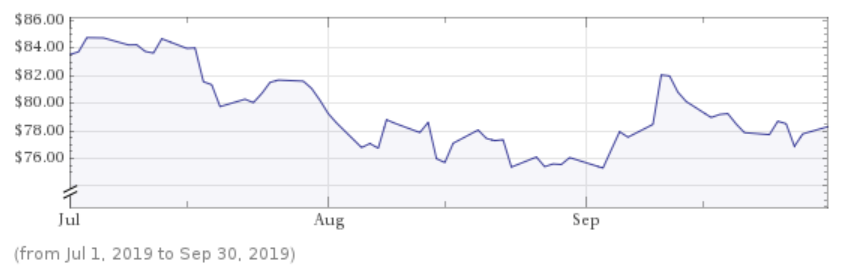

Omnicom:

Summary:Omnicom is still very focused on their digital data audience platform, "Omni." Not raising any major alarm bells about the economy impacting in the short term. Omnicom's PR firms seem to be a drag on revenue currently. While Omnicom has downplayed the impact of in-housing, it remains a hot industry topic overall.

Global Growth:

- U.S.: +2.7 percent

- Canada: +2.7 percent

- U.K: +3 percent

- Asia Pac: +.4 percent (India, Japan, and New Zealand had doubledigit growth, Australia and China were negative in the quarter)

- Euro: Italy, the Netherlands, and Spain performed well. France had negative growth due to loss of a specialty print production client and event business difficulties.

- NonEuro: Czech Republic, Poland, and Russia did well.

- Latin America: +6.6 percent

- Middle East/Africa: 4.5 percent, primarily due to S. Africa

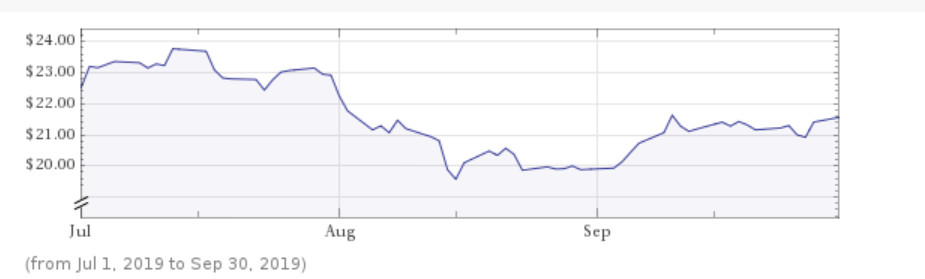

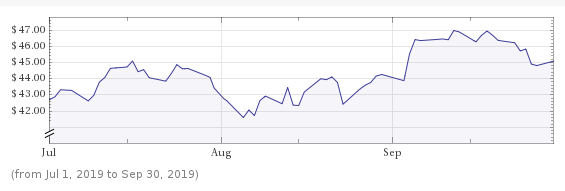

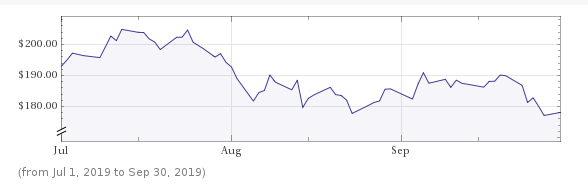

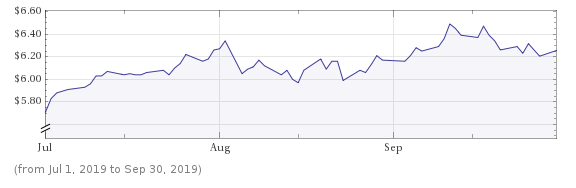

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote:

"Turning to our organic growth by discipline, advertising and media was up 3.4%. Healthcare had another very strong quarter with growth of 9.5 percent." – John Wren, CEO

Quotes:

"In the third quarter, Omnicom Precision Marketing Group, which manages our CRM and digital agencies, acquired a majority stake in Smart Digital. Smart Digital services and technology platforms are used to deliver large-scale, real time personalization solutions that enable individual brand experiences and increase loyalty across all consumer touch points.

"Smart Digital follows on the heels of the group's acquisition of Credera. Credera overlays management consulting and digital transformation on top of existing CRM and digital offerings. In a little more than a year, Credera has helped us forge stronger relationships and partnerships with many of our multinational clients.

"Per Forrester (regarding Omnicom's data platform Omni), '"When comparing data and technology platforms across the various holding companies, the report states that the Omni platform offers the most creative integration of agency platforms. It cannot be achieved simply by buying legacy data platforms that weren't built with the flexibility required to meet the rapidly changing demands of today's marketers.'

"To date, we have scaled Omni by training over 4,000 employees worldwide.... As Forrester eloquently stated in its report, it's a combination of humans and machines that will give CMOs the data-driven execution they desire and agencies the new capabilities they need to remain relevant.

"In the third quarter, we deepened and expanded our existing engagements with some of the largest clients, including AstraZeneca, Novartis, Wells Fargo, and Unilever. We also won several new client engagements from world class marketers during the quarter. Kroger, the largest grocer in the United States and the second-largest retailer behind Wal-Mart, named DDB New York as its first ever creative agency of record. OMD won the global Boehringer Ingelheim animal health account, and Allianz named a number of Omnicom agencies for an integrated offering, which will include creative media branding and PR. "- John Wren, CEO Omnicom

When asked about how advertisers are feeling about the economy and general business tone:

"I'd suggest that it's business as usual. There are always macro concerns and they change from quarter to quarter or period to period, but there's always something out there. Our folks are focused on our clients' needs and we don't see any significant change for them.

"I think the U.S. economy is strong. I think, when we look at our core businesses, the ones that we anticipate growth from — they grew very well — mid-single digits.

When asked if they've noticed the slowing of media, as Publicis stated in their Q3 2019 report:

"I haven't read the Publicis transcript, but our media business continues to perform very well, as reflected in our numbers. It's a very vibrant business and we continue to win our fair share — more than our fair share of accounts. In regard to the fourth quarter, I think I'll say something very similar to what I've said the last 22 or 23 years of fourth quarters, and that is there's always unidentified projects in the fourth quarter. They generally, in our case, start off looking like they're $200 million around the end of September, and I think all but one of those years, with the impact of the Great Recession, we've been able to fill those gaps through projects and budget releases from clients who might have been holding back as of September 30. So, we're cautiously optimistic, as usual, and our people are focused on gleaning that revenue.

When asked about in-housing (the seeming trend of many marketers taking some or all of their media buying internally):

"I mean, technology changes what comes in-house and what stays out at an agency. Oftentimes, somebody was doing something with us and they decide to in-house. We follow them in-house to help them set up and grow, and that just enhances the relationship. But I think that the most dramatic changes that we've noticed on in-housing really has been in the CPG area. Others do it, but they do it for a while … and then decide that they can't do it and come back to us…." - John Wren, CEO Omnicom

Summary: Much of the discussion on the call centers around the approval of the sale of a substantial portion of Kantar. Q3 showed slow and steady financial improvement; however, economic headwinds are still prominent in their forecast.

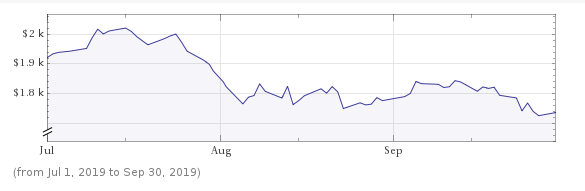

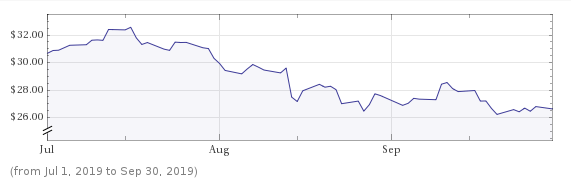

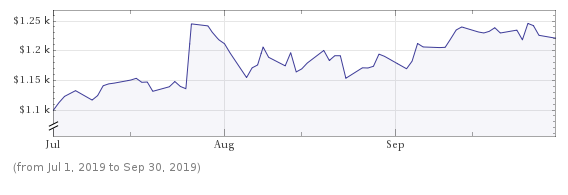

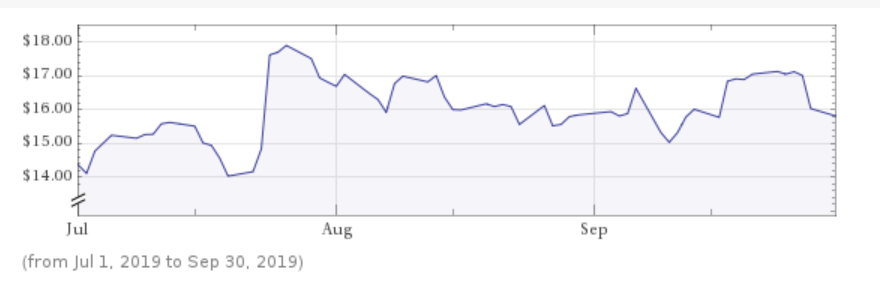

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote: "We set out a three-year plan on December 11th last year to return WPP to sustainable growth. I think there are two key objectives in that — one or two key metrics. One was organic growth and the second was leverage, and I think you can see in this set of numbers and yesterday's approval of the Kantar transaction good progress on both. And so, we really remain on track to deliver our three-year plan. We set out a new vision and offer for the company; really the vision to be a creative transformation company and a broader offer, covering communications, experience, commerce, and technology. a broader offer. We will be better positioned to the faster growing parts of our market and what a modern marketing business needs to grow and succeed in today's environment. And I think you can see in the wins in our business, the improved retention of clients, such as Centrica or the U.S. Marine Corps, that [are] having some success and an increasingly integrated proposition is working with clients." – Mark Read, CEO

Quotes:

"I think pleasingly, … we have to look at it in the context of it being one quarter, the improvement was broad-based, both geographically and functionally, and we saw a continuing improvement in the U.S. business from minus 5.9 percent to minus 3.5 percent in the third quarter.

"Overall, I would point out wins that took place during the quarter — the creative win at Mondelez, the media win at eBay, the retention by Wunderman Thompson of its business with the U.S. Marine Corps, and the win or extension of our business with Centrica — that we had much of the business in the U.K., but not outside the U.K. It was a hotly contested account during the quarter.

"The second task was really to have a much simpler structure for the group. Importantly, to eliminate this artificial distinction between analog and digital or creative and digital and to integrate our activities to make it much simpler for clients to access the talent that we have inside the business and, frankly, make it easier for us to manage the group and sort of cut down some of its sprawling nature. VMLY&R, I mentioned before, grew positively in both the U.S. and globally in the third quarter, and Wunderman Thompson has shown improvements as well in its performance, both globally and in the U.S., in the course of the year. It's a much larger company to bring together. And so, I think it will take more time to see the results there. But I think the initial impact is positive and, certainly, we know we continue to believe in both of those cases that it was the right thing to do, as was bringing our healthcare businesses together in the core agencies.

"We are reiterating our guidance for 2019 of minus 1.5 percent to 2 percent, both including and excluding Kantar." – Mark Read, CEO

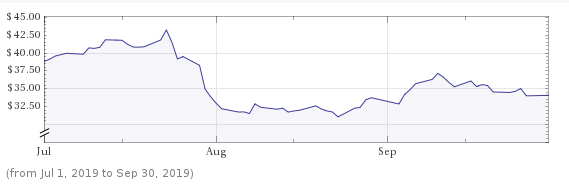

Q3 Stock Trend (Source: Yahoo Finance)

Summary: A dour earnings call with organic revenue restated downwards. However, post-earnings call Publicis did pick up part of the global Disney business (Theme parks, Disney+), which should boost both morale and revenue.

Q3 organic growth -2.7 percent

Q3 reported net revenue up +17.3 percent

Organic forecast restated to -2.5 percent for 2019

Top quote: "We are without a doubt at the hardest part yet of our journey, and as is the case with any major structural change, things always get worse before they get better." - Arthur Sadoun, CEO

Quotes:

"Our third quarter shows the two faces of our transformation, which have never been so extreme.

"The cost of our transition is hurting short-term organic growth with a negative Q3 below our internal expectations. This is leading us to take a very cautious approach and reset our guidance for revenue this year, now expected at -2.5 percent.

"Our transformation is starting to show concrete results. We are posting a 17.3 percent growth in our reported revenue, shifting the revenue profile of the group towards future-facing expertise.

"We have clearly identified the challenges affecting our industry and we haven't lost a second addressing them. We are disrupting our traditional operations with data and technology thanks to the acquisition of Sapient and Epsilon to deliver personalization at scale. We have streamlined and simplified our organization to seamlessly connect creativity, media, data, and technology. Now, we are focused on executing our strategy and there are already concrete signs that make us confident for the future.

"Finally, this improvement in our activity mix, the increased efficiency of our organization thanks to our country-led model, and our ongoing cost savings plan gives us a high level of predictability on our margin, which we are confident of maintaining at an industry-high level.

"We could have chosen the easy route and taken advantage of the status quo to find small pockets of immediate growth. Instead, we are accepting this painful situation in the short-term to be better prepared for the future." - Arthur Sadoun, CEO

Summary: Continued revenue growth internationally (Canada, Continental Europe, and LatAm ) but challenges in the U.S.

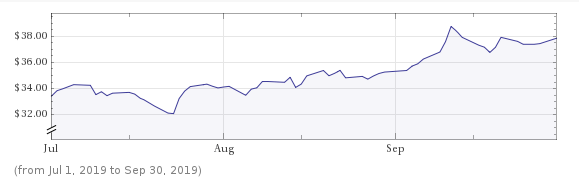

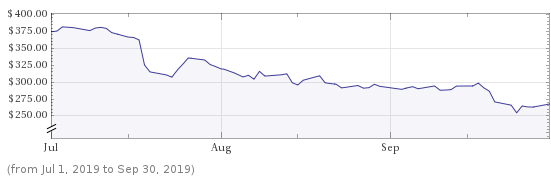

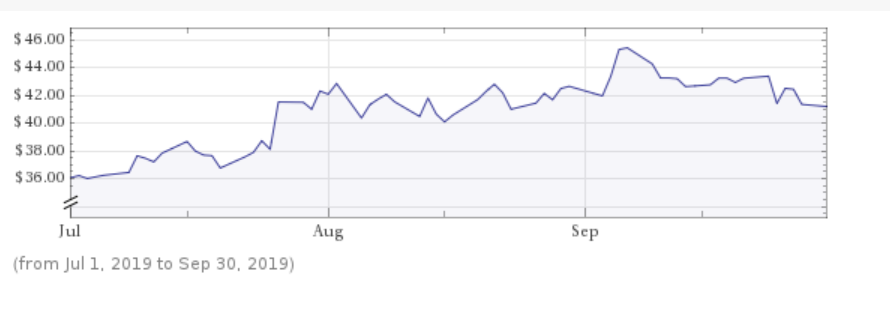

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote:

"...We will be held accountable to meet an elevated set of demands and responsibilities for ethical sourcing, collection, curation, and compliant deployment of data from all sources, including third parties. That is why we feel very strongly that what is worth owning is the highest level of capability and expertise in data management. That is a significant and increasingly necessary differentiator in today's world. It makes [companies] like ours a more strategic business partner for our clients." - Michael Roth, CEO

Quotes:

"We are pleased to post another quarter of solid financial performance. Our growth was led by our media, healthcare marketing, public relations, and sports & entertainment offerings. We saw contributions from a broad range of client sectors, including healthcare, financial services, retail, tech and telecom, and consumer goods.

"Acxiom continues to perform consistent with our plan, and we are seeing the benefit of our leadership position in data management capabilities.

"At quarter end, total headcount was approximately 54,300 — an increase of 5.7 percent from a year ago." - Frank Mergenthaler, Executive Vice President, Chief Financial Officer

"We also invested in embedding modern digital offerings and expertise into all of our agency brands. We pioneered the open architecture model, which brings the best agnostic solutions to global clients in a way that moves their brands across the consumer landscape. This client-centric approach is currently deployed across many of our largest clients worldwide. Open architecture is enabling clients to reap the benefits of all of IPG's assets; customized offerings that help them address the demands of a fragmented consumer and media environment.

"To note, Acxiom now has a prominent seat at the table with our top open architecture clients. That is because clients increasingly recognize that the future of marketing is data-driven. Marketers are looking to leverage their own first-party data, coupled with other strategic data sets to create more seamless and connected consumer experiences at scale. What that means is that expertise in managing first-party data and PII at scale is indispensable for a high-value media and marketing services partner. Ultimately, we are seeking to achieve people-based marketing."

"Brooklyn-based Huge unveiled a new operating model, as the agency elevated key leadership roles and streamlined its U.S. offering. The agency also saw a number of new business wins in the third quarter, including AccuWeather and e-commerce car buying platform RumbleOn.

"R/GA Ventures announced its Oregon enterprise blockchain venture studio during the quarter. The six participating companies presented a demo day this month aimed at building a scalable blockchain-based ecosystem.

At Deutsch, we recently announced that both New York and LA offices will be led by women CEOs from within that agency. The Deutsch LA office was awarded Behr Paint, Mattel, and global dot com redesign responsibilities for the Almond Board of California, while NY secured Reebok, Michelob Ultra and Budweiser, and J&J's Attune.

In response to a question about the global movement to legislate and protect privacy:

"I don't think it is a secret that with GDPR, we see it already in place. I think it's in January in California and other states have adopted similar requirements, which is why, by the way, we support the Business Roundtable position on our federal GDPR. I mean, it's not easy to do it on a state-by-state basis. Each of the states are going to require different things and, therefore, … 'is a great deal of additional work for our clients, as well as us, and if we had a federal legislation that covers it, it's an important issue. I think it's pretty clear that it's here to stay and regulation in this area is important." - Michael Roth, Chairman & CEO

In response to a question regarding growth of addressable advertising:

There is a shift moving from TV to digital. We see that in terms of having TV and linear TV pass digital in terms of total spend. So, all of this is frankly why we bought Acxiom and why we isolated certain aspects of that in Kinesso. So the value proposition that we can bring to our clients, in terms of addressable, [is] finding the right individuals — to think of it as looking for individuals, not just groups of people and on a cleanse basis. So, yeah, I think it's happening in the marketplace and we add value when those issues come up. So, when clients ask about it, that's good for us because if we can be in front of our clients showing our capabilities, it adds to the relationship significantly.

In response to a question regarding the implications of a possible recession:

"I don't see any signs of a 2008-2009 recession right now and, even with the talk, a lot of people are talking about if there is a recession, it is going to be a recession light — whatever that means. But in 2008-2009, marketing dollars, there was no capital. I mean, it was a whole different world. I think we've taken the position already. That's why we're able to expand margins like you are seeing — [because]we match revenue and expense very carefully. All of our agencies have very strong disciplines that, before they had headcount, it has to be associated with revenue. Well, the fact that we are doing the dispositions on those countries that were not necessary to be in all leads itself to margin expansion efficiencies and protecting our P&L in the event that a recession comes." - Michael Roth Chairman & CEO

Summary: Still very much in the re-building phase, and some good account wins:

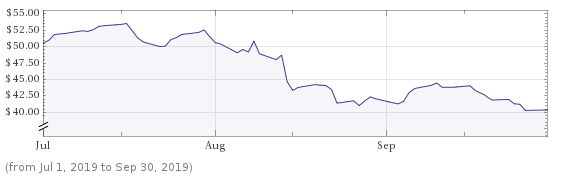

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote: "We're taking smart actions that will organize our offerings, reduce our costs, capitalize on our strengths, and enhance our go-to-market capabilities. During the second quarter we announced the alliance between MDC Media Partners and Gale, bringing our media agencies and our sophisticated data analytics more closely together. The new team is effectively reuniting media with creative.

Quotes:

"In terms of performance, the significant cost reduction actions taken in late 2018 and throughout this year, in tandem with prudent financial management, helped deliver a 6 percent increase in adjusted EBITDA on a year-to-date basis. Revenue softness was driven by the clients in media healthcare and one of the global creative agencies.

"We're addressing all of the issues as part of the New World plan and are seeing a rebound in new business in some of those areas. Although revenue was down for the quarter, net new business was again solid at over $30 million, with several notable wins, including Nature's Bounty at Done, Vodafone Global; and expanded assignments with Ancestry.com and Anomaly; international creative duties with Electrolux Group and F&B, and Qualcomm, and Allison Partners.

"In addition, last quarter, we reported that we won Haagen-Dazs global creative duties with F&B, and we've since further expanded this relationship to a new General Mills brand with another MBC agency. This momentum has continued into Q4 with 72andSunny's fantastic win of Audi global creative duties, announced just this morning, on top of Doner's recent win of three [of] Johnson & Johnson's most recognizable brands: Tylenol, Listerine, and Zyrtec. The latest Doner achievement is not only a significant win for MDC, but since it was one together with the Stagwell Group's, Code, and Theory, it's an indicator of the potential success that can come from such collaboration.

"We're about to enter the next phase of our plan with the formation of two additional multi-agency networks, led by two of our flagship agencies. Together with the combination of MDC Media Partners and Gale, we expect to reduce our 25 reporting units by half.

"We expect to complete our full New York transformation by the end of 2020 and generate future annualized cost savings of about $10 million. – Mark Penn, CEO

Summary:Asia-Pac is weighing down the overall business, and U.S. is showing signs of strength, in large part driven by the win of a portion of Proctor & Gamble business.

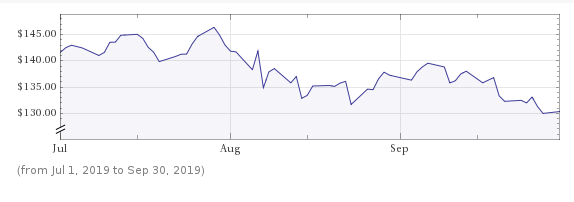

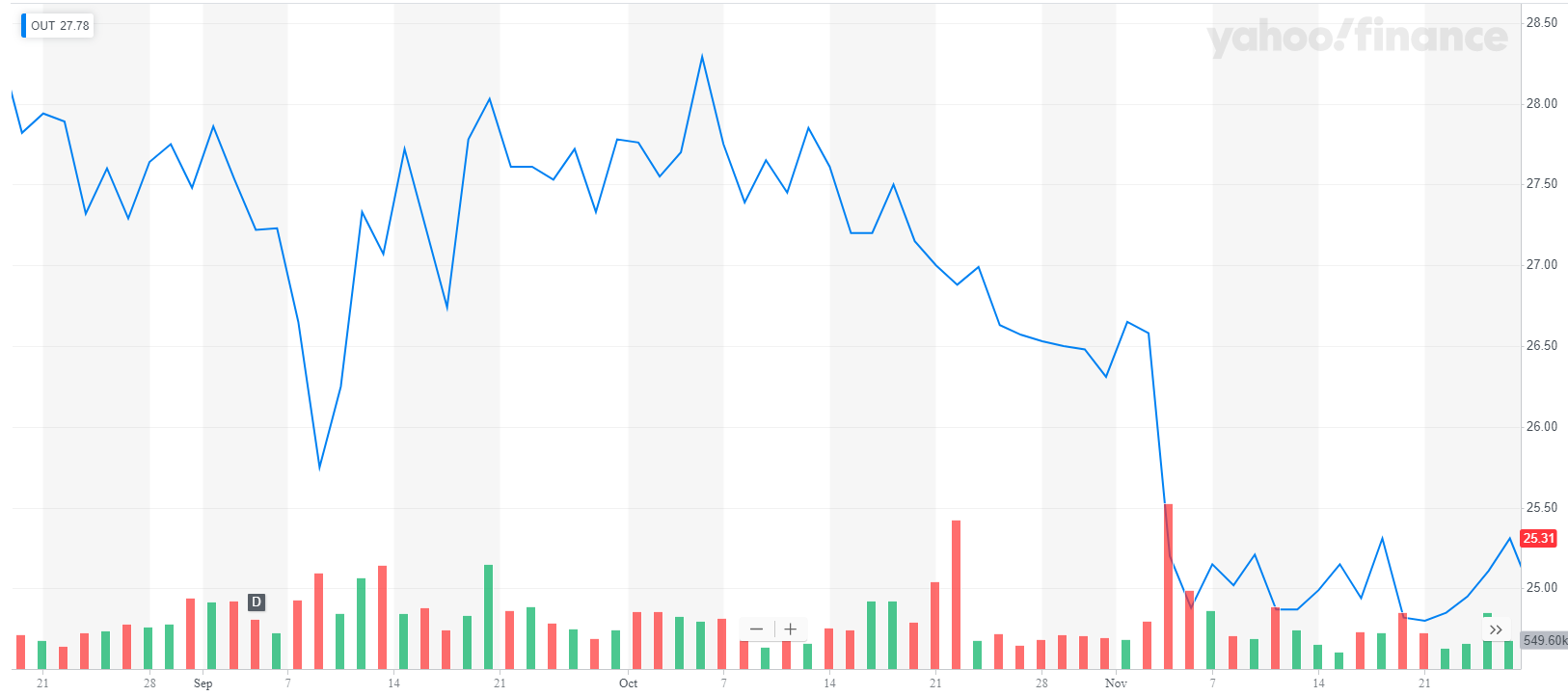

Q3 Stock Trend (Source: Yahoo Finance)

Top Quote: "Clients are expecting much more services, but what allows us to have a robust win rate is the combination of our capability. The fact that we can deliver idea-led, data-driven, and tech-enabled offerings to clients with the strong data and analytics products we've been able to make since our acquisition of Merkle. And these are the things that make us more competitive in the pitch environment." – Timothy Andree, executive officer & director

Quotes: "There are no green shoots of recovery in the Chinese and Australian markets, both of which continue to severely impact the regional and group performance."

"In the international business, in order to future-proof our business and serve clients more effectively, we have streamlined and consolidated our offering around three lines of business: creative, media, and CRM. These lines of business have been designed around client needs and will ensure we are set up to help clients win, keep, and grow their best customers by being data-driven, tech-enabled, and ideas-led. 2020 is a year of transition and by 2021, we will be operating under these three lines of business and be truly integrated by design.

"–…Our entire CRM and data business is really leading our growth. If you look at the numbers in the Americas where Merkle, as a brand, has its highest percentage of business, it really accounts for the lion's share of the growth and momentum we have in the market. Merkle cannot really be compared as a business or an offering to Acxiom or Epsilon, which are largely just data businesses. Merkle has always been even and has continued to be since our acquisition, a double-digit organic growth business…. Merkle is in the people-based marketing business, which is currently in high demand from clients and in the highest-growing sectors of ad tech, mar tech, and commerce implementation.

"But the uplift in the U.S., I attribute, in September, largely to the coming online of the P&G North America win in our media business that came on stream in July and then built momentum and reached, really, the kind of consistent level in September." – Timothy Andree, executive officer & director

In response to a question requesting a split of the DAN revenue across the three units of media, creative, and CRM:

"In terms of the split of the international business across those three lines of business, in round numbers, 50 percent in the media line of business, 25 percent in creative, and 25 percent in CRM." – Nick Priday, Executive Officer.

In response to a question about the current pitch environment:

"The current announced pitches … have been announced by clients [totaling] about JPY 4.7 billion in size of media billings. And of that, about 75 percent of those opportunities are offensive pitches — opportunities for us, with 25 percent being cases where we're the incumbent. Our expectation, and it's only an expectation, but based upon our assessment of the market, we expect 2020 and 2021 for that pitch pipeline to grow and to be larger than it currently is. However, also looking at the mix, we expect that the defensive pitches may have a slightly higher percentage, as we look at 2020 and 2021 based upon our existing contracts … with clients.

"Of course, a large portion of our media business, for example, still remains to be regular pitching for local multi-market media accounts, which really accounts for about 40 percent of our mix.

"The pitch environment pricing does play an element of it, but where clients are expecting more than that, it is total value for their dollars. They're expecting much more addressability in their capability. Data plays a bigger role. So, in that respect, pricing is always a factor. There's always that aggressive competitive nature of that business. But, in the end, the type of business we want to win is not where we're the lowest bidder." – Tim Andree, executive officer and director

In response to a question regarding the impact that Google is making in the overall agency business, in addition to consultancies:

"We don't see ourselves being directly disintermediated in a large way from Google media. It's true with some smaller clients and D2C clients do go to Google and some of the social media platforms first. But, in large scale, that's not impacting our business, largely because … the role that we could play that Google can't, it is to manage the entire media and marketing ecosystem and balance out in a strategic way the client's investment. When clients go directly to Google, Google's recommendation is for them to buy more Google. And so, that has not been a big impact on our business. …In many ways, we partner in developing products with Google to help benefit our clients. And so, I don't see that as a particularly impactful concern of direct disintermediation of media going to Google in our markets."

"In regard to the consultancies, you know that we compete daily against the consultants. Our Merkle and Isobar brands compete and win regularly against them. Our approach is far more about growing the top line and having deep consumer insights in how consumers behave. And then those insights can play themselves into full execution. Where I think the consultants have largely focused less on execution, more on strategy, as well as more on bottom line efficiency. So, I think' everyone's evolving. They're formidable competitors." - Timothy Andree, Executive Officer and Director

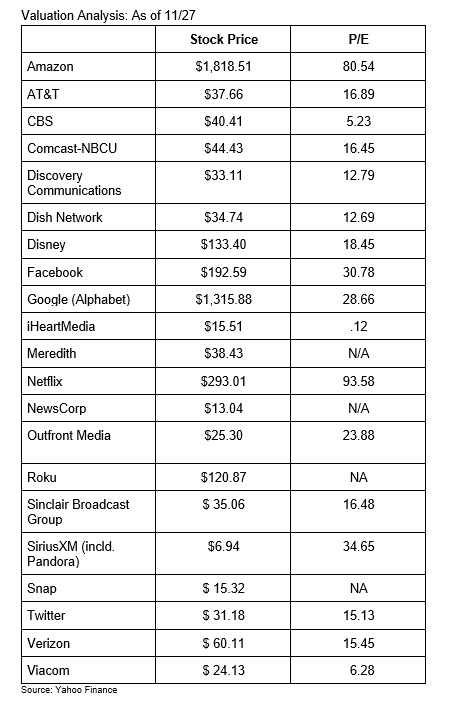

Summary: While advertising is only a very small portion of the overall revenue (and an even smaller part of the earnings call), it is growing and they seem happy with performance to date.

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote:

"Yes, so let me start with the first question on advertising. So other revenue, which is principally advertising, grew 45 percent this quarter, up from 37 percent last quarter and the biggest thing in there is advertising and advertising grew at a rate higher than that 45 percent. – Brian Olsavsky, CFO

Quotes:

"So, it's still early and what we're focused on really at this point is relevancy, making sure that the ads are relevant to our customers, helpful to our customers. And to do that, we use machine learning and that's helping us to drive better, better, and better relevancy."

We are very happy with the progress in the advertising business and continue to focus on advancing advertising experiences that are helpful for customers, helping them to see new products. We want to empower our businesses to find attract and engage these customers. And it's increasingly popular with vendors, sellers, and third-party advertisers.

- Brian Olsavsky, CFO

>"I think, specifically on the advertising side and the opportunity with that, we are continuing to see some increased adoption. One of our areas of focus is expanding our video and OTT offerings for brands. It's still early in this space, but we've done a few things with IMDb TV, live sports, things like adding more inventory through Fire TV apps, … adding more OTT video supply through Amazon Publisher Services or APS integrations and streamlining access for third-party apps and really just making it easier for advertisers to manage their campaigns and provide better results.

"I have to start with the fact that we did recently introduced 20 new Fire TV products, so that includes … the first Fire TV Edition sound bar, Fire TV Cube. - Dave Fildes, Director of Investor Relations

Summary: Pay television subscribers to traditional MVPD (DirecTV, U-Verse) fell off a cliff in Q3 2019 with a loss of over 1.3 million subscribers. HBO Max was a large focus and, in fact, a full investor's day (summary of the WarnerMedia Investor's Day follows below) was dedicated to formally introducing HBO Max.

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote: "Third, we were convinced that the value of premium content would increase significantly over time, as consumer demand continued to grow and new forms of distribution emerged, and I think you've already seen that with some of the multiples paid for media companies after we did our deal. Vertically integrating content and distribution is the future, and we're seeing it across the board" - Randall Stephenson, CEO

"Since 2012, we've made a series of strategic investments, and those investments have been aligned around two overarching trends: First, consumers will continue to spend more time viewing premium content and, second, businesses and consumers will continue to demand more connectivity, more bandwidth, and more mobility. When we began pursuing this strategy, we saw an emerging world in which consumption of video and other premium content was no longer bound to your living room. And everything we expected has arrived, and it has arrived sooner than we or anyone else anticipated. And now, the foundational elements of our investment thesis are clearer than ever. It all starts with advanced, high-capacity networks.

"Over the last 18 months, we've been putting all this capacity into service, and the performance results have been dramatic. AT&T now has the fastest and most reliable wireless network in the U.S. We've also been undertaking the most aggressive fiber deployment program in the U.S. since 2015 with over 20 million locations passed. Over the next 3 years, our strong spectrum position will allow for lower capital intensity, and that bodes well for growing operating margins.

"The second essential element is direct customer relationships, and we have about 170 million of them across mobile, pay TV, and broadband. And that number reaches 370 million when you include our digital properties such as cnn.com, Bleacher Report and Otter Media.

"Gaining scale in linear pay TV was the core rationale behind our DirecTV acquisition. We realized the satellite business was mature and we anticipated subscriber losses. However, the content savings quickly turned our U-verse pay TV business from loss to a profit. And since we bought DirecTV, it has generated healthy cash flows of over $4 billion per year or a total of $22 billion in cash by the end of this year.

Responding to a question if AT&T has hit peak subscriber loss in TV:

"But as we get into next year, then you'll have the satellite then you'll have the software platforms. And AT&T TV is the standardized software platform, and that will be our primary vehicle for going to market, particularly pairing it with our fiber product and our broadband product. And then, HBO Max becomes the workhorse for our video product as we move into next year. And all of the muscle, and as you can see and as you articulated, the range of investment is going behind HBO Max. This is a product that's going to be very different from anything else that you've seen in the market so far. This is not Netflix, this is not Disney, this is HBO Max, and it's going to have a very unique position in the marketplace. And I would tell you, we feel very comfortable at these investment levels, that we can do something very significant in the market and drive some significant subscriber gains. This is going to be a meaningful business to us over the next four or five years. And we're talking a 50 million subscriber business. And I'm really, really enthusiastic about this.

"But HBO Max becomes the SVOD platform for AT&T as we move forward into the future. And what you should expect is, as we get into the future, this won't be day one. …[Through] the platform … we also deliver live stream TV. So, you want an SVOD service, HBO Max, great. Over time, we look forward to bringing [the] live element into HBO Max, as well. And so, this thing gets more and more simplified and we ultimately get down to where we have two products: the traditional satellite, which will be there for a long time; and then our streaming product, which will be premised on the HBO Max platform.

"And we have been on a very aggressive plan for deploying fiber. And we put in a very short period of time 20 million locations passed with fiber. And we are somewhere between 20 percent and 25 percent penetrated in that footprint [and], in the next couple years, are going to be about penetrating. It's really about penetration. That doesn't mean we're stopping fiber deployment. 5G requires us to continue deploying fiber. We have business customers who have expectations and we deploy fiber into business locations. And what that does is create capillaries that we, then, expand off of. And so, you're going to continue to see the capillary of fiber in this company expand. It's just not going to expand at the pace we've been going on. It's been on a torrid pace. I would suggest it's been the most aggressive in the United States. Now, it's time to reap the rewards of what we've done and let's go penetrate the market.

"But the most powerful video bundle we have with our mobile business is HBO, in terms of what it does to churn and retention. And the reason I think that's very exciting is now think about HBO Max and taking that product to a different level. And it's going to be something different. And now, bundling that with our mobile business and the impacts on churn, we believe, are going to be very, very powerful. And so, we're very excited about putting wireless with HBO Max. HBO Max is a natural bundle with, obviously, our video business, whether it's DirecTV or AT&T TV. It's a great bundle with our broadband business, particularly the fiber business. So, we're really bullish right now on how HBO Max gets leveraged across the footprint."

WarnerMedia Investment Day (HBOMax)

Summary: In addition to the Q3 earnings call for AT&T, an information-packed, two-hour program was dedicated the following day to fully introduce WarnerMedia's HBOMax streaming service. This very much played like a major Upfront note, that there is a clear announcement of an advertising-supported service around a year following the launch of HBOMax. HBOMax will be released in May and is priced on the high end at $14.99/month.

Top quote: "In the era of Amazon, Apple, Google, and Netflix, scale is no longer defined by distribution to a quarter of U.S. consumers. It's a global game." - John Stankey, CEO WarnerMedia

Quotes:

"There are three pillars needed for success in streaming. Premier content, a technology platform, and marketing & distribution. Only AT&T enters this space with solid footing in all three."

"Why is the launch of HBO Max so important? Just like cable introduced the rise of niche networks to grow audience, general entertainment streaming is the next great opportunity to aggregate and grow audience.

"HBO Max will have a positive and immediate impact on the stickiness of our wireless and pay TV and broadband offerings. A reduction of 1 basis point of wireless churn is equal to $100 million in revenue.

"Less than a year after we launch, we plan to expand the Max platform to include an AVOD option, offering consumers access to even more content with greater flexibility on how we price and monetize these customer relationships. This is where Xandr employs data from AT&T's customer database, along with innovative ad formats.

"Programmatic and targeted advertising associated with high quality content is a winning combination.

"Today, we have approximately 10 million HBO subscribers that include TV, mobile, and HBO Now subscribers served by WarnerMedia. On day one, we'll provide a frictionless opportunity for these HBO subscribers to sign up and get HBO Max immediately.

"Our customers (AT&T) interact with us more than 3.2 billion times annually, and we have more than 170 million direct customer relationships across mobile, pay-TV, and broadband.

"We intend to reach 50 million subscribers domestically by 2025.

"We are prioritizing our international expansion in LatAm and Europe.

"As a result of our global efforts, we plan to reach 75-90 million premium worldwide subscribers by 2025 across the U.S., Latin America, and Europe." - John Stankey, CEO WarnerMedia

"40 percent of the total viewing of HBO this year has been in digital.

"HBOMax will launch domestically in May of 2020 and will include the HBO service and library bundled together with a large offering of original new content, appealing to all the younger demos plus a choice slate of acquired programming and titles from the extensive Warner Bros. library.

"In 2018, 120 million people engaged with HBO content. Around the world, it reaches over 150 countries.

"Nielsen tells us that the average search time on SVOD is eight to nine minutes. HBO recently introduced the concept of '"Recommended by Humans,'" and we're going to adapt that idea for HBOMax, so we never have to rely solely on an algorithm to serve our customers the best content.

"HBO Max will begin with 10,000 hours of content. While less than some of our competitors, we actually think that the value proposition improves when you narrow the options, removing much of the filler no one watches anyway.

"The median age of linear HBO is only 49, but that drops to 36 when you look at HBO Digital, where the younger audience is growing quickly." Bob Greenblatt - Chairman of WarnerMedia Entertainment

"HBO shows will continue to have what they've always had: great writing, casting, direction, incredible production value, but, most importantly, context. They all have something to say about the world we live in.

"Breakout Chernobyl's masterful storytelling helped it surpass 13 million viewers. It's now our most-watched mini-series of all time. 'Euphoria' quickly became our second most dsseries behind only 'Game of Thrones'. With over 9 million viewers, the first installment of 'Leaving Neverland' now ranks as HBO's highest rated documentary of all-time.

WarnerMedia announced the following shows to be included on HBOMax:

- "Run" a new comedy executive produced and guest-starring Phoebe Walker-Bridge, the Emmy winner for "Fleabag."

- "The Outsider," based on a Stephen King novel.

- "The Undoing" with Nicole Kidman, Hugh Grant, and Donald Sutherland, a chilling thriller by David E. Kelley.

- "Lovecraft Country" from Jordan Peele and J.J. Abrams. A 1950's period piece that turns into '"one of the scariest thrill rides you've ever seen.'"

- A reboot of "Perry Mason," starring Mathew Rhys of "The Americans."

- "Avenue 5," a sci-fi comedy from the creator of "Veep", Armando Iannucci, starring Hugh Laurie and Josh Gad.

- "I Know This Much is True" with Mark Ruffalo, based on Wally Lamb's bestseller

- "The Plot Against America," starring Wynonna Ryder and John Turturro.

"I want to highlight three big events for 2021. We have Joss Whedon's highly anticipated new fantastical series "The Nevers". We have Kate Winslet as a complicated Pennsylvania detective in a limited series called "Mare of Eastown", and we have something totally delightful for fans of "Downton Abbey": Julian Fellowes' "The Gilded Age," set in opulent New York in 1885 with a dream cast that includes Christine Baranski, Cynthia Nixon, and Amanda Peet. And I haven't even mentioned our big slate of documentaries and doc series that will take us into so many other compelling worlds. - Casey Bloys, President of Programming HBO

"Our research tells us there is a subscription opportunity of 75 million potential domestic in these demos, and we're going after them.

"We see that only a handful of individual titles drive more than 2 percent usage among the thousands of content hours available on those services. Further, of the thousands of titles available, it's the top 100 that drives half the total usage. An SVOD service may have 35,000 hours of content, but half of their usage is driven by only the top 100 titles.

"The top ten licensed comedies on competitive streamers account for 80 percent of the total licensed comedy viewing.

"Breadth of choice is important, but content that matters to viewers is the real point of differentiation.

"We are overjoyed to extend our license to all 50 seasons of the show, [Sesame Street] which we will curate during the year, plus we'll have the next five seasons of new episodes too. HBOMax will have streaming exclusivity on the whole gang. We have lots of new Sesame Street content, including the next season of "Esmee and Roy", a new series called "MechaBuilders", plus a great new special, "Monster at the End of This Story". And not to be left out of the late-night wars, we have a new talk show starring a furry red monster, and no, I am not talking about Conan O'Brian. It's none other than Elmo ("The Not Too Late Show with Elmo").

"HBOMax will have an outstanding offering with over 1,800 movies, featuring half of the top 50 box office titles of the year in the HBO service alone. Top Warner Bros. franchises available across our first year include the full set of "The Hobbit", "Lord of the Rings", and "The Matrix" trilogies. Plus, over half of the top 20 horror movies of all time, anchored by the most successful modern horror franchise, "The Conjuring" which has generated over $2 billion in worldwide box office. Both "Gremlins" films will be available and the Lego movies will be added in time for the summer break.

"I want to take a minute to talk about one of the most valuable assets of this company, DC, which has been part of Warner Bros. since 1969. From "Batman", "Wonder Woman", and "Suicide Squad" to "Shazam" and "Aquaman", the top grossing DC title of all time, HBOMax will have all DC releases of the last decade available within the first year of launch, including every Superman and Batman movie from the last forty years. The current box office smash "Joker" will be available at HBOMax at launch through the HBO service.

"Friends" will now be calling HBOMax its exclusive SVOD home.

"We have another group of friends and one of the biggest shows for 12 years, "The Big Bang Theory". This is the first time that all 279 episodes will be seen in any streaming platform and HBOMax has them exclusively.

"Today, I am happy to announce that HBOMax will be the exclusive SVOD home of Trey Parker and Matt Stone's brilliant animated satire, "South Park". HBOMax will offer over 300 episodes, which is 23 seasons, all available shortly after launch and 3 new seasons.

"We recently announced an exclusive landmark deal with one of the most acclaimed animation studios in the world, Studio Ghibli for their entire catalog of 21 of the most revered Japanese animation classics, which have never before been offered on any streaming platform.

"We'll have 31 Max Originals series in our launch year. Combined with HBO, that's 69 series on HBOMax in 2020. We'll grow our Max Originals to 50 series in 2021. Combined with HBO, that's a total of 88 series in 2021."

"We know you like to binge and on HBOMax, you can binge previous seasons and library content to your heart's desire [but not new content]. - Kevin Reilly, chief content officer

"The Warner Bros. Animation Studio and Cartoon Network are both in the family and we are in business with them in several ways. Starting with Cartoon Network, we'll have fun new episodes of the "The Fungies" and "Tig n' Seek". We are bringing back their number one franchise, "Adventure Time," with four brand new hilarious specials made exclusively for Max. We also have a delightful new animated series "Little Ellen" from Ellen DeGeneres with her as a 7-year-old girl growing up in New Orleans. "Gremlins: Secrets of the Mogwai" is the origin story of those naughty little creatures who we all know and love. We are also developing an inspired new series from visionary Robert Zemeckis called "Tooned Out," which merges animation and live action with a cast of Looney Toonscharacters you can only see on Max.

"We also have inventive content for older kids in the unscripted area, such as "Craftopia" with YouTube superstar, Laura DIY, and "Karma", a fast-paced challenge game where how the kids treat each other affects their chances of winning."

Announcing new originals targeted to Millennial/Gen Z:

- "Tokyo Vice," starring Ansel Elgort and directed by Michael Mann

- "LoveLife" with Anna Kendrick in her first series

- The reboot/revival of "Gossip Girl"

- New episodes of DC fan favorite "Doom Patrol"

- "DC Superhero High" from Elizabeth Banks

- "Grease: Rydell High"

- Issae Rae's, "Rap Sh*t", a look at the Miami music scene

- "College Girls" for Mindy Kaling

- "The Flight Attendant," starring Kaley Cuoco and produced by Greg Berlanti

- "Strange Adventures" by Greg Berlanti

- "Green Lantern" by Greg Berlanti

- "Unpregnant" from Greg Berlanti, based on the novel by Jenni Hendriks and Ted Caplan

"We have the futuristic "Station Eleven," based on a novel we love. It's produced and directed by Hiro Murai, from the award winning "Atlanta". "Made for Love" is a quirky, dark comedy about a husband using cutting edge technology to control his wife's mind. We are adapting the sweeping book "Americanah" into a series starring the incomparable Lupita Nyong'o.

"We also have "Circe," a fantasy epic based on the recent best-selling book about one of the most evocative goddesses in ancient Greece. And last, but not least, a new science-fiction epic from Ridley Scott, "Raised by Wolves". This is one you simply haven't seen before. It focuses on a rogue, female AI, that will stop at nothing to raise her children.

"Movies are important to our original programming mix, so we'll start building this focusing on five to 10 originals per year. We made a two-picture deal with Reese Witherspoon and her company, Hello Sunshine, who have cornered the market on telling fresh, contemporary stories from a female perspective.

"We are also thrilled to be working with one of the great contemporary filmmakers Stephen Soderbergh, who brought us "Let Them All Talk," starring the legendary Meryl Streep.

"We have the one of a kind Melissa McCarthy, starring in "SuperIntelligence" about a woman whose romantic life is selected for observation by artificial intelligence.

"Finally, we have "Bobbie Sue," featuring Golden Globe winning "Jane the Virgin" star Gina Rodriguez as a brilliant young lawyer who upends a conservative law firm." - Sara Aubrey, Max Original Content

"We just commissioned 80 brand new original shorts (Looney Toons) aimed at today's audience.

"We also own the Hanna-Barbera characters (The Flintstones, Scooby Doo, Yogi Bear, Magilla Gorilla, Top Cat, QuickDraw McGraw), all of whom will be in series, movies, and digital shorts in the platform. We even have a brand, new original series called "Jellystone!" where all these original characters come together.

"We entered into a long-term arrangement to bring the next 10 Warner Bros.-produced CW shows to HBOMax after they premier on the network.

"Rick and Morty, with over 1 billion SVOD views. The past seasons will be available on HBOMax at launch and the newest season will be available in the first year after premiering on Adult Swim.

"Over 100 unscripted series. We have additional new footage from "The Bachelor". We have over 100 hours of Impractical Jokers.

"Rizolli & Isles, The Closer, Major Crimes, The Alienist, The West Wing, Dr. Whowill be on HBOMax."- Michael Quigley, Library and Acquisition

"When you are streaming dragons and white walkers, you have to be prepared for just about anything, like streaming five million concurrent users across 22 device platforms on a Sunday night. iStreamPlanet, the undisputed leader in live streaming, is also part of this company. In 2018, over 4 billion live stream minutes passed through this platform like the Super Bowl, the Olympics, NCAA, and FIFA World Cup." - Tony Goncalves, Otter Media CEO

"The average person looking for something to watch on-demand burns about nine minutes per session searching. Twenty percent of those people give up and wander away without watching anything. On top of that robo-recommendations only result in 26 percent of viewers watching what the algorithms recommend. Data by itself is not the answer. We think you still need those human elements that make entertainment so enjoyable: personality, connection, emotions. We believe the big opportunity here is to blend the smart use of data with real human touch and to present them via novel product experiences and ways that are elegant, trustworthy, and seamless. - Andy Forssell, Executive Vice President & General Manager

"We expect to release updates every six to eight weeks to stay ahead of the curve in this highly competitive environment.

"We will launch HBOMax with all the bells and whistles in our playbook. That goes beyond television commercials and billboards. We will mobilize our innovative marketing teams across our entire company to drive audiences to HBOMax.

"HBOMax will retail for $14. 99. Current HBONow billed subscribers will get immediate access to HBOMax in May at no extra charge.

"We value both our current subscribers and distribution partners and intend to make it easy for them too. Those over 30 million HBO subscribers should be able to download the app, login, and watch. We are in active discussion with our distributors and we have an agreement with AT&T to distribute HBOMax and we look forward to working with our distributors, so they can also get HBOMax in front of their customers.

"We will utilize this unique foundation to give the AT&T subscriber base many options to learn about, subscribe to, and trial our offering. AT&T today is the number one distributor of HBO in the U.S. Those existing AT&T and DirecTV HBO subscribers will have immediate access to HBOMax at no extra charge. Now AT&T customers without HBO who subscribe to premium video, mobile, and broadband packages will be offered bundles with HBOMax included at no extra charge. In addition, the HBOMax app will be pre-loaded on both AT&T TV-connected set-top boxes and Android phones. And on top of all that, wireless and broadband subscribers will also be able to use their existing credentials to sign in to HBOMax.

"Our goal is to bring one of the richest collections of content on a direct-to-consumer basis for everyone" - Tony Goncalves, Otter Media CEO

In Q3, CBS was focused on finalizing the merger with Viacom, (which officially was completed on 12/4/2019) but that did not seem to be a distraction, as they increased production, generated higher revenue from retrans negotiations and licensing of content to other content distributors, aka Netflix. Advertising revenue year-to-year was down on Q3, but that was mainly due to 2019 not being a political year. Network advertising grew a modest 2 percent, while digital advertising across platforms grew a healthy 19 percent.

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote: "Starting next September, Nielsen's measurement of out-of-home viewing will be included in our ratings, so we will have an opportunity to monetize this viewing for the very first time. The NFL offers a great example here. Nine weeks into the season, the NFL on CBS is off to a strong start, up 6 percent year to date. When you factor in out-of-home viewing, we get an additional 11 percent lift to that increase. It is a significant lift in ratings. For example, the Super Bowl had an over 10 percent lift and that means that's over 11 million people watch that were not in the rating. national news is also another one. Believe it or not, daytime content is also a big lift." – Joe Ianniello, President & Acting Chief Executive Officer

Quotes: "Before we discuss our third-quarter results, I want to give you an update on our merger with Viacom. As you may have heard, our S-4 has been declared effective, and we are on track to close in just a few weeks.

"So, with our balanced schedule of new and established hits throughout the week, we can already predict that CBS will finish the season in May of 2020 as America's most watched network for the 12th consecutive year. We will also finish the year NUMBER ONE in late night yet again. And we're very pleased to have reached multiyear contract renewals with both Stephen Colbert and James Corden.

"Our front-loaded content investment is the key reason we are driving sustained revenue growth across direct-to-consumer, content licensing, advertising, and our linear distribution revenue. And, in terms of dollars, the biggest increase during the third quarter came from a revenue source that's been at the forefront of our growth plan, retrans, reverse comp, and virtual MVPDs, which were up 18 percent despite CBS being off the air with AT&T for more than 20 percent of the quarter. Plus, about 50 percent of our retrans footprint and about 30 percent of our reverse comp footprint are coming up for renewal next year, which means we will have another strong year of healthy gains from retrans and reverse comp in 2020 as we continue to reset the value of our content to current market rates.

"D2C revenue was up over 39 percent for both the quarter and year, to date, as consumers shift from traditional bundles to skinnier bundles, to CBS All Access and to Showtime OTT, we are getting paid higher rates per sub. Even with the headwinds of the traditional MVPD business, when you include subs from virtual MVPDs and our direct-to-consumer platforms, our overall subs at CBS and Showtime grew 4 percent year-over-year, which means consumers are actively seeking out our content as they select the platform of their choice.

"We are currently creating an all-time high of 94 shows, up 20 percent from a year ago, and that's up more than 120 percent from what we did just five years ago.

"Our underlying network advertising revenue was up 2 percent for the quarter and 2 percent year-to-date, as well. And the momentum continues here in the fourth quarter with strong scatter pricing and steady advertiser demand.

"I am pleased to announce today that we have a deal in place with Viacom to add more AVOD channels on Pluto starting tomorrow. And we continue to look at our content to see how we can expand our reach of our CBS properties on a growing number of platforms." - Joe Ianniello, president & acting chief executive officer

On CBS All-Access:

"We launched a new original series on All Access, Why Women Kill, starring Lucy Liu, which was just renewed for a second season and helped drive subs for us during the quarter. Next, we had a summer reality show, Love Island, which launched on the CBS Television Network and attracted a much younger audience on All Access, where more than a third of the viewers binge the show. So, this represents an example of our ability to expand our reach across multiple platforms. In addition, combined streams from the NFL and the SEC are up nearly 60 percent over last year's strong growth.

"We are also very excited about a new development for All Access. We will now have exclusive, live marquee sports for the very first time. The UEFA Champions League, including a UEFA Europa League, and the newly created UEFA European Conference League, will be coming to CBS and CBS Sports platforms with all matches available on All Access and select games airing on broadcast. We will now have more than 400 matches per year spanning nine months across the calendar. - Joe Ianniello, president & acting chief executive officer

On Showtime:

"During the third quarter, we launched three new critically acclaimed series, The Loudest Voice, City on a Hill, and On Becoming a God in Central Florida, and these original series are helping drive sub growth at Showtime OTT. And there's more to come with a big programming lineup that rolls right into next year. Here in the fourth quarter, we have Shameless, Ray Donovan, and a brand-new version of The L Word. And in 2020, we have a number of new shows with lots of star power, including Penny Dreadful: City of Angels, starring Nathan Lane; The Good Lord Bird, starting Ethan Hawke; and Your Honor, starring Bryan Cranston." - Joe Ianniello, President & Acting Chief Executive Officer

On the political year:

"By early next year, we will have our local versions of CBSN in all the major CBS markets where we have local news operations, so we can benefit from a more robust multi-platform approach as we head into the next election cycle. As we've said before, we expect 2020 to be a record-setting year for political ad sales." – Joe Ianniello, President & Acting Chief Executive Officer

On Advertising Revenue

"Advertising was down 7 percent from last year when we had record political spending. As you heard, underlying network advertising was up 2 percent for the quarter and 2 percent year to date. And digital advertising for network content across platforms grew 19 percent. Operating income for the third quarter of 2019 was $581 million, compared to $736 million last year, which included an increase in non-sports programming of more than 20 percent."

"At the CBS Television Network, scatter is up more than 30 percent from Upfront pricing here in the fourth quarter, and we are seeing strong increases in all entertainment and news daypart.

"Tech and pharma are our strongest categories. And, while it's early, we have seen the beginnings of what we believe will be a very hot political market.

"As we renegotiate deals that recognize the fair value of our content, we are on track to reach our target of $2.5 billion in retrans and reverse comp revenue in 2020. And as we continue to accelerate the growth of our direct-to-consumer services with our investment in premium content, we are also confident we will reach 25 million subscribers combined on CBS All Access and Showtime OTT in 2022. In summary, for the first nine months of the year, we have achieved record revenue for the CBS Corporation.

"We are positioning CBS and, ultimately now, ViacomCBS, for continued growth across our key revenue streams in advertising, content licensing and affiliate, and subscription fees, and we are set up for particularly strong growth in our biggest revenue opportunity, our direct-to-consumer services."– Chris Spade, Chief Financial Officer

Summary: Strong report across the board with actual cable and broadband growth.

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote: "I think in terms of the overall ecosystem and the promotional intensity …' it's not too surprising to me. I think you've got the 3 biggest media companies — Disney, Time Warner and NBCUniversal — all launching streaming platforms. And this is a moment in time and a lot of people are being very, very aggressive about it. And I would anticipate that to happen until, at some point, there'll be an inevitable slowing down and shakeout, and the market will get a little bit more rational. But I think it's a moment in time, and consumers are making their choices of apps and viewing habits, and you want to be aggressive to get in there and make sure that your service is one of the consumers' handful of favorite services." - Stephen Burke, Senior Executive Vice President, CEO NBCUniversal

Quotes:

"Starting with broadband — it goes without saying the utility and demand for high-speed and reliable internet access are ever increasing. We see this in our customers' behavior — monthly data usage more than doubled in the last 3 years — and our power users are connecting nearly 20 devices in their homes daily.

"And with Flex, we just added a fourth pillar: streaming, designed to meet the growing needs of customers who only consume video over-the-top. Flex enables these streamers to quickly and easily search, access, and enjoy content across their favorite apps on the TV using our award-winning voice remote. It's a wonderful product and, now, we are providing it to our broadband-only customers for free.

"Cable added 379,000 broadband customers, the most for a third quarter in 10 years. This drove our best total customer net additions on record for any quarter, contributing to a 3.4 percent year-over-year increase in customer relationships. And we're also increasing the value of our relationships. EBITDA per customer relationship grew 3.2 percent. And what is even more impressive, our net cash flow per customer relationship grew 13 percent.

"NBC plays number one in primetime among adults [ages] 18 to 49 for the sixth consecutive 52-week season. Telemundo was number one in Spanish-language weekday prime for the third consecutive season. On top of all this, the teams at NBCUniversal and Sky are jointly producing and delivering content. For example, we've greenlit our first co-productions, shared over 1,000 hours of sports content and are creating a global news channel." - Brian Roberts, CEO Comcast

"Overall cable revenue increased 4 percent to $14.6 billion in the third quarter, led by the increase in total customer relationships, as well as higher ARPU. Total customer relationships increased 3.4 percent year-over-year to $31.2 million, including 309,000 customer net additions, the best on record. This growth was driven by 379,000 high-speed internet customer net additions, the highest third quarter net additions in 10 years. We've added 1.3 million broadband customers over the last 12 months. Overall, our connectivity businesses, residential broadband, and business services continue to drive [cable] growth…. Our revenue in these businesses, collectively, reached $6.7 billion in the quarter, up 9.3 percent year-over-year." - Michael Cavanaugh, Senior Executive Vice President, CFO

"Regarding Peacock, we announced about a month ago, the name, and listed a fair number of shows that we're going to have on the service. I think the most important thing to think about as you're thinking about Peacock and its role inside NBCU and, broader, Comcast is we're not doing the same strategy that Netflix and people chasing Netflix have adopted. We're primarily working with the existing ecosystem and doing a lot of AVOD activity. And what that's going to do, we think, is cut the investment pretty substantially because I think we're going to get to cruising altitude much more quickly than a subscription service. We're also playing to our strengths. We happen to be part of a company that has 55 million video customers and is the biggest provider of television advertising in the United States. So, we'll have a mix of originals, exclusive acquisitions like The Office and a lot of non-exclusive product, as well. Importantly, we're going keep selling to other companies. If you take movies, for example, we plan to keep selling into the premium window. We're not taking all of our movies off of premium platforms like HBO or Sky or other platforms around the world.

"We're planning on launching in April. We're going to use the Olympics as sort of an afterburner after our launch, and then we'll be adding content pretty significantly throughout 2020.

"We have not closed the revenue gap in terms of retransmission consent, which leads into your next question about the cable channels. We have a lot of deals expiring in the next 12 to 24 months and channels like Telemundo that have made big strides. MSNBC is another one. MSNBC is solidly beating CNN almost every night and by a fair margin. And CNN has a much higher affiliate fee than we do. I think you can expect to see us make some real progress there." - Stephen Burke, Senior Executive Vice President & CEO, NBCUniversal

Summary: Strong Q3 performance with strength in ratings with TLC. While Discovery is embracing OTT and launched Food Networks Kitchen, they are still debating on their overall strategy.

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote: "As women over the past year around America have put their TV sets on, they can choose to watch movies, scripted series, they could watch anything they want, but more have chosen to watch our programing than any other media company, which makes us the number one media company for women in the United States." - David Zaslav, CEO and President

Quotes:

"We envisioned a major opportunity to not only enhance their position globally, but also to carve out a differentiated direct-to-consumer strategy. A few weeks ago, we launched another key component of that strategy with Food Network Kitchen, a world-class customer experience in the kitchen with live and on-demand cooking classes with the most celebrated chefs from around the globe. We worked closely on all elements of the product with our partner Amazon over the last year to get it off the ground. We are very pleased with the product and very excited about the opportunity of value creation it presents.

"We generate roughly 8,000 hours of original content annually alongside a library of titles in every language that aggregate several hundred thousand. It's a huge competitive advantage, especially as we watch our industry peers on the premium scripted side pay whatever it takes to amass enough content for a slice of the fragmenting entertainment space within the direct-to-consumer market. We are not in that series scripted and movie side of the entertainment business. It's crowded, it's aggressive, it's expensive, and it's risky.

"In addition, our strategy of pivoting into sports has made us the largest producer of live sports outside the U.S.

"Food Network Kitchen is also the first new product to launch on our owned and operated tech stack and it is becoming increasingly apparent that owning and operating our own tech architecture is a distinct competitive advantage and one that should allow us to further scale opportunities across multiple verticals, meaningfully driving global functionality, efficiencies, and speed to market.

"The team at TLC has done an extraordinary job turning around and building that network. Just two years ago it was the ninth or tenth network in America for women. Today, it continues to be the number one, ad-supported cable network in primetime for women [ages] 25 to 54 and women [ages] 18 to 49." – David Zaslav, CEO and President

"In the third quarter, Discovery, again, achieved healthy operating performance, delivering 3 percent U.S. advertising growth, 6 percent U.S. affiliate growth, and 10 percent international advertising growth, which included a full quarter of impact from the consolidation of the three networks acquired from UKTV, which added about 300 basis points of growth and 8 percent international affiliate growth.

"For U.S. advertising, growth is expected to be, again, in the low-single digit range, driven by the typical dynamics in pricing, digital monetization, the health of the market, and, of course, the impact from ratings, which remains the greatest variable impacting U.S. ad revenue growth. While ratings of some key networks have been challenged in the third quarter, we have doubled the amount of premier content on the Food Network for the holiday season and we are excited about our programing slate for the remainder of the year, such that our Q4 estimate of low-single digit growth could turn out to be conservative. In addition, we expect to continue to benefit from increased viewership on our GO platform, further growth from our data-driven Engage product, as well as upward CPM pressure from innovations, such as Discovery Premiere, all of which are contributing to our top peer performance and revenue growth, despite the noted ratings headwinds.

"U.S. affiliate is projected to increase in the three percent to five percent range for the fourth quarter. And we reaffirm our full-year guidance for U.S. affiliate revenue growth in the mid-single digit range. As you know, in the fourth quarter, we will lap our initial inclusion in certain virtual MVPDs, such as Hulu and Sling TV. Accordingly, implicit in this projection is a sequential decline in our core subscriber growth.

"We expect international advertising growth in the mid-single digit range, driven by share growth in our top markets and contributions from our digital investments. Contribution from the consolidated UKTV lifestyle business is projected to again add two to three percentage points of growth. While the balance of our international advertising business remains healthy, there are some increasingly more challenging markets, such as Mexico and Argentina, creating an overall more volatile picture and one that we will keep a close eye on during the remainder of the quarter.

Responding to a question on direct-to-consumer plans:

"As you know, we've really shied away from these seven or eight players that are rock 'em sock 'em fighting it out in this entertainment area. It's getting more and more expensive. And we believe that three or four of them are going to make it. And it's going to be a lot of carnage, and very, very difficult. [They're] great companies, and good luck to them.

"We really have two strategies: one is the people will have three of those or maybe four of those, but then they still love golf, they still love natural history and science. We, together with everything we got from the BBC, now have a definitive collection of content with Planet Earth — Blue Planet, Space, Ocean, Science — that, if you think about when we were younger, a family would buy World Book or Encyclopedia Britannica because every family and every child should see it. We have a collection of natural history and science content, not just in scale and having the majority of it that exists in every language, but a collection of content that every family and every child should watch, which is very differentiated from watching scripted [sic] series [and] movies.

"We have Chip and Joanna Gaines, and we'll be launching in 2020 with them with direct-to-consumer. And we have cycling and cars, and so we're going in these niches.

"We're looking at the strength of our IP in the U.S. in the aggregate, and '–… [are] talking to consumers [about] how much they love it. We see through our GO platform how young the people [are] that are using it and how much time they're spending with it. And we're now looking at how do we take that content. We're already doing it independently. Is there an opportunity for us to take that content on a broader basis to reach — to mount an attack on those that are not existing cable subscribers? That's the full ecosystem. That's what everyone is looking to do and needs to do, which is take the great IP and reach everyone. We want everyone to watch our content. – David Zaslav, CEO

"For those of you who have the app (Food Network Kitchen), which I hope is everybody on this call, we have Alex Guarnaschelli, Marc Murphy, Rachael Ray, Jeffrey Zakarian, and Bobby Flay over the next five days. Bobby Flay, I think, is doing three classes on Sunday. The consumer demand on the classes has been so high so far that we're actually going to make two changes: We're going to expand the number of live classes from 25 per week to 40. We're also happy to announce the opening of a brand-new Food Network Kitchen studio in Los Angeles. So, we're going to double. We have this Food Network Kitchen here in New York. We're going to double our capacity by opening up a studio in Los Angeles. That will allow us to serve customers all across the U.S. well, but also allow us frankly to add more and more classes over time. So, the live and on-demand classes we're very pleased with so far.

"David mentioned the partnership with Amazon has just been terrific. Most consumers in the U.S. will be on Amazon between now and the end of the year, as we have this big holiday shopping season, and I'm happy to say Food Network Kitchen will be featured prominently across the site. And that includes all the Alexa devices and it also includes the very popular Fire TV. So, Fire TV has millions of customers right now, and if you tune into Fire TV, front and center is Food Network Kitchen…. So, we feel like we're on the right track at this point, and net-net, we're very pleased with the first couple of weeks of results. – Peter Faricy, CEO, Global Direct-to-Consumer

Summary: On the plus side, positive news from Dish, as the company had a net subscriber gain due to improved subscription to Sling TV; however, the Sling TV subscribers are less valuable at this time and, therefore, it hit overall revenue. The call did give some clarity on Dish's views on the upcoming year of direct-to-consumer OTT services, in addition to clarity on why Dish walked away from Regional Sports Networks.

Q3 Stock Trend (Source: Wolfram Alpha)

Top Quote: "I'd like to first congratulate our team here for a solid quarter. It's the first period since the fourth of 20'17 that we've been able to announce total pay-TV net sub growth." – Erik Carlson, President and CEO

Quotes:

"We ended the third quarter with 148,000 total pay-TV net additions. Now, I recognize that we lost 66,000 net subs on DISH TV, but this is notable progress. Now, we've realized year-over-year growth in our DISH TV gross additions, 416,000 subscribers chose DISH in the third quarter compared to a year ago with 294,000 growth addition. The trend's not accidental. Obviously, there are both headwinds and tailwinds in the third quarter and it's fair to conclude that we both benefited, and …' [were] impacted by programming disputes across the industry. Again, we're adding the right customers in the right geographies and in aggregate additions in the quarter, [which] represents the highest average credit scores that we've seen.

"On the Sling side, we saw 214,000 net additions, largest growth we've seen since we started publicly announcing Sling Stat.

"We're pleased to see the FCC issued its order this week, approving the proposed T-Mobile-Sprint merger. The framework established by the FCC will facilitate and accelerate DISH inventory as a new nationwide facilities-based provider. Our goal is to spur competition and drive America's leadership in 5G — all of the benefit of American consumers and industry. With regard to our announced acquisition of Sprint's prepaid business, including Boost Wireless, we're moving forward, assuming that the T-Mobile-Sprint merger will close. Should the merger receive approval, we're confident in our day one plan for Boost, for its team, its partners, and its customers, we will be ready.

"J.D. Power named DISH number one in overall customer satisfaction among national TV providers for the second year in a row — the top honors in our category, earning the top ranking in all four geographic regions, and that's the first for a company in our industry.

Responding to the relatively small loss of subscribers in light of Dish losing the Regional Sports Networks (RSNs) to Sinclair:

"DISH's consumers are a little bit different. So, as many of you know, in regional sports, there's different zones and people in the cities tend to pay more for regional sports than people in the rural areas, but contractually Sinclair wants to go a little different route there. And so, there was a lot of complications. The biggest complication was [sic] Disney themselves, who had contracted the negotiations out [but] didn't extend the contract. We lost the highest value regional sports customers because the months of August and September are the highest viewed months for regional sports by a long shot.

"So, to beat down during that period of time, they felt that was negotiating leverage against us. And so, that's why they did it. In my opinion, because we lost our best customers … we couldn't pay as much money to put regional sports back up again. So, because our cost output for those viewers would go up and you're in a situation … we'd rather have a deal. We like Sinclair. We've had a long-term relationship with Sinclair. We like the company. We like the people there. We'd rather have regional sports, but we're, as a company, we're not going to subsidize. We're not going to subsidize regional sports. And so, there are economics that may not work for them, but there are economics. We know what the economics are for us. We actually analyze stuff. The other thing is, you have to look at the macro environment.

Analyst adds that Disney is taking programming off of Dish and moving it to Disney Plus:

"And that doesn't increase their value to us, right? So, obviously that has to be taken [into] consideration [during] negotiations. Additionally, I would imagine that even regional sports, even teams themselves will probably stream directly and our customers get HBO a different way today. They don't have to get it from us. They can pirate it. They can use code-sharing. They can get it through another distributor, or they can get from Amazon. Our customers will be able to get regional sports and local channels when that comes up with Sinclair. They're just going to get it a different way